Governance Tokens | Feb 15, 2024

Image: De.Fi

Image: De.FiPromise of Decentralization versus Reality of Governance Token Structures

Governance tokens enable democratic decision-making processes within decentralized autonomous organizations (DAOs). These tokens, designed to democratize governance by granting voting rights to token holders, promise a future where stakeholders have a direct say in the direction and operation of a project. However, recent data and analyses suggest that the actual governance structures facilitated by these tokens may not live up to the ideals of good governance they aim to embody.

Crypto governance tokens don’t have good governance.

Governance tokens are a pathway to a more inclusive and participatory governance framework, and are meant to be different than centralized decision-making models. In theory, these tokens empower their holders with the ability to influence decisions, propose changes, and vote on key issues related to the project’s development, financial management, and strategic direction.

See: Are DAO governance attacks avoidable?

Despite the promise of governance tokens, practical implementations have often fallen short of creating truly democratic governance structures. the data reveals several critical issues that undermine the effectiveness of governance tokens as tools for good governance. Bottom line is poor governance can erode trust among stakeholders, lead to low community engagement, and result in short-sighed and poor decisions for the long term sustainability and health of a project.

- In many projects, governance tokens are distributed in a manner that results in a significant concentration of voting power among a small group of holders. This concentration can occur due to initial token distribution events favoring early adopters, developers, or large investors. As a result, the democratic ideal of one token, one vote is compromised, leading to governance decisions that reflect the interests of a few rather than the collective will of the community.

- Another challenge facing governance token-based systems is the consistently low participation rate in governance votes. Factors include a lack of engagement or interest from token holders, the technical complexity of participating in votes, and the perception that individual votes have little impact on the outcome. This apathy undermines the governance process, making it less representative and effective.

See: Arca Report: DAOs – Institutional Guide to Decentralized Governance

- The governance mechanisms enabled by tokens can be complex, requiring a deep understanding of the project’s technical and financial aspects. This complexity can exclude average token holders from the governance process, as they may feel ill-equipped to make informed decisions or engage meaningfully in discussions.

- Governance token holders may be motivated by short-term gains rather than the long-term health and success of the project. This short-termism can lead to decisions that prioritize immediate profits over sustainable development, potentially compromising the project’s future viability.

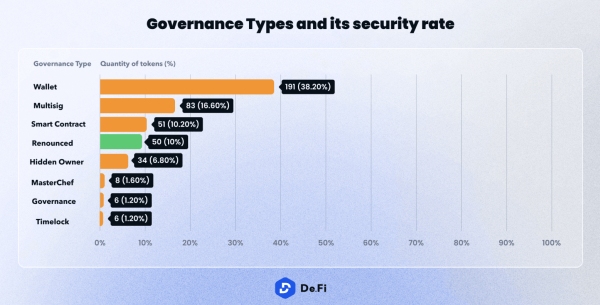

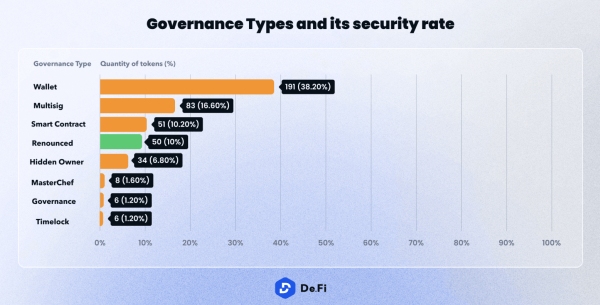

Digging Into the Data

Addressing the Issue

Several mechanisms can be implemented to mitigate the risk of power concentration:

- Projects can aim for a more equitable distribution of governance tokens, such as through airdrops to a wider base of users, rewards for community contributions, or limiting the amount of tokens that any single entity can hold.

- Use a quadratic voting system which weights votes based on the square root of the number of tokens a voter holds, diminishing the power of large holders and amplifying the voice of smaller ones.

- Allow token holders to delegate their voting rights to representatives or to join voting pools can help balance power dynamics, ensuring that the interests of smaller token holders are represented.

See: Research: Ownership of Top 10 Web3 DAOs is Surprisingly Concentrated

- Use time-locked voting where the voting power of tokens increases with the length of time they are held can encourage long-term commitment over short-term speculation and reduce the influence of large, transient stakeholders.

- Simplify the voting process, improve the accessibility of information, and educate token holders about the importance of their participation can increase engagement. Additionally, use quadratic voting or other mechanisms that mitigate the influence of large holders could make the governance process more democratic.

- Ensure that decision-making processes are transparent and that outcomes are communicated effectively can build trust in the governance system. Establish clear guidelines for proposals, voting, and the implementation of decisions is crucial for accountability.

Conclusion

While governance tokens hold the promise of decentralized and democratic governance, the reality is that their current structures often fall short of this ideal. By addressing the challenges of concentration of power, low voter turnout, complexity, and short-termism, the DeFi community can work towards creating governance models that truly reflect the principles of good governance – inclusive, fair, hack-proof, and focused on the long-term sustainability of the project.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/addressing-the-paradox-of-governance-tokens/