Binance is seeing a higher than usual outflow of assets as sharks that have been hopping since FTX, now try and see whether to hop or circle here.

“We saw some withdrawals today (net $1.14b ish). We have seen this before,” said Changpeng Zhao, Binance’s CEO. “Some days we have net withdrawals; some days we have net deposits. Business as usual for us.”

That follows a Reuters article putting withdrawals at $1.9 billion based on blockchain data by Nansen.

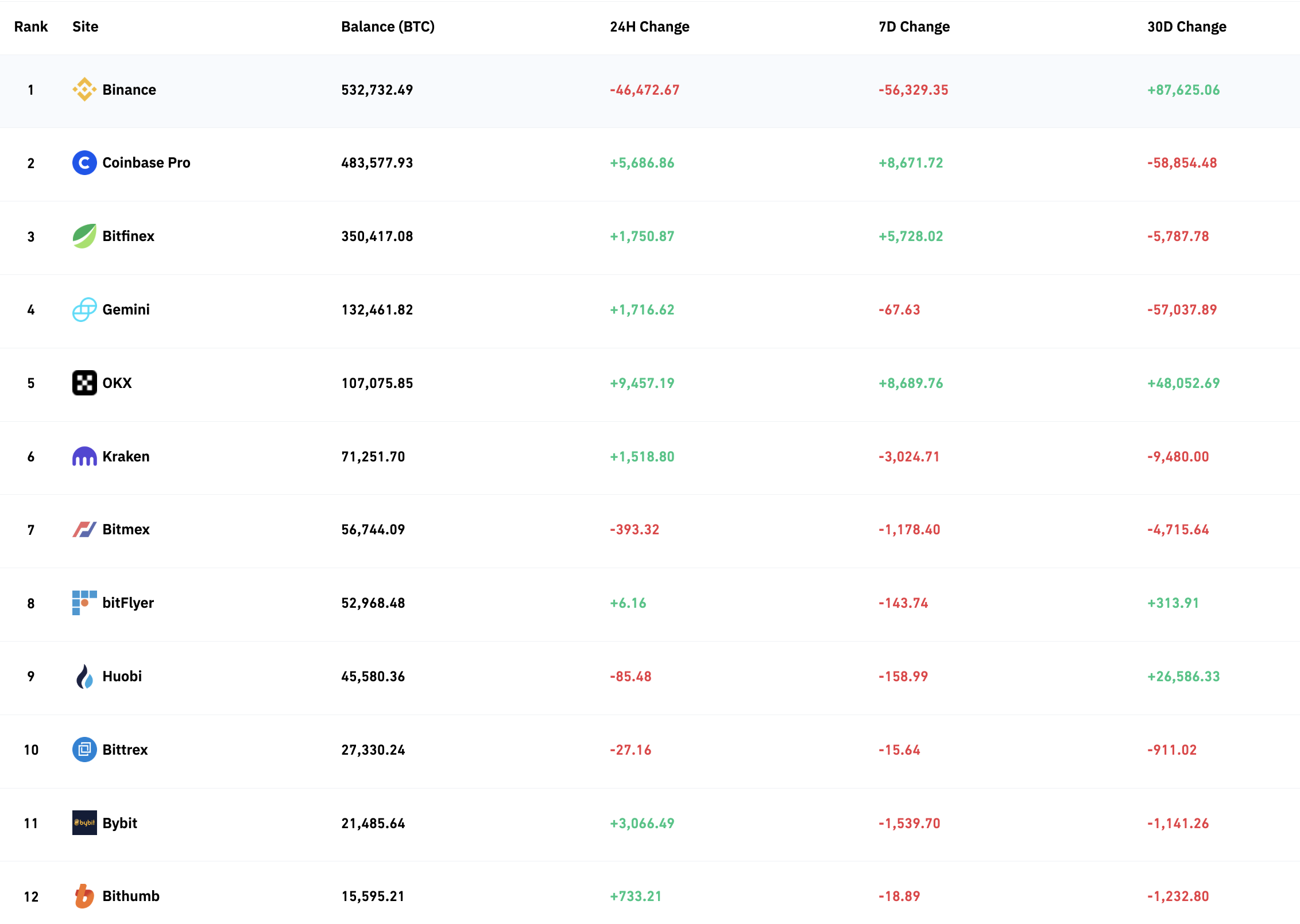

The latter says that Binance’s 24 hours net outflow has increased to $3 billion, but blockchain data has inbuilt uncertainty as you can’t easily know whether a withdrawal is to another Binance address or by Binance itself.

