Key Points:

- Geopolitics return to the fore as concerns mount around the Middle East and Asia..

- Safe haven demand sees gold (xau/usd) rise toward 2350 resistance.

- Silver technicals hint at the potential for further upside.

Commodity markets have returned to positive territory this morning, driven by gains in both silver (XAG/USD) and gold (XAU/USD). Growing concerns about the Middle East and a potential escalation seem to have renewed safe-haven demand following the U.S. holiday yesterday.

Safe haven demand appeared to have waned toward the back end of last week but news of a potential escalation on the northern border between Lebanon and Israel has market participants on edge. The idea of a wider conflict could significantly impact global growth and have an impact on the ongoing fight against inflation.

Furthermore, Russian President Vladimir Putin is in Asia and held meetings with both North Korean and Vietnamese leadership. This is seen as a further escalation in Asia as the G7 looks to reign in China’s influence and support allies in the region. All of these factors over the past few days definitely seem to be having an impact on the risk outlook and thus leading to a renewed demand in haven assets.

Another reason that may be contributing to a rise in both gold and silver prices could be the renewed optimism for rate cuts from the Federal Reserve. The stark decline in retail sales data earlier in the week continued a trend of softening data with the exception of the NFP print earlier in June. We are seeing some signs of strength from the US dollar in the early part of the European session and it will be interesting to gauge whether this continues. If the US dollar continues to appreciate throughout the day will it be able to halt the rally in both gold and silver? This question will be key to the movement of gold prices today and potentially tomorrow as well.

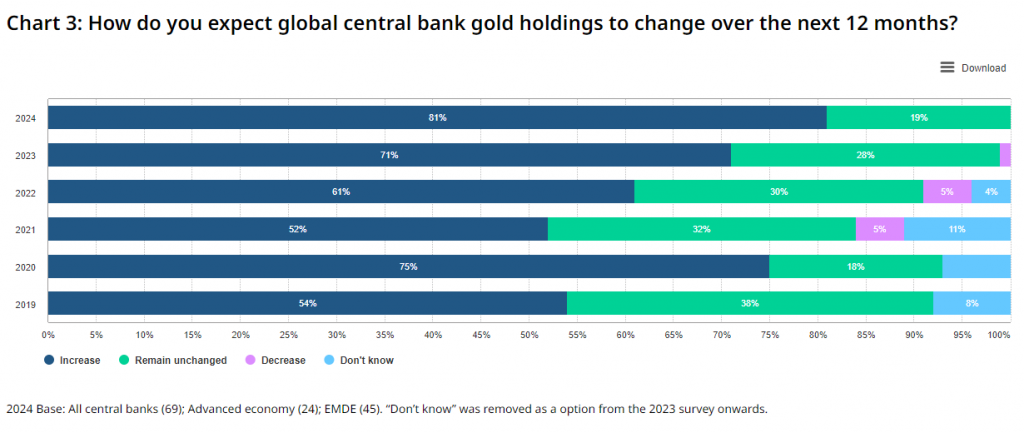

Looking at other reasons that continue to keep buyers interested in the precious metal is the ongoing purchases of the gold by various central banks. According to a World Gold Council report dated June 18, 2024, an increasingly complex geopolitical outlook is making gold the go to for central banks. According to a 2024 Central Bank Gold Reserves (CBGR) survey, conducted among 70 central banks between February 19, 2024 and April 30, 2024, 29% of the central banks intend to increase their gold reserves in the next 12 months. This provides central banks to hedge against geopolitical uncertainty and in the case of some, sanctions as well.

A view of the responses of central banks on gold holdings over the next 12 months

Source: World Gold Council (click to enlarge)

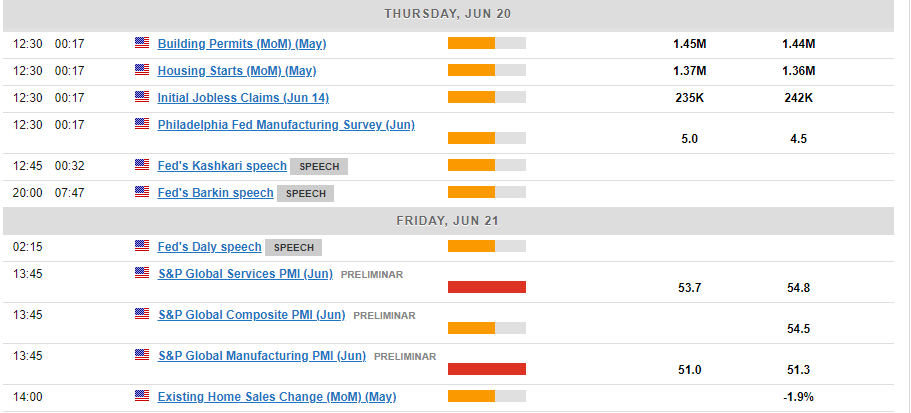

The Look Ahead

Later in the day we have a swathe of low impact US data with the main attractions coming in the form of comments from Federal Reserve policymakers Kashkari and Barkin. The comments by Fed policymakers could stoke some short-term volatility in the US dollar and by extension gold and silver as well. To wrap up the week we have US PMI data to be released tomorrow which could give us further insight into the service sector as well as the US manufacturing sector moving forward.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Outlook

Gold Technical Outlook

Gold prices continue to experience whipsaw price action as the 2300 level continues to provide stern support. This is evidenced by the lack of follow through after the precious metal recorded a daily candle close beneath the 2300 support level on June 7.

Gold has since been on a steady march higher printing higher highs and higher lows on its way to the 2350 resistance level. Looking at the H4 chart below, this morning’s bullish run failed to recapture the 2350 handle, facing selling pressure in the 2344-2345 region.

Gold four-hour chart, June 20, 2024

Source: TradingView.com (click to enlarge)

Key Areas to Pay Attention to:

Support

- 2331 (weekly open)

- 2320

- 2300

Resistance

- 2345

- 2358

- 2370

Silver Technical Outlook

Silver on the other hand provided a very clean technical trade idea yesterday after 4 successive days of sideways price action. The bounce of the ascending trendline (which added a further confluence) has seen silver prices approach a two-week high.

There is a descending trendline ahead which could hold the keys to silver’s next move. A break above the trendline could set silver on course for a retest of the previous highs. Alternatively, a rejection of the trendline could lead to a return toward support around the 28.87 handle.

Silver daily chart, June 20, 2024

Source: TradingView.com (click to enlarge)

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/commodities/gold-silver-test-two-week-highs-on-geopolitical-concerns-and-rate-cut-optimism/zvawda