In a strategic move to solidify its position in the competitive landscape of Bitcoin spot Exchange-Traded Fund (ETF) issuers, Grayscale has announced plans to introduce a low-fee version of its flagship ETF, the Grayscale Bitcoin Mini Trust.

The asset manager giant, which manages the $28 billion GBTC spot bitcoin ETF, is currently seeking approval from the U.S. Securities and Exchange Commission (SEC) to start the development of the new bitcoin ETF.

Grayscale Bitcoin Mini Trust: A Relief from 1.5% Fees

The proposed Grayscale Bitcoin Mini Trust, expected to trade under the BTC ticker on NYSE Arca, represents a calculated step in the growing ETF landscape. Notably, Grayscale secured this ticker in 2021 by purchasing an equity stake in the ETF firm Clearshares, which originally owned the ticker.

If approved, this low-fee version would enable the investors to enjoy reduced total blended fees, offering relief from the comparatively high 1.5% fees associated with the current GBTC.

The proposed Mini Trust also presents a unique approach, involving a corporate spinoff that would automatically transfer a percentage of GBTC shares to seed the new product, all without incurring capital-gains tax for investors.

Renowned ETF analyst James Seyffart stated on X:

“Using the spinoff mechanism definitely helps out long term GBTC holders — particularly the taxable ones who were sorta stuck with potential capital gains tax hits. Not a full solution. But way more helpful than launching a standalone product from scratch.”

Undisclosed Fees

The undisclosed fees associated with the Grayscale Bitcoin Mini Trust are expected to be competitive with some of the low-cost bitcoin ETFs currently available in the market.

This move aims to address concerns related to the relatively high fees associated with GBTC, especially when compared to rival offerings like Franklin Templeton Digital Holdings Trust (EZBC) and Bitwise Bitcoin ETF (BITB), boasting fees of 0.19% and 0.2%, respectively.

Moreover, as the Bitcoin community speculates on the approval timeline, Seyffart provides a cautious estimate, suggesting a potential approval timeframe ranging from 60 to 270 days.