Activity however has picked up, but it is a somewhat small amount compared to the $62.5 billion in crypto assets held by Binance.

In the past week, there was an $8.7 billion outflow and $5.1 billion inflow, giving net withdrawals of $3.6 billion.

In which case, considering the $3 billion was withdrawn in the past 24 hours according to these data, then we have an increase of about 30x in withdrawals.

As the data concerns scale rather than veracity, even if there is noise, that noise would also apply for the $600 million net outflow in the previous six days, and therefore one arguably can have more confidence in the scale of increase regardless of whether it is $1 billion actually withdrawn or $3 billion.

That significant increase has led to some problems. USDc withdrawals were temporarily paused earlier today with Changpeng stating:

“On USDC, we have seen an increase in withdrawals. However, the channel to swap from PAX/BUSD to USDC requires going through a bank in NY in USD.

The banks are not open for another few hours. We expect the situation will be restored when the banks open.

These are 1:1 conversions, no margin or leverage involved. We will also try to establish more fluid swap channels in the future. In the meantime, feel free to withdraw any other stable coin, BUSD, USDT, etc.”

PAX/BUSD and USDc are all meant to be $1, but the peg in some occasions and for some stablecoins can come off. For bUSD, however, it is still trading at $1.

Binance’s own volatile coin, BNB, is down slightly 0.5% even though both bitcoin and eth are up about 6%.

That’s obviously because the market is speculating regarding both this Proof of Keys test, and an article by Reuters that claimed the US Department of Justice is split on whether to bring charges for money laundering against Binance and Changpeng himself.

That would be quite a big step with the ‘interest of the public’ consideration weighing quite heavily, especially if steps have been taken to remedy any of DoJ’s concerns, as Binance of course claims, stating they have “responded to over 47,000 law enforcement requests.”

In addition, an over the top blog post by an unknown argued that Binance’s auditor, Mazars, did not vouch for the audit they performed which was limited to nonetheless stating that Binance holds all of the bitcoin to meet all BTC deposits.

They have revealed their asset addresses on-chain as well, and claim to have no debt.

We therefore expect the sharks to hob, based on that information, and if all is sound the good news would be that the sharks did hop from Grayscale to now Binance.

Since Binance is a centralized custodian however, without a full on proper audit you can’t really be sure. But, on the other hand, no evidence has come across that where the cryptos themself are concerned, there’s anything amiss.

“I actually think it is a good idea to ‘stress test withdrawals’ on each CEX on a rotating basis,” Changpeng said, and that’s what has been happening since June.

There was hopping from stETH, even USDc, circling at FTX, hopping from Crypto.com, from Grayscale and probably quite a lot more we are missing.

Binance however went through its stress tests and scrutiny when it was new back in 2017-18.

The exchange in fact sort of became a prize for hackers because Changpeng is himself a hacker, so hacking a hacker is quite a badge, presumably and in some corners.

Most failed, one did succeed to a very limited extent, but Changpeng is a very ‘old’ cryptonian. He worked for Blockchain.com, and some other crypto companies after jumping from banks – where he was coding for high frequency trading – to crypto in 2013.

All this time, if there was anything amiss in his character where dishonesty in regards to customers’ funds are concerned, you’d think it would have come out.

But we did sort of learn that USDc is not actually 1:1 backed with USDc tokens, although as far as we know as of now, it is backed with equivalent stablecoins or usd.

That is to say dishonesty is not a necessary requirement for things to potentially go wrong, although ultimately there’s no perfection as they can go wrong in your own custody too.

Binance’s risks however may be more on the regulatory front where Changpeng tried to play a jurisdictional game in 2018, but ultimately effectively submitted in 2020s.

The sharks may therefore hop again as the bear runs out of low hanging fruits, at least hopefully, with these tests likely to strengthen the crypto space overall as cryptonians effectively engage in self-regulation of the entire global industry.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2022/12/13/1-1-billion-withdrawn-from-binance-says-changpeng-zhao