From $100-an-hour wages to the return of a conventional pension program, United Auto Workers negotiators have dumped a list of “over 700” demands onto the laps of their counterparts at Detroit’s Big Three automakers.

And while officials with General Motors, Ford and Stellantis have indicated a readiness to meet some, perhaps many, of those demands, they’re far from ready to roll over, even if that results in a strike when the automakers’ current contracts expire on Sept. 14.

“At the end of the day, we all want to work together” to come up with a workable agreement, said the chief negotiator for one of the Detroit manufacturers, asking not to be identified by name or company in order to speak freely about the talks. But that doesn’t mean his company will simply write a blank check, he cautioned, noting “We don’t want to raise the price of our vehicles to the point customers can’t afford them … or eat into our margins.”

The demands

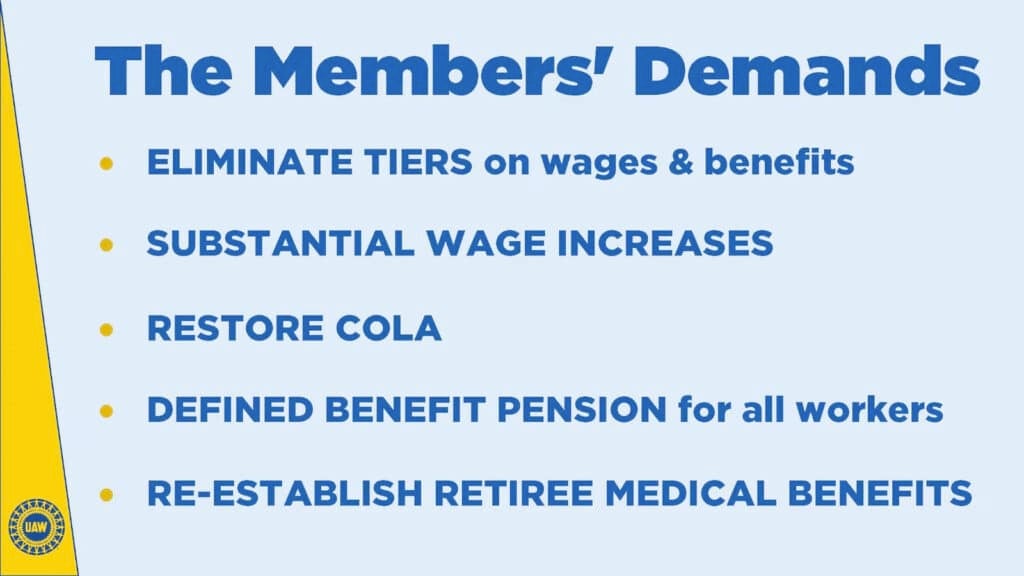

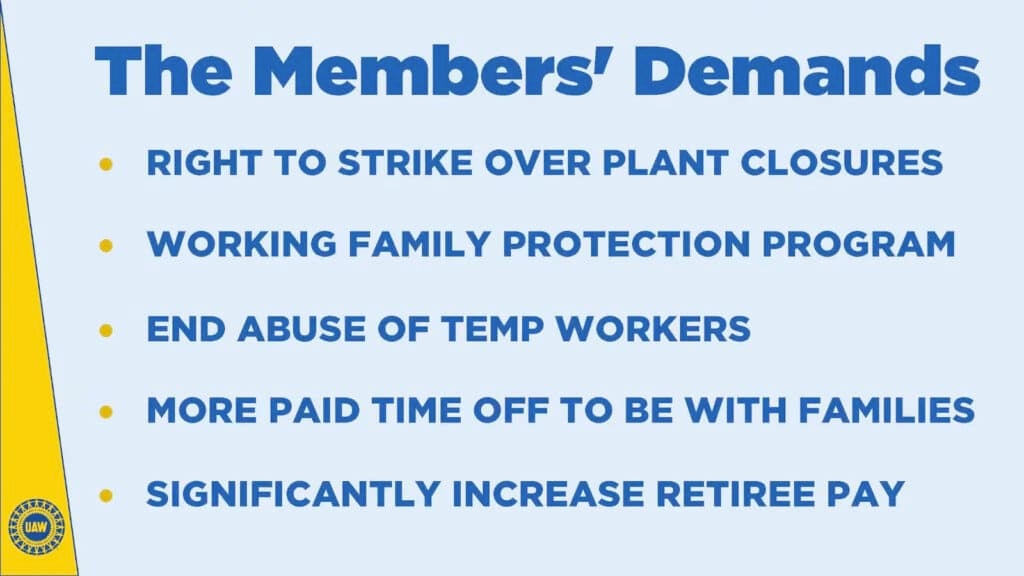

Among what UAW President Shawn Fain described last week as “the members’ demands” are scores of small matters, many of them focused on issues at individual plants. But the key issues include:

- Pay increases that could boost to nearly $100 an hour the average pay and benefits for hourly employees, a roughly 40% increase;

