- WTI Oil on course for its best week in over two months.

- WTI unfazed as OPEC and IEA forecast paint differing demand pictures.

- WTI eyeing trendline break and psychological $80 a barrel mark.

Fundamental Overview and Week in Review

WTI oil prices are experiencing a resurgence this week, driven by demand optimism. This positions WTI for its best week in over two months. WTI is up 4.48% at the time of writing, with the $80 a barrel mark now firmly in sight.

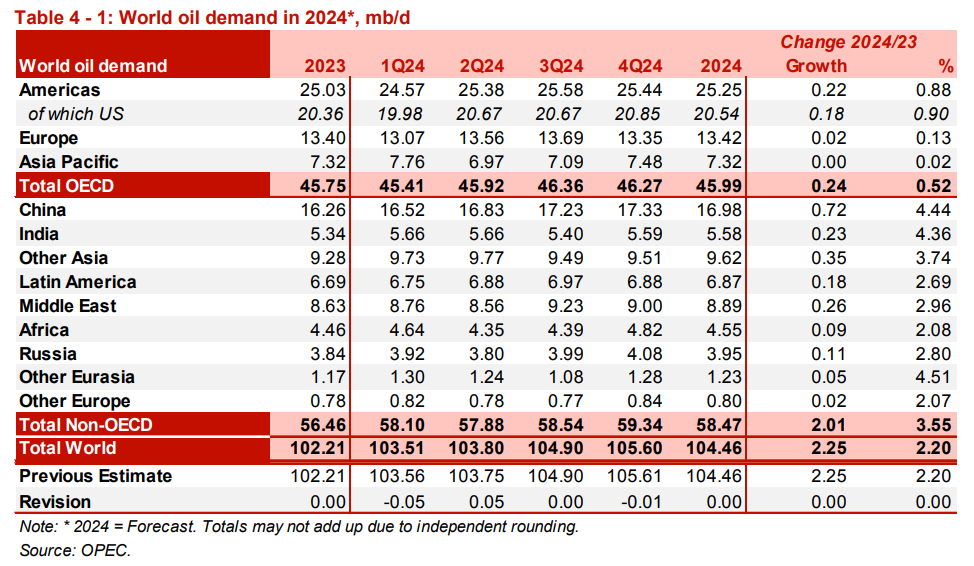

WTI prices rose in part due to OPEC maintaining its forecast for strong growth in 2024. Despite a somewhat disappointing first quarter, on Tuesday, OPEC reiterated its prediction of robust oil demand for the year, citing an improved outlook for travel and tourism in the second half of 2024. Furthermore, OPEC also cited steady global growth in the first half of 2024 with the services sector singled out as a key driver for growth to continue. This followed a Monday report by Goldman Sachs in which the investment bank stated that transport demand would push the market into a third quarter deficit.

OPEC Updated Oil Demand Forecasts as of Jun 11, 2024

Source: OPEC MOMR, June 2024

There is a lack of consensus however when it comes to demand forecasts for 2024, and this gap appears to be widening. The International Energy Agency (IEA) released its own report on Wednesday with the agency trimming its 2024 forecast down to 960k bpd. A drop of around a 100k bpd citing sluggish consumption in developed countries. This is in stark contrast to the OPEC forecast of 2.25 million bpd and the largest gap between the IEA and OPEC forecasts since 2008.

Heading into a new week with momentum and market participants will be keeping a close eye on WTI. Mixed US data saw rate cut hopes resurface post the FOMC meeting which adds another layer of confluence supporting higher oil prices. A stronger US dollar might challenge OPEC forecasts, as it could lead to higher prices for other countries (currency depreciation against the US dollar) and reduce demand.

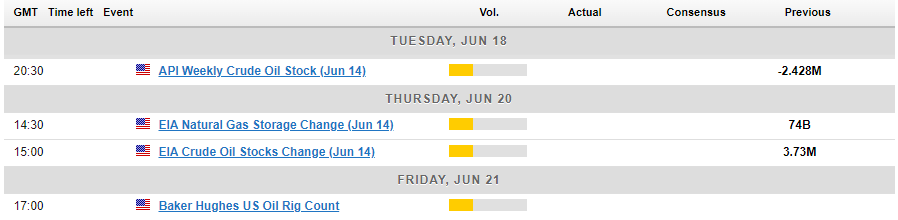

The Week Ahead: US PMI Data and Oil Inventories

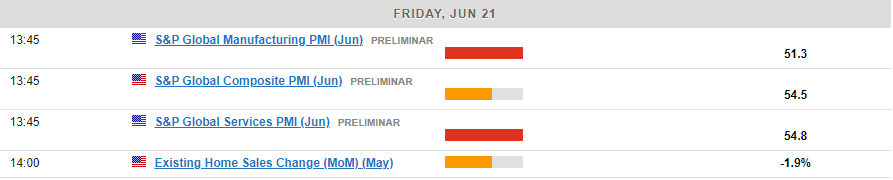

Looking ahead to next week, market participants will closely monitor whether WTI can maintain its recent rally. With a lighter economic calendar, the US PMI data on Friday may trigger some reactions, especially in light of OPEC’s comments. Since the US is primarily a service-driven economy, this data will offer insights into OPEC’s optimism regarding travel, tourism, and service sectors contributing to global growth in the second half of 2024.

Other key events include US retail sales data on Tuesday with API and EIