This report was produced through a collaboration between Him For Her and Crunchbase. Contributors include Gené Teare of Crunchbase and Laura Gluhanich of Him For Her. Lauren Rivera, professor at Kellogg School of Management, co-authored the original 2019 benchmark study upon which subsequent annual research has been based.

Executive summary

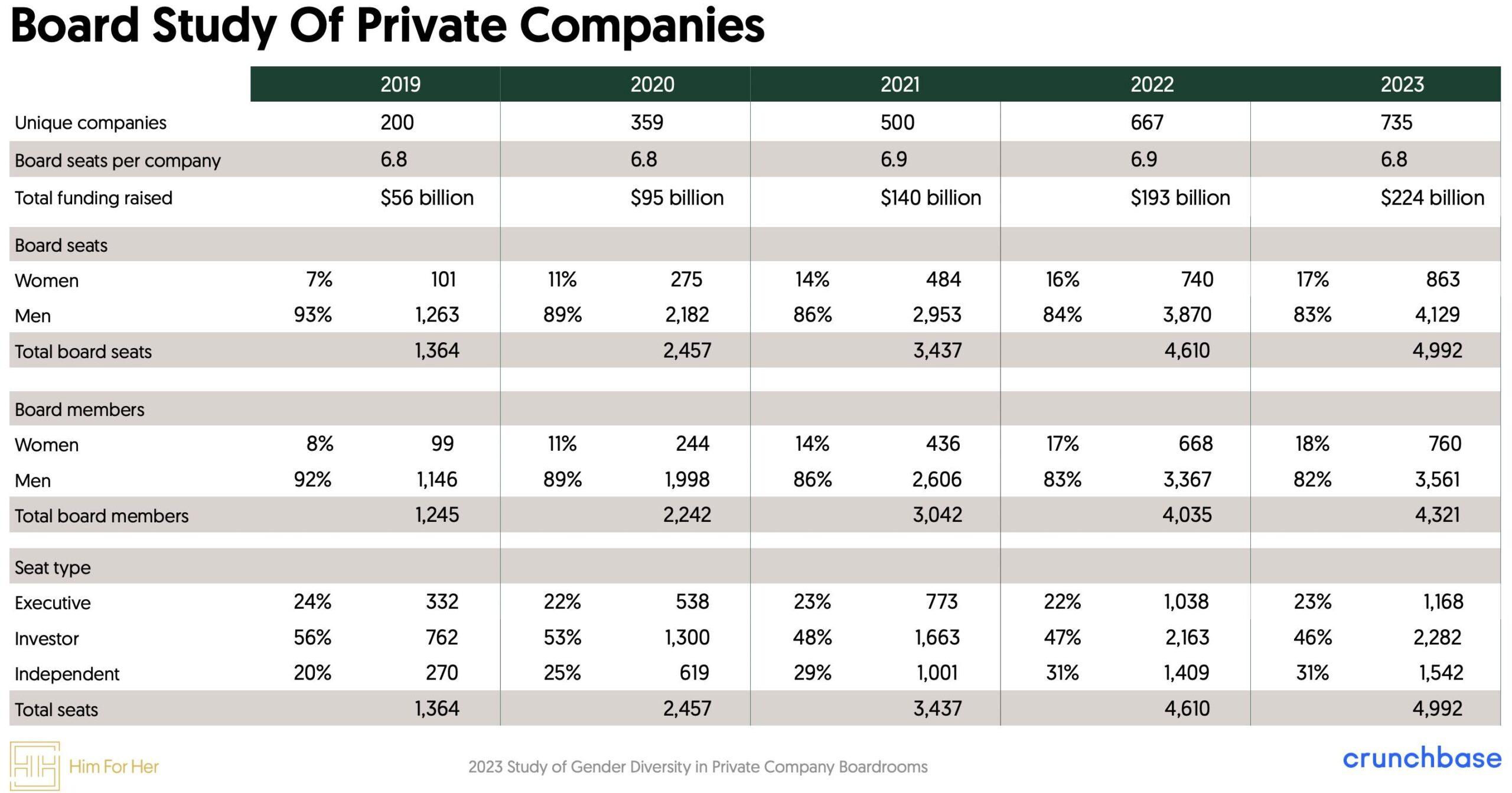

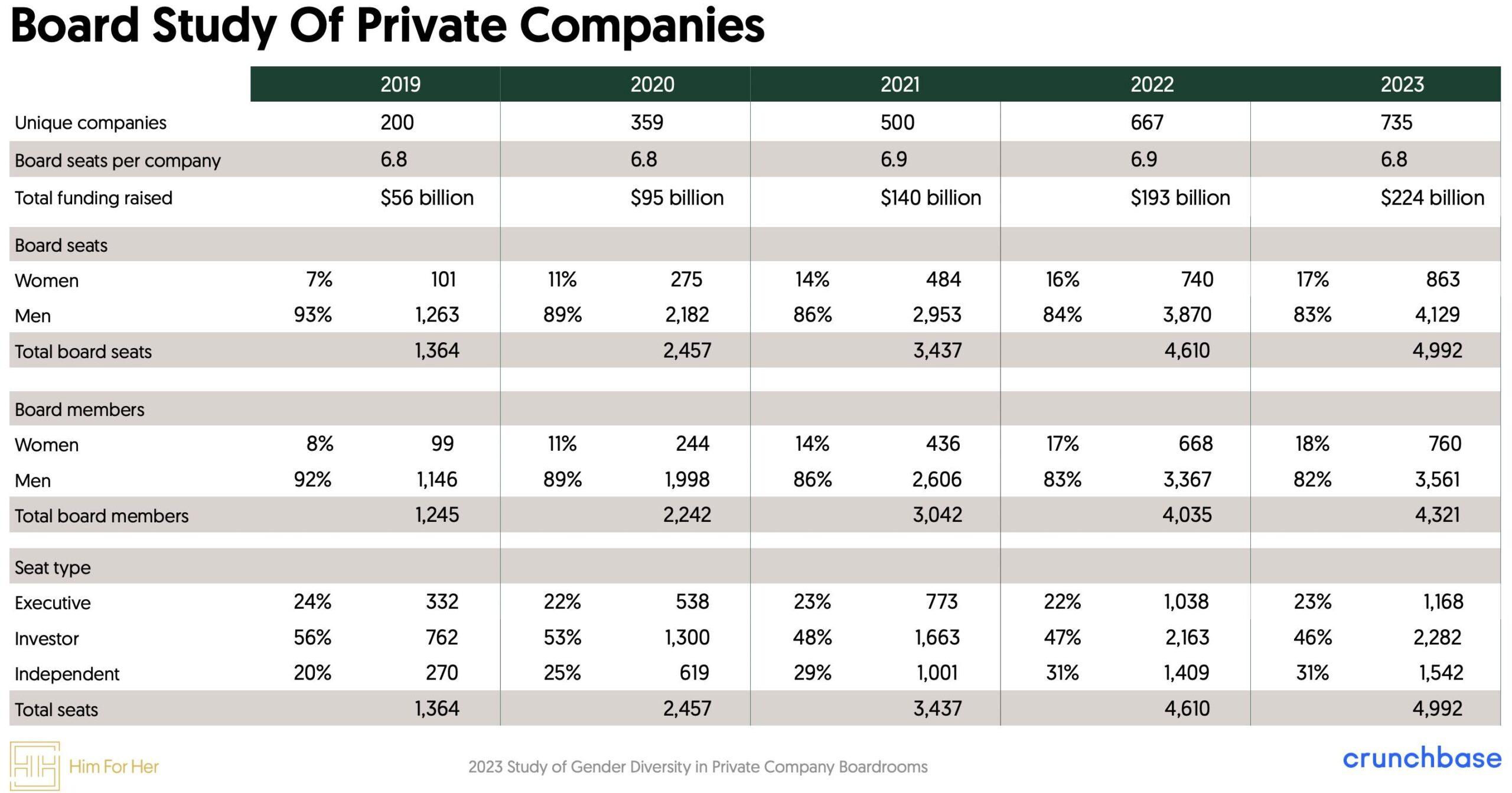

Our fifth annual study, which characterizes the boards of the most heavily funded private companies in the U.S., reveals significant improvement in board diversity over the past five years.