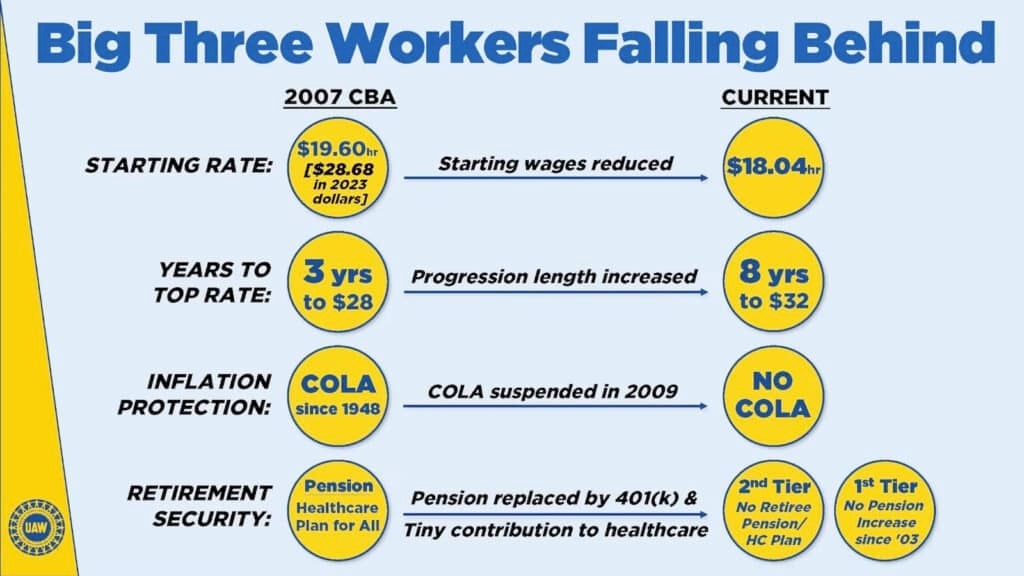

- The return of the cost-of-living benefits dropped during the Great Recession as part of concessions to save the Detroit Big Three;

- A return to defined pensions, rather than 401k programs;

- More paid time off which could translate into a 32-hour work week.

Speaking on Facebook live, Fain acknowledged the list is “audacious,” but went on to stress, “If the companies want to brag about record profits, then it’s time for record contracts. It’s time for them to deliver for our members, and we’re going to deliver for our members, come hell or high water.”

Memories of 2019

Among the various negotiators and close observers TheDetroitBureau.com has talked to, the sense is that this year’s negotiations are tougher than the industry has long seen, perhaps even more so than in 2019, when GM was hit with a six-week walkout that cost $10.7 billion in lost revenue and $3.6 billion in profits — about $2 a share, GM reported in its third-quarter earnings statement that year.

The automaker wasn’t the only one hurt, the Anderson Economic Group estimating GM workers suffered $835 million in lost wages.

The contracts that followed — each automaker negotiating its own final terms but generally following a similar pattern — were significant, with wages and benefits jumping around 20%, to a Detroit average of roughly $70 an hour. And that didn’t include the profit sharing checks that put as much as $50,000 in individual workers’ bank accounts over the life of the deal.

“Contracy to what we hear in the media,” the 2019 agreement “was very lucrative for our employees,” said one negotiator.

The Big 3 have their own concerns

The automakers have their own concerns. One that has come up repeatedly is the issue of “unplanned absenteeism.” On any given day, more than 10% of the hourly workers at the typical Big Three plant don’t show up. That is a costly problem, requiring extra staffing as backup. It can impact morale, manufacturers claim, and also result in lower quality.

Another thing manufacturers are pressing for is productivity. For decades, they’ve used contracts to find ways to improve efficiency on the line. And that’s going to become increasingly important going forward as the industry shifts from internal combustion engines to battery drive. Ford CEO Jim Farley has suggested that with EVs simpler to build, automakers might need 40% fewer workers.

But that threatens to deliver another hammer blow to a union that’s seen its automotive rank-and-file drop from over 1 million, at peak in 1979, to barely 150,000 today. That’s not all due to productivity efforts, of course. The reality is that where GM, Ford and the old Chrysler generated over two-thirds of U.S. car sales in 1979, they account for barely a third today. And none of the foreign-owned competitors’ “transplant” assembly lines are UAW-represented.

A strike remains a strong risk

Job security, several observers on both the corporate and union side have said, could be the ultimate roadblock to resolution this year.

“The two sides appear to remain far apart,” CFRA analyst Garrett Nelson warned late last month, expressing his concern about “the risk of a UAW strike potentially beginning as soon as mid-September.”

Biden steps in

And that worries not only the automakers and the union, but President Joe Biden. The threat of a recession remains a concern, and the potential impact of a strike on the economy could be massive, according to the Anderson Economic Group and others. It could also prove a stumbling block in Biden’s bid for reelection.

The president brought Fain in for a White House chat last month. And he’s assigned Gene Sperling as his point man on the ground in Detroit. Sperling knows many of the players, having served on the team that pulled together a bailout after GM and Chrysler went bankrupt during the Great Recession. But while the UAW has traditionally been a major force among organized labor supporting the Democratic Party, Fain has notably refused to endorse Biden so far.

The competition

At first glance, this year’s talks might seem like a win-win for Detroit’s competition, companies like Toyota, Honda, Volkswagen, Hyundai, and even new players such as Tesla and Rivian. A strike of more than a few days could leave dealers short of inventory, sending buyers searching elsewhere. And with new vehicle prices already at record levels, a sharp rise in labor costs could make it all the more difficult for the Detroit Big Three to remain competitive.

Then again, foreign-owned plants, such as Toyota’s facility in Georgetown, Kentucky, the VW facility in Chattanooga, and the Nissan plant in Smyrna, Tennessee, have traditionally adjusted wages and benefits to echo what happens in Detroit — though they typically maintain at least a bit of a cost advantage.

They’d likely have to do so again this year, threatening to raise vehicle prices industry wide. The alternative would be risking the anger of their own workers who, until now, have repeatedly rejected the UAW’s efforts to organize the transplants.

The clock is ticking

Back in Detroit, company negotiators say they’re still crunching the numbers to see precisely what the UAW’s demands will cost. The next question is how much the manufacturers will then be willing to give. It then comes down to whether there’s room to meet somewhere in the middle. The two sides have a little more than five weeks to come up with the right answers.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.thedetroitbureau.com/2023/08/automakers-scramble-as-uaw-delivers-over-700-demands-as-contract-deadline-looms/