So we’ve covered Klaviyo several times at SaaStr, and we’re super excited CEO Andrew Bialecki is coming to 2024 SaaStr Annual Sep 10-12 in SF Bay to share his learnings!! (We also have a great deep dive we did a little ways back with Andrew below).

Klaviyo is not only a rocketship, but it’s been the only SaaS IPO since Dec 2021. The only one. 1. That’s. One SaaS IPO in 2.25+ years.

And to IPO in that loooong stretch of … no IPOs … it really had to be a good one. Which Klaviyo is. At $800m it has the full package: 39% (!) annual revenue growth, 16% free cash margins, and 117%. It doesn’t get too much better, folks.

5 Interesting Learnings:

#1. NRR Holding Up at 117%.

At IPO, NRR was 119%. Today, it’s still 117%, even as other marketing leaders like HubSpot have seen big drops in NRR in today’s macro environment. This is pretty impressive, especially with many smaller customers. A big part of that is likely that e-commerce growth overall remains strong. The small NRR drop Klaviyo attributed to lapping a price increase, not macro impacts. HubSpot by contrast has seen NRR fall from 110% to 100% today.

#2. Revenue Growth Remains Top, Top Tier at 39% on Way to $1B ARR. But Down a Bit From Crazy Growth Pre-IPO.

Few at Klaviyo’s scale have its revenue growth of 39% approaching $1B in ARR, especially these days when the average annual growth for public SaaS companies is barely 20%. It’s incredible. Now combine new customer growth of +20% (see below) and 117% NRR, that just about adds up to total growth of 39%. But growth has come down a bit from insane to merely incredible levels.

#3. New Customer Count Up +20%, $50k+ Customers Up 80%

I’ve come to believe that this is the single most important metric in SaaS — your net new customer growth. If net new customer growth is strong, you can fix anything else. And Klaviyo’s is super impressive. Even as it comes up on $1B in ARR, it’s growing new customers overall +20%, and its bigger customers +80%. HubSpot is doing the same at $3B in ARR. It’s super impressive.

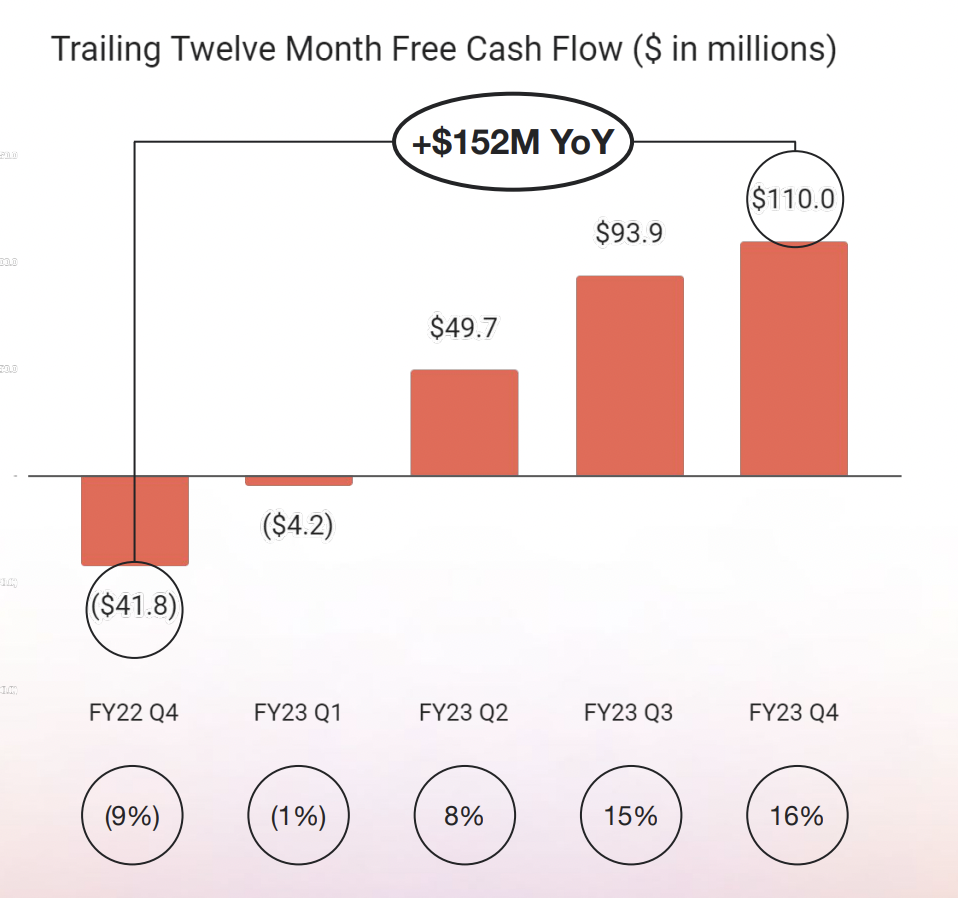

#4. Very Efficient. with 16% Free Cash Flow Margins

Klaviyo was very efficient most of its history, outside of an investment period pre-IPO when it increased the burn, so this is less of a cultural change than it is for other public SaaS companies. But it’s still very helpful to see it this way. Klaviyo is an efficient cash engine.

#5. ACV Up 16% to $5,600

Klaviyo’s roots are SMB but as you can see above, its $50k+ mid-market customers are its fastest growing segment. As part of that drive upmarket, the blended ACV has gone up materially, +16% to $5,600.

And another interesting learning:

#6. 95% of Revenue Still in eCommerce

Klaviyo is slowly expanding from its eCommerce base, but its dominant position in the Shopify ecosystem remains its core.

And a great deep dive with Founder CEO Andrew Bialecki here:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.saastr.com/5-interesting-learnings-from-klaviyo-at-800000000-in-arr/