It also points to independent board seats as the critical lever for change when it comes to increasing cognitive diversity in the boardroom, expanding networks, and, as suggested by our latest data, even boosting funding.

Within this study, we look at gender diversity, which is reasonably measurable, as a proxy for diversity of perspectives, life experience, areas of expertise, and other demographics. In a world in which boards composed exclusively of men have been the rule rather than the exception, the presence of women in the boardroom — particularly in an independent director role — may be an indication of those boards’ intention to add diversity and of their efforts to seek talent outside their immediate networks.

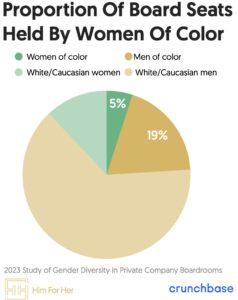

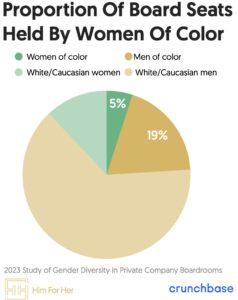

Our 2023 study indicates that women now hold 17% of board seats — up from 7% in our inaugural 2019 study. Over the same period, the number of boards without any women fell significantly, from 60% to 32%. Women of color now hold 5% of board seats, up from 3% in 2020, the first year for which this metric was available.

Women who serve on boards are most likely to be independent directors, as opposed to investor or executive directors. Women hold 29% of independent board seats, compared with 13% of investor seats and 10% of executive seats. While nearly every private company board includes executive and investor directors, nearly 20% of the companies in the study haven’t appointed even one independent director.

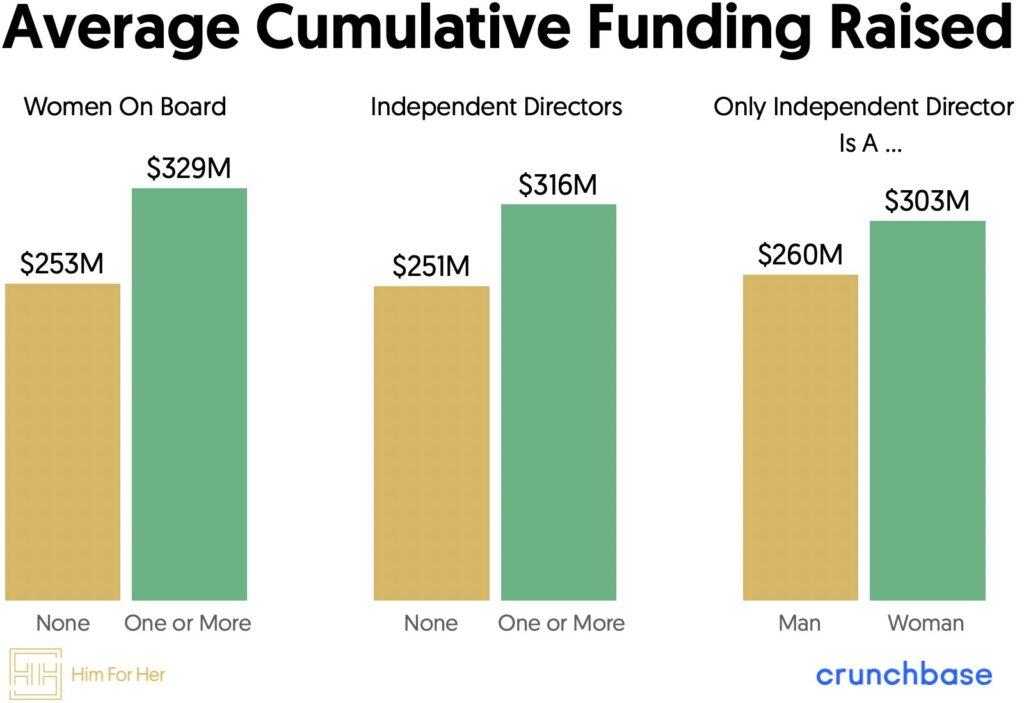

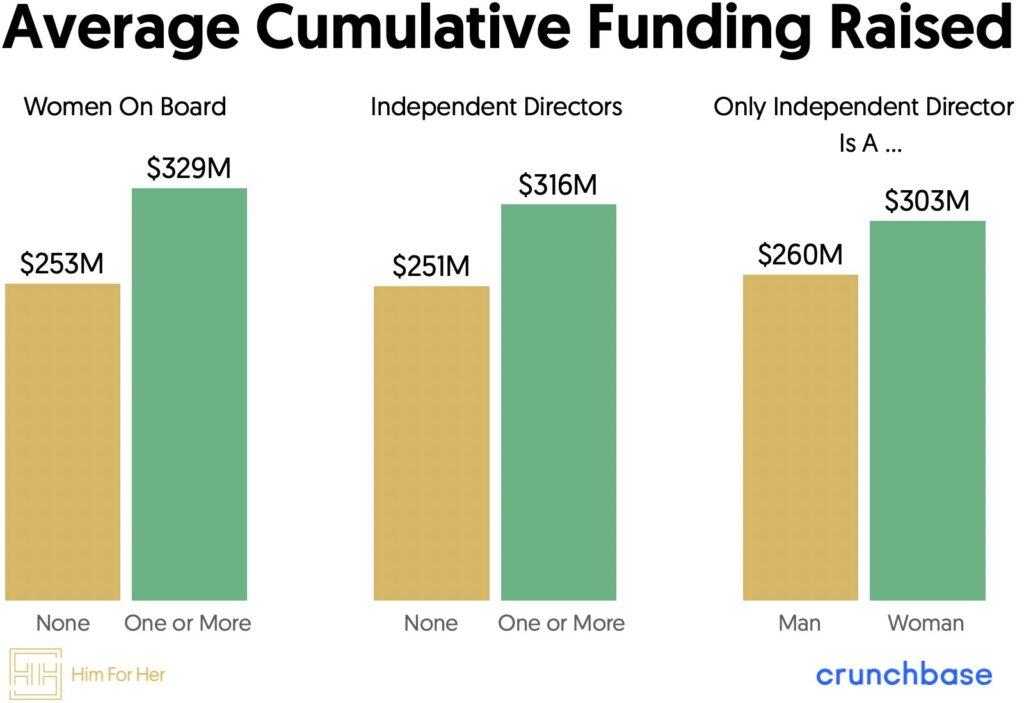

Notably, when companies have only one independent director and that director is a woman, they raise an average of 16% more capital than when that independent director is a man.

The greatest gains in independent directors — and, consequently, in gender diversity on boards — occurred between 2019 and 2021. The rate of change then dropped notably in 2022 and 2023. This timing tracks with two trends in the broader capital markets that influence recruitment of new directors.

- As the IPO market softened, urgency to build public-ready boards diminished.

In the year or more leading up to a public offering, companies typically revisit board composition to meet SEC requirements, adding an audit chair and other independent directors. IPOs peaked in 2021 and fell dramatically in the two years following. As a result, fewer companies needed to prepare their boards for imminent public offerings. - With limited access to private funding, CEO attention turned to profitability versus board-building. At the same time that the horizon for IPOs moved out, companies had a harder time raising additional private capital. According to an analysis of Crunchbase data, 2023 was the lowest year for U.S. venture funding since 2018. CEOs without adequate cash runways focused on the operational challenges of accelerating revenue growth and cutting expenses, rather than the strategic opportunity to build out their boards.

Concurrent with these market conditions, advocates for corporate board diversity — including State Street, Blackrock, Vanguard, Goldman Sachs, Nasdaq and some state legislatures — began to face opposition as ESG and broader DEI initiatives became politicized. The effect, if any, of these new headwinds is less clear than the stifling effects of the capital markets in 2022 and 2023.

In fact, our most recent study points to hopeful trends on private company boards:

- Younger companies are more likely to have women directors.

Among companies founded since 2015, 20% of board members are women, compared with 16% for companies founded before 2016. Additionally, only 22% of the newer companies have all-male boards, whereas 37% of the older companies don’t have any women in the boardroom. - More women investors are taking board seats.

The historic lack of gender diversity among funders has a downstream effect on private company boards where investors hold nearly half of the seats. Encouragingly, the percentage of investor-directors who are women increased from 5% in 2019 to 13% in our latest study. - Fewer women are boardroom “Only’s.”

Our study indicates that 30% of directors are the lone woman on their boards, down from 44% in 2020. This supports the notion that one of the key benefits of board diversity is expanding the board network to access new talent.

Adding independent directors provides private company boards with the opportunity to tap critical expertise, bring in new perspectives, and expand the reach of their networks. While companies have been slower to take advantage of this lever in the last two years, continued progress even in the midst of challenging capital markets suggests that boards recognize the long-term value of cognitive diversity.

Why this study?

When it comes to boardroom trends, numerous studies track public company boards, but high-growth private company boards have been largely overlooked. We launched our inaugural study in 2019 to fill this information gap.

Board diversity is important for public companies, but it’s also important for private companies.

Private companies surpass public companies in number, employ millions of people, and drive innovation. They are the public companies of the future. In fact, nearly half of the public companies founded since 1979 began as venture-backed startups. Yet years before they hit the public markets, private companies create the products and services and define the business models that will shape society for decades to come — a critical time period for cognitive diversity in corporate governance and oversight.

The composition and challenges for private company boards differ significantly from those of public company boards and therefore warrant special attention. Determining the mix of executive, investor and independent directors — and trends related to those types of board seats — is essential to understanding private company boards and is therefore a key focus of our research.

This 2023 study includes our largest sample to date:

- 735 U.S.-based private companies which have raised at least $100 million

- 4,992 board seats

- 4,321 individual board members

These boards govern companies which employ nearly 300,000 people and have raised $224 billion in investment.

Key findings

- Women hold 17% of board seats among the companies studied, up from 7% in our original study in 2019.

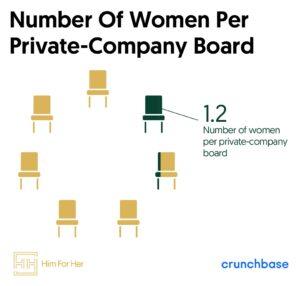

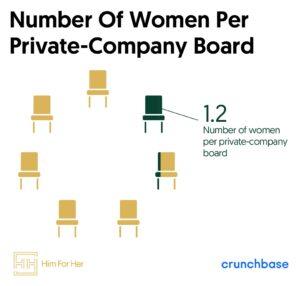

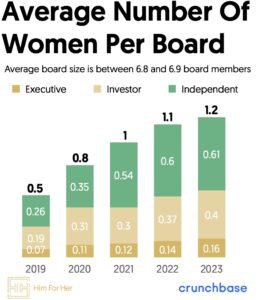

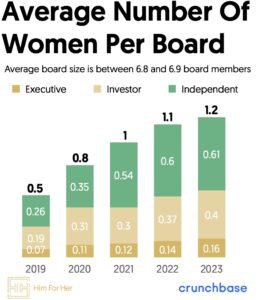

- Between 2019 and 2023, women gained two-thirds of a board seat (0.67); they now represent roughly 1.2 out of 6.8 board members.