Inflow-Outflow Game

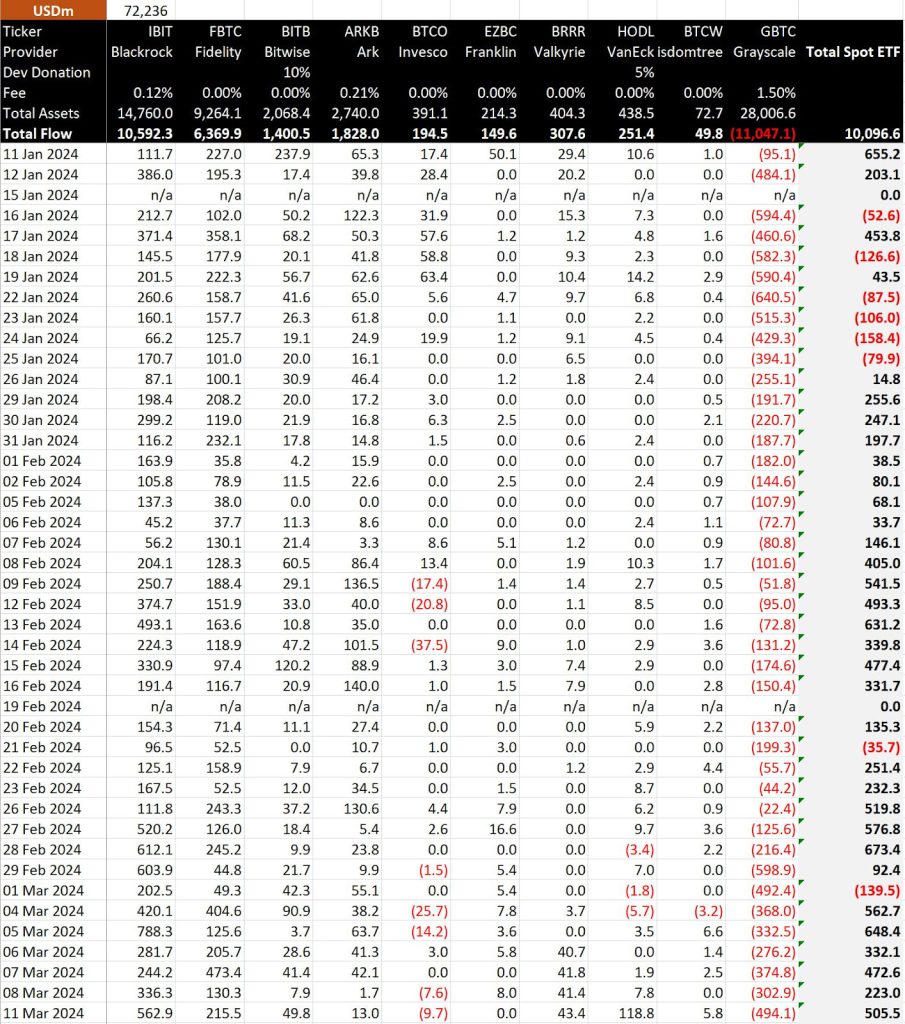

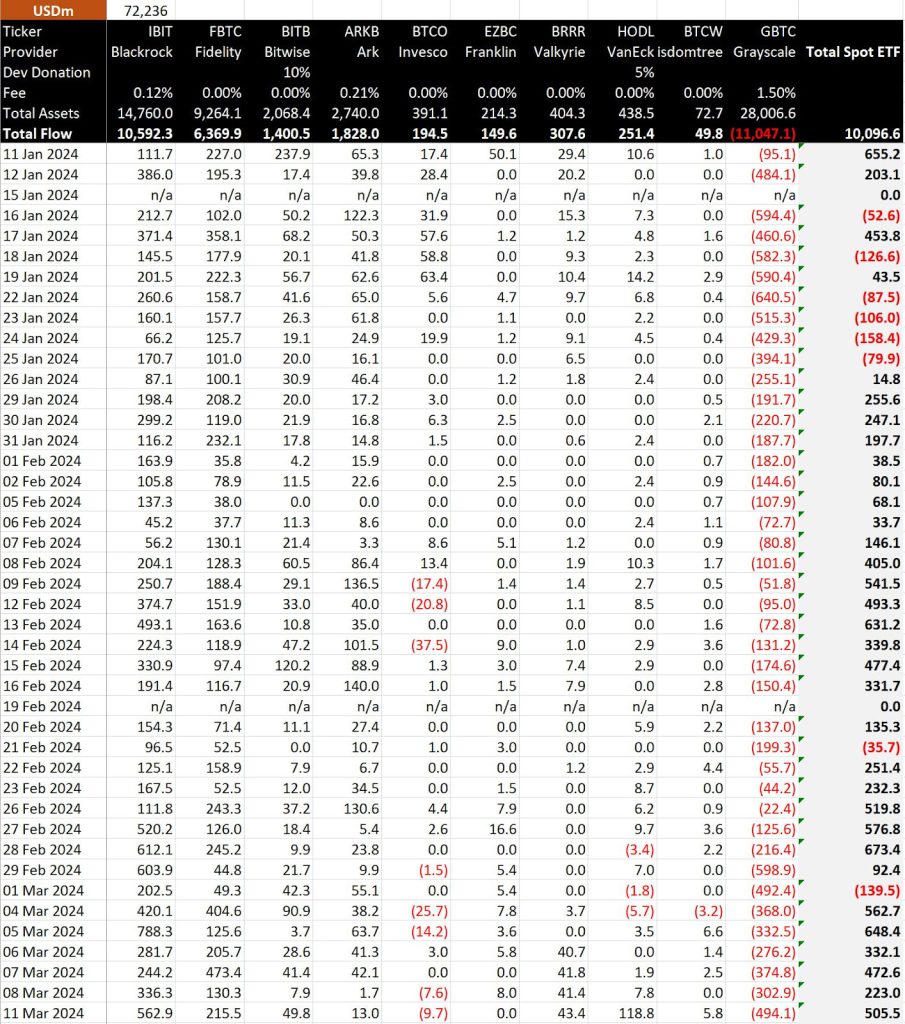

An approval from the SEC on the Grayscale Bitcoin Mini Trust could potentially reshape the ETF market by impacting the inflow of other ETF issuers.

The U.S. spot ETFs have gained massive enthusiasm since their launch, primarily driven by optimism around potential Federal Reserve interest rate cuts, propelling bitcoin to surpass its previous all-time high.

Notably, since the approval of spot bitcoin ETFs in January, Grayscale’s GBTC has faced outflows of over $11 billion. On the other hand, rivals BlackRock’s iShares Bitcoin ETF and Fidelity Wise Origin Bitcoin Fund have seen substantial inflows of $10.59 billion and $6.37 billion, respectively.

Recognizing the pivotal role fees play in influencing investment decisions, Grayscale’s strategic move towards a more cost-effective alternative is seen as a pragmatic response to cater to the preferences of registered investment advisors (RIAs) and broker networks.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinnews.com/markets/grayscale-bitcoin-mini-trust/?utm_source=rss&utm_medium=rss&utm_campaign=grayscale-bitcoin-mini-trust