*Together with

Specializing in tissue-specific therapeutics

Nasdaq: IMMX

Good day, 360!

Here are our top 3 investing ideas today. These setups look primed! Be the best prepared trader on the Street!

POLA – up over 75% in pre-market after announcing its taking pre-orders for new line of mobile EV chargers

JAGX – 2nd day play, up over 20% in pre after launching AI-powered web portal to support patient access to Mytesi, the company’s FDA-approved prescription drug

U – Up over 9% in pre after increasing earnings guidance

* A message from Biotech Market Reporter

? Hot Stock of the Day ?

Immix Biopharma, Inc. (Nasdaq: IMMX)

Among the mass of stagnant stocks, one small biopharmaceutical company has taken flight, rocketing 335% from its November low to its high just a few days ago.

Immix Biopharma (IMMX) is leading a charge against colorectal cancer (the second most lethal cancer in the US), pioneering novel therapeutics that in one trial produced a 100% tumor shrinkage!

It’s no wonder Roth Capital’s wunderkind analyst Jonathan Aschoff, Ph.D has set a “buy” rating for IMMX with a price target of $14.00…

That’s fully 500% over its opening price this morning.

Do your research and see if it fits your trading profile. Happy trading, and f%^$ cancer! ?

*Sponsored by Lifewater Media, please see disclosures below

POLA – up over 75% in pre-market after announcing its taking pre-orders for new line of mobile EV chargers

Polar Power (POLA) a power generation and renewable energy business soared over 75% in pre-market after announcing pre-orders for a new line of mobile EV chargers.

Mobile EV chargers are used for emergency roadside service providing a fast-charging solution for EVs that have run out of charge before reaching a stationary charging facility. The goal is not to fully charge the vehicle but place a sufficient charge allowing the vehicle to proceed to the nearest charging station; this being analogous to the can of gasoline provided to stranded motorists.

The $1.70 area was support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $1.90 and then the after-hours high of $1.98. Beyond that, $2.10, $2.20, $2.20 and $2.90 come into play.

Below $1.70, there is potential support at $1.62, $1.50, $1.40 and a gap to fill at $1.04.

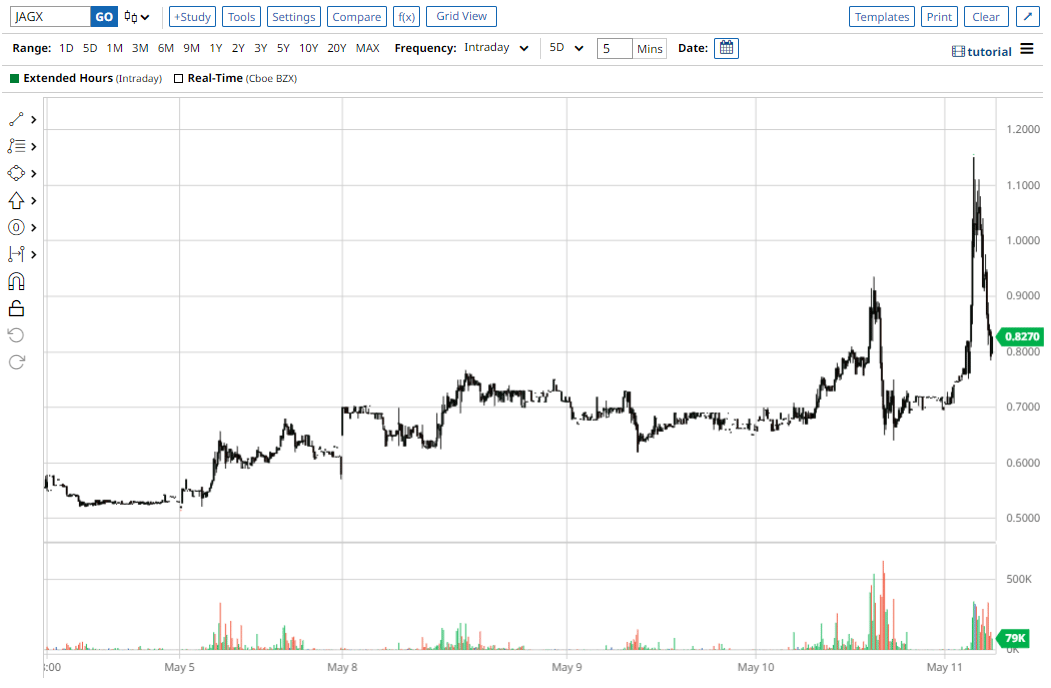

JAGX – 2nd day play, up over 20% in pre after launching AI-powered web portal to support patient access to Mytesi, the company’s FDA-approved prescription drug

Jaguar Health (JAGX), a commercial stage pharmaceuticals company, focuses on developing prescription medicines for people and animals with gastrointestinal distress, specifically chronic and debilitating diarrhea.