- Nearly a third (32%) of companies don’t have any women on their boards, an improvement from 60% in 2019.

- 5% of all directors are women of color, up from 3% in 2020.

- 25% of company boards include a woman of color, up from 19% in 2020.

- Women hold 29% of independent director seats, 13% of investor director seats, and 10% of executive director seats.

- Companies with a woman as their first and only independent director have raised 16% more funding than those whose first and only independent director is a man.

- 30% of directors are the only women on their boards, down from 44% in 2020.

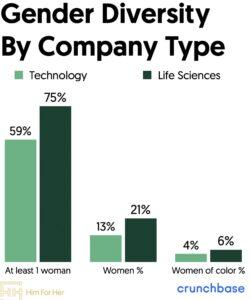

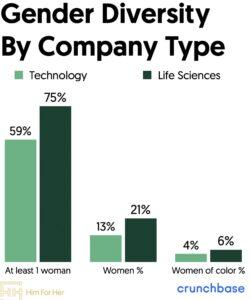

- Life sciences companies continue to outperform technology companies on all board-diversity metrics.

The percentage of women directors more than doubled since our inaugural study

Within the average private company board of 6.8 members, women hold 1.2 seats. This represents a significant gain from 2019 when women held just 0.5 seats but only a slight improvement from the 1.1 seats we reported last year. Women now make up 17% of the directors within high-growth private companies. By comparison, within public companies, women hold 33% of board seats among S&P 500 companies and 29% of board seats among the Russell 3000.

Within the average private company board of 6.8 members, women hold 1.2 seats. This represents a significant gain from 2019 when women held just 0.5 seats but only a slight improvement from the 1.1 seats we reported last year. Women now make up 17% of the directors within high-growth private companies. By comparison, within public companies, women hold 33% of board seats among S&P 500 companies and 29% of board seats among the Russell 3000.

Over the span of our research, the prevalence of all-male boards has declined from 60% in 2019 to 32% in our latest study. Among public companies, all S&P 500 boards have included women directors since 2020.

Within our study, the 238 private companies governed by all-male boards represent more than $60 billion in cumulative funding and employ more than 86,000 people.

Research suggests that boards need at least three women directors to capture the full economic benefits of diversity, yet only 32% of boards have more than one, and just 12% have more than two. However, our study indicates that the percentage of board members who are the only woman in the boardroom has dropped to 30% from 44% in 2020. Notably the boardroom gains for women over the last year appear to have been driven by adding additional women to boards rather than introducing the first woman director to all-male boards.

The percent of women of color continues to rise

Women of color now hold 5% of the 4,992 board seats we studied. That’s an improvement from 3% in 2020, when directors named “Dave” outnumbered women of color in the boardroom.

An estimated 19% of private company board seats are held by men of color. Roughly two-thirds (64%) of the boards studied have at least one man of color on the board, while a quarter (25%) include a woman of color. The number of men of color (778) who are board directors exceeds the total number of women directors, regardless of race or ethnicity (760).

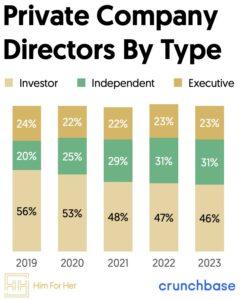

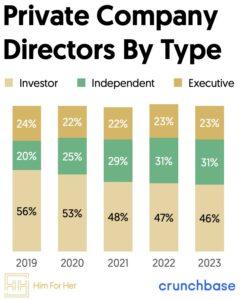

Though still the majority in the boardroom, investors hold fewer seats

Investor directors hold just under half (46%) of seats on the boards we studied, down significantly from 56% in our inaugural 2019 study. During that period, the average board size has remained essentially flat at just under seven members. The mix has shifted toward independent directors, who now hold 31% of board seats, up from 20% in 2019.

Private company board directors can be classified in three groups: executive directors, investor directors and independent directors. Executive directors include CEOs, co-founders and any other members of the company’s management team who hold board seats. These make up 23% of the board seats within the companies studied, consistent with our findings in prior years.

