Blockchain technology has been around for the better part of the last two decades, changing how money is transferred and transacted across the world. Nonetheless, scaling the technology has proven to be one of the toughest obstacles to its global adoption. Today, millions of regular users still find the technology either too slow or too expensive to use. For example, Bitcoin, on average, completes 5-7 transactions per second (TPS) while Ethereum’s maximum recorded TPS is about 57 transactions – both charging exorbitant fees and a long way off the speed of traditional means of payment such as VISA, which boasts over 50,000 TPS.

For blockchain to be adopted in the mainstream, faster and more scalable solutions are needed.

Luckily, blockchain developers have been building these solutions to make the technology more scalable for regular users. One of the most successful solutions yet is Layer 2 solutions, built atop Layer 1 blockchain such as Bitcoin and Ethereum, enhancing the speed and scalability of transactions. These Layer 2 solutions mainly comprise state channels (e.g. Yellow Network and Lightning Network on Bitcoin) and side channels (e.g. Polygon and Rootstock), each offering a unique way of making the Layer 1s faster and more scalable.

The Blockchain Trilemma conundrum

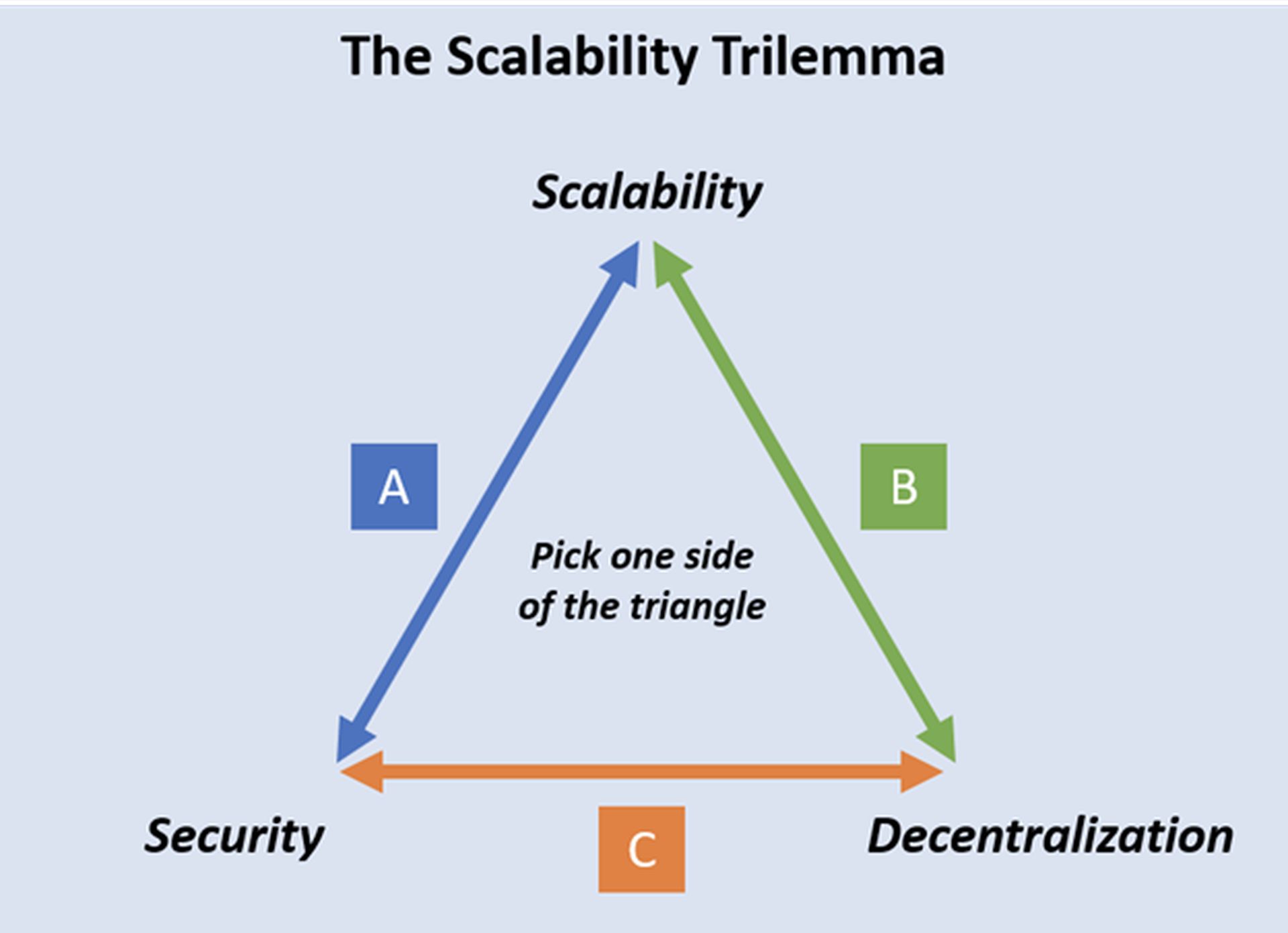

While making blockchains faster and more scalable has always been in the minds of blockchain developers, from Satoshi’s 2009 Bitcoin whitepaper to date, one puzzle still affects the space – the blockchain trilemma. Simply, the trilemma states you can not achieve all three blockchain standards (decentralization, security and scalability) without sacrificing one for the other. Several Layer 2 solutions have also faced this issue, whereby in their quest to scale blockchains, many lose the security or decentralization aspect of it. Well, till the invention of state channels.

Simply, state channels allow users to transact with one another directly outside of the main blockchain (off-chain), greatly minimizing their use of ‘on-chain’ operations. While on-chain transactions are not completely eliminated, state channels reduce the number of transactions on the main chain, with only the most important transactions happening on the main chain.

If two users are transacting on a blockchain, say, person A and person B are making 100 transactions a day between each other using Ethereum, they will need to pay fees on each of the transactions, which could be very costly. Using state channels, the two traders will only need to pay fees when opening the state channel and when closing it, greatly reducing the amount of fees.

Think of state channels as a time card used in your workplace. You only need to punch in when you arrive at work and punch out when you are leaving the shift. Any other action happening in between the shifts does not need a punch-in on the time card.