It was the AI play du jour yesterday after announcing the launch of an AI-powered web portal to support patient access to Mytesi, the company’s FDA-approved prescription drug. The found buyers yesterday after retracing some of the move to close up 5.96% for the day. It’s trading up 20% this morning in pre-market as interest in the stock remains.

The $0.76-$0.80 area has been an an area of interest yesterday and has found buyers at the top end of the range this morning.

Above it, targets to the upside are $0.94, $1, $1.10 and then the pre-market high of $1.15. Beyond that, $1.25, $1.40 and $2 come into play.

Below $0.76, there is a gap to fill at $0.72 with potential support at $0.70 and $0.65 and then $0.55 below that.

U – Up over 9% in pre after increasing earnings guidance

Unity Software (U), operates a platform that provides real-time 3D development tools and services. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.

In the after-hours U reported Q1 EPS of -$0.67 vs -$0.60 a year prior. Despite the worsening EPS, U reported revenue of $500million vs the consensus $481.46 million. U also said it sees Q2 2023 revenue of $510-$520 millions vs $497 million consensus and full year 2023 revenue of $2-2.2billion vs the consensus $2.13 billion. The stock is trading 9% higher in pre-market on the back of the earnings release.

$31.15-$31.30 has been an area of support in the after-hours and the pre-market.

Above it, targets to the upside are $31.80, $32, $32.25, $33 and then the after-hours high of $33.68. Beyond that, $34, $35, $36 and $38 come into play.

Below $31.15, there is potential support at $30, $29 and then a gap to fill at $28.74.

Needham reiterated its Buy rating on Unity Software this morning, maintaining its $44 price target

Economic Calendar (EST)

8:30 am Initial jobless claims

8:30 am PPI-Final demand

10:15 am Fed speaker Christopher Waller

Earnings for Today (After Market)

ACHR, ACOR, ACTG, AFIB, AGAE, AIRG, AKLI, APDN, ARLO, ASXC, AUID, AWH, AXDX, AXU, AYTU, BCAB, BDSX, BIOL, BRCC, BRLT, BSQR, BURU, CAPR, CELL, CETX, CLPT, CLVR, CTIC, CURI, CYCC, DERM, DRCT, EAR, EARN, EDUC, EGAN, EGHT, ELDN, ETON, EYEN, FFIE, FLUX, GEN, GEOS, GETY, GRNT, GRTS, HGBL, HQI, HROW, HRTX, HSDT, HYPR, IAG, IGXT, INDI, INOD, INTZ, IONQ, IRIX, ISDR, IVVD, KINS, LCTX, LFLY, LIDR, LPTH, LPTV, LUNR, MIRO, MKFG, MNTS, NOTV, NRXP, NSYS, NVVE, NWS, NWSA, OPFI, OSS, OUST, OWLT, PHUN, PLSE, QSI, RAIN, RCEL, RGTI, RKDA, RSSS, SANG, SANM, SFT, SGBX, SIEN, SILV, SLF, SLGC, SMSI, SNES, SOUN, SPRO, SRGA, SRT, SSIC, SURG, TBIO, TELA, THRN, TLIS, TMC, TRVI, TSHA, VINP, VSTA, VTRU, VTYX, WEST, ZOM

Top Headlines

DOX Amdocs to Acquire Service Assurance Business of TEOCO to Assure and Enable Monetization of Next Generation Dynamic Customer Experiences

PFLT Pennant Park Floating Rate Capital Ltd. Announces 2.5% Increase of Its Monthly Distribution to $0.1025 Per Share and Financial Results for the Quarter Ended March 31, 2023

DMRC Digimarc Signs Multi-Year, $30 Million-Plus Contract to Protect the Authenticity of High-Value Items and National Recycling Program