As private companies raise venture capital, investors often take seats on the board. Within the study data, investor directors have consistently made up the largest pool of board members, though the average number of investor seats per board has declined from 3.8 in 2019 to 3.1.

Independent directors are typically the last to be added to the board, as they are neither tied to the company’s founding management team nor early investors. Private companies are not required to have independent directors; however, public companies must have at least one independent director, depending on the size of the board.

The average number of independent directors on the boards studied has grown to 2.1 from 1.4 in 2019, offsetting the decrease in investor directors over that time. Despite this growth, 18% of these heavily funded private companies don’t have any independent directors on their board.

Independent director appointments drive boardroom gains for women

To some extent, the lack of gender diversity on private company boards is a downstream effect resulting from the lack of gender diversity among venture investors and the entrepreneurs they choose to fund, with the percentage of women in associate board seats roughly matching estimates of the percentage of woman check-writers and venture-backed founders. Thus, the increases we’ve observed in women-held executive and investor seats over the past five years — from 4% and 5%, respectively, to 10% and 13% — likely reflect the efforts of investment firms to be more inclusive in recruiting and funding talent.

Because investor and executive director seats are usually tied to funding dynamics, independent board seats often provide the most immediate opportunity to introduce more cognitive diversity into the boardroom. Women now hold 29% of independent director seats, up from 19% in 2019. These independent board appointments have been responsible for more than half (54%) of the board seats gained by women over the past five years.

Companies with a woman independent director have raised more money

Publicly available financial data for privately held companies is scant. Therefore, identifying associations between board composition and business performance is virtually impossible. However, one objective basis for comparison is the amount of cumulative funding raised by companies in our data.

Perhaps not surprisingly, companies with at least one independent director average 26% more in cumulative funding than those without an independent. Considering that independent directors are almost always the last of the three types of directors to be added to the board, the fact that those with an independent are better capitalized stands to reason.

Companies with at least one woman director have raised an average of 29% more than those without any women in the boardroom. Again, this may be explained by the fact that women directors are most likely to hold independent seats and be later-stage additions to the board.

However, our data offers an interesting basis for comparison: the gender of the independent director among companies with only one independent. We found that companies in which the only independent director is a woman out-raised those in which the only independent director is a man by 16% (an average of $303 million compared with $260 million). Interestingly, recent research on public company boards concluded that those with women directors commanded a 5% higher acquisition price.

Although our data can’t draw conclusions about a causal relationship between fundraising and women independents, it does suggest companies that receive greater funding may be those which prioritize bringing more diversity onto the board.

Life sciences companies lead technology companies in board diversity

The 735 company boards included in our study spanned all industries, with 48% in life sciences fields, 39% in non-health-related technology industries, and the remaining 13% in energy and other areas. Across all measures of board diversity, life sciences companies out-perform technology companies.

Women hold 21% of board seats among life sciences companies compared with 13% among tech companies. They hold 3x as many executive director seats and twice as many investor seats on life sciences boards than on tech boards. While the percentage of women holding independent seats is the same for life sciences and technology companies, the former tend to have more independents per board.

Looking at the percentage of all-male boards by industry highlights this disparity. While 41% of technology company boards are all men, this drops to 25% for life sciences companies.

Given the disparity in diversity metrics by industries, it’s worth noting that the fundraising patterns described above hold true across both life sciences and technology companies. Also, while the mix of industries within our study data has shifted slightly over the past five years, that shift alone explains only a small fraction of the change we’ve observed in blended-board diversity measures over time.

Younger companies have more diverse boards

Within our study of boards founded since 2004, 39% got their start after 2015. These younger firms have a higher percentage of women directors (20%) compared with older firms (16%). They are also less likely to have men-only boards (22%) than firms founded before 2016 (37%). Much of this disparity is due to the fact that younger companies are more likely to have women investors on their boards. Within these companies 17% of investor director seats are held by women, compared with 10% for the older companies.

