Apple finally jumped on Buy Now, Pay Later (BNPL) bandwagon to take on PayPal, Klarna, and Affirm. The iPhone maker announced on Tuesday finally the launch of its highly-anticipated Apple Pay Later service, which enables users to split purchases into four payments spread over the course of six weeks with zero interest and no fees

The news comes a year after Apple quietly acquired London-based fintech startup Credit Kudos for $150 million as part of its push to dominate the payments space. The Apple Pay Later service is part of the tech giant’s push into the lucrative BNPL market.

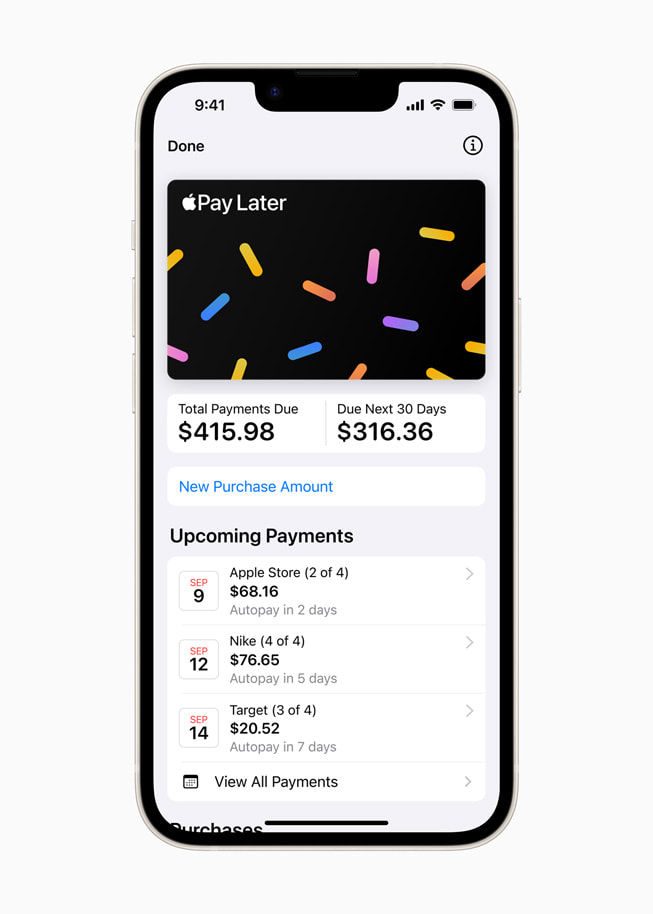

In a statement, Apple said that Apple Pay Later will “allow users to split purchases into four payments, spread over six weeks with no interest and no fees.” Additionally, Apple Pay users can easily track, manage, and repay their Apple Pay Later loans in one convenient location in Apple Wallet.

In addition, individuals can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay. “Starting today, Apple will begin inviting select users to access a prerelease version of Apple Pay Later, with plans to offer it to all eligible users in the coming months,” Apple said in a news release.

The Apple Pay Later service is offered through the Mastercard Installments program, so merchants that already accept Apple Pay will not need to make any changes to implement the software for their customers.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Apple also added that users can apply for a loan within the Apple Wallet app without it affecting their credit score. Once they select the amount they would like to withdraw, a soft credit pull will be conducted to make sure they are in “a good financial position” to take on a loan.

Apple will invite select people to access a prerelease version of Apple Pay Later on Tuesday, and the company said it plans to expand access to all eligible users in the coming months.

Approved users will see a “Pay Later” option while using Apple Pay to check out online and in apps on iPhones and iPads. They will also be able to apply for a loan right at checkout. Apple said purchases using the software will be authenticated using Face ID, Touch ID or a passcode.

“Apple Pay Later is built right into Wallet, so users can seamlessly view, track, and manage all of their loans in one place. With Apple Pay Later in Wallet, users can easily see the total amount due for all of their existing loans, as well as the total amount due in the next 30 days. They can also choose to see all upcoming payments on a calendar view in Wallet to help them track and plan their payments. Before a payment is due, users will also receive notifications via Wallet and email so they can plan accordingly. Users will be asked to link a debit card from Wallet as their loan repayment method; to help prevent users from taking on more debt to pay back loans, credit cards will not be accepted,” the company said.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://techstartups.com/2023/03/29/apple-launches-pay-later-service/