HLMN: Secondary Offering of Common Stock by Selling Stockholders — 22,455,000 shares — Jefferies Underwriter

REXR: Public Offering of 13,500,000 Shares of Common Stock.. WFC, GS, JPM and Truist bookmanagers

CDXS: Codexis Unveils ECO Synthesis(TM) Platform for Large-Scale RNAi Therapeutics Production at TIDES USA

C Citigroup Announces $1.5 Billion Redemption of 1.678% Fixed Rate / Floating Rate Notes due 2024

BAC Bank of America Announces Redemption of 1.486% Fixed/Floating Rate Senior Notes Due May 2024

HOOD Robinhood Says It Will Launch 24-Hour Trading Five Days a Week on Some Stocks and ETFs — WSJ *Robinhood to Make 43 Securities Including Apple and Tesla Available for Overnight Trading – WSJ

HOOD ROBINHOOD EXPECT TO LAUNCH FUTURES TRADING BY END OF 2023

TSLX: Announces Public Offering of Common Stock.. 4,500,000 shares

GVA: Pyramid Highway Project Nets Granite an Approximately $58 Million Contract

COOP Mr. Cooper Group to Acquire Home Point Capital for $324 Million in Cash

CPRX Catalyst Pharmaceuticals Reports Record First Quarter 2023 Results, Achieving 98% Total Revenue Growth Year-over-Year

LXRX: New Analysis Finds Sotagliflozin to Be a Cost-Effective Treatment at Commonly Accepted Willingness-to-Pay Threshold in Patients with Worsening Heart Failure

HEXO: HEXO Corp. Announces Receipt of Interim Order in Respect of Arrangement With Tilray Brands, Inc.

DIS Disney To Take Impairment Charge Of $1.5B-$1.8B Related To Removing Content From Streaming Services, CFO Christine – Says Charge To Be Recognized In Q3

POLA Polar Power Launches New Line of Mobile Electric Vehicle Chargers

INTC: Intel and BCG Announce Collaboration to Deliver Enterprise-Grade, Secure Generative AI

STNG: Scorpio Tankers Inc. Announces the Exercise of Purchase Options on Five Ships and Repurchases of Its Common Shares

ACM: AECOM to conduct PFAS investigation and remediation for U.S. Army National Guard facilities nationwide

PRAX: Praxis Precision Medicines Announces Positive Topline Results from PRAX-628 Phase 1 Study Enabling Best-in-Class Profile

BCYC: Bicycle Therapeutics and Orano Med Present Preclinical Bicycle(R) Radio-Conjugate Data at TIDES 2023

MOTS Motus GI Announces DDW 2023 Clinical Study Presentation Showing Pure-Vu EVS Drove a 33% Hospital-Wide Improvement in Incomplete Bowel Prep Rate at Minneapolis VA Medical Center

BRDS Bird Reports Revenue of $29.5 Million in First Quarter and Best First Quarter in Company History for Adjusted EBITDA

SA Seabridge to Raise US$150 Million under KSM Net Smelter Royalty Agreement with Sprott Funds to be Used Towards Achieving ‘Substantially Started’ Status

FWBI: First Wave BioPharma Completes Patient Screening For Phase 2 Span Adrulipase Clinical Trial in Cystic Fibrosis

KKR: KKR to Acquire Leading Testing and Measurement Instrument Provider Industrial Physics from Union Park Capital

TLRY: Solei Brand Debuts Premium CBD, CBN and THC Infused Tea Collection

AA: Alcoa and United Steelworkers Reach Tentative Agreement for U.S. aluminum smelters in Indiana and New York State

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

*PAID ADVERTISEMENT. RagingBull has been paid ten thousand dollars by ach bank transfer by Lifewater Media for advertising Immix Biopharma, Inc. from a period beginning on May 10, 2023 through May 10 of the same year. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull, do not hold a position in Immix Biopharma, Inc. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Immix Biopharma, Inc, increased trading volume, and possibly an increased share price of the Immix Biopharma, Inc. securities, which may or may not be temporary and decrease once the marketing arrangement has ended.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull can guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https:// www. sec.gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://ragingbull.com/editorial/leading-the-charge-ev-and-ai-stocks-plus-surprising-earnings/