Summary

The five years of data we’ve now accumulated tracking private company boards have revealed steady, if not always swift, progress in shifting the bodies that govern these companies to incorporate a broader diversity of thought, perspective and life experience.

The appointment of independent board directors is the most expedient way to bring new talent into the boardroom, including not only demographic diversity but also operating experience, key competencies and relevant expertise. While market conditions have made board recruitment both less urgent due to longer IPO horizons and a lower priority due to cash constraints, hopeful trends suggest that progress will accelerate as macroeconomic conditions continue to improve.

Him For Her, a social impact venture, was created to reduce the friction for CEOs looking to build their boards and extend their networks by connecting them with outstanding candidates who bring expertise and perspectives critical to companies’ success.

Data in this study points to the good news that once boards include a critical mass of women and people of color, the challenge of board diversity can be solved in perpetuity as boards expand their access to new networks.

Methodology

This tracking update largely reproduced the methodology employed with our prior studies published in December 2019, March 2021, March 2022 and March 2023. For this update, we analyzed 735 of the most heavily funded private U.S.-based companies to understand the composition of their boards as of Q4 2023 — one year after the prior study and four years after the original.

Leveraging the Crunchbase database, we identified 2,848 U.S.-based private companies founded since 2003 with cumulative funding of at least $100 million as of June 30, 2023. To ensure that each company’s board profile was current, we included only companies that publish their board of directors on their website.

We then referenced company website data, Crunchbase profiles and other publicly available information to characterize the board members. The study included only board directors; board observers and/or advisers were excluded from the data set. For each company, we segmented board members according to type of board seat: executive, investor or independent. In the few cases in which founders and past executives remained on the board despite no longer having an operating role at the company, we classified them as “executive directors” in recognition of their original relationship to the company. We identified gender by referencing professional profiles on Crunchbase and, when not available, other sites. For racial/ethnic identity, we leveraged self-identification information where available and supplemented that with contextual information and visual identification. As reflected by U.S. Census Bureau data collection, people of color include Black or African American, American Indian or Alaska Native, Asian, Native Hawaiian or Other Pacific Islander, Hispanic or Latino. Those with MENA backgrounds are not included among people of color.

About the authors

Him For Her is a social impact venture aimed at accelerating diversity on corporate boards. To bridge the network gap responsible for the sparsity of women in the boardroom, Him For Her engages business luminaries and partners with 100+ leading private equity and venture capital firms to connect the world’s most talented “Hers” to board service. Drawing from its ever-growing referral-only talent network of 7000+ women, a third of whom are women of color, Him For Her introduces board-building companies to board-qualified candidates. More than one hundred board appointments have resulted directly from Him For Her introductions to date. Together with guest hosts like Scott Cook, Carmine Di Sibio, Robin Washington, and Eric Yuan, Him For Her also convenes roundtable discussions that extend networks for CEOs and current and aspiring board members. A 501c3 corporation, Him For Her operates through the generosity of its founding partners GV, IVP, L Catterton, Mayfield, Silver Lake Partners, SoftBank, Starboard Value and Tiger Global Impact Ventures, and supporters like Brad Feld & Amy Batchelor, Reid Hoffman, Jeff Weiner, Nasdaq and many others.

Crunchbase is the leading provider of private company prospecting and research solutions. Over 70 million users — including salespeople, entrepreneurs, investors and market researchers — use Crunchbase to prospect for new business opportunities. Companies all over the world rely on us to power their applications, making over 6 billion calls to our API each year. To learn more, visit about.crunchbase.com and follow us on Twitter @crunchbase.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Are investments in AI startups slowly becoming a thing of the past? Surely not, writes Flint Capital’s Dmitry Smirnov who shares which areas hold the…

We recently spoke with Felicis general partner Sundeep Peechu about where the firm — an early investor in Canva and Notion, among others — is…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://news.crunchbase.com/diversity/2023-gender-study-private-boards-him-for-her/