At a glance, state channels may seem less secure than directly conducting business on chain, hence the notion that they cannot be used for sensitive transactions e.g. financial transactions. However, with platforms such as Yellow Network, which introduces a Layer 3 peer to peer platform, users can achieve the same level of security and facilitate trading and settlement through smart clearing.

How do state channels solve the issue of security?

The growth of cross-exchange connections and transactions is growing more sophisticated by the day, forcing developers to create ways to maintain the security that Layer 1 blockchains provide. While many L2 solutions have been built to solve the challenge of security, none has implemented the technology as successfully as Yellow Network. Over iterations of upgrades and changes, the platform has introduced new, secure ways to enhance asset transfers across its state channels.

The platform seeks to solve the problem of ultimate decentralized trading, allowing participants to swap assets across different exchanges without relying on block creation, which slows Ethereum and Bitcoin down. The platform creates a network of brokerages, exchanges and trading firms to offer a more efficient and scalable trading infrastructure. It introduces a new approach to a clearing system that leverages blockchain technology to enable inter-exchange direct trading without counterparty risks.

Through collaboration with Consnsys Meash, the Yellow Network team has created a clearing system between centralized and decentralized exchanges using its state channels. Trading firms can optimize their capital usage by netting trades and allowing for reduced margin requirements. Additionally, the platform leverages the proof-of-funding consensus mechanism, signing every transaction as an Ethereum transaction would, maintaining the security.

Signing off: Advancing privacy preservation

Apart from offering faster and more scalable transactions, one of the biggest advantages of state channels is privacy. State channels help users preserve privacy as transactions within the channel are only known by the participants in the channel. Unlike Ethereum, where all transactions will be broadcasted publicly, on an auditable channel, transactions within state channels remain hidden, with only the opening and closing transactions broadcasted on chain.

This ensures all off-chain transactions, which include sensitive information remain private, making it suitable for financial transactions and sensitive data transfer.

Featured image credit: Shubham Dhage/Unsplash.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://dataconomy.com/2024/02/15/can-we-safely-turbocharge-asset-swapping-across-exchanges-by-going-off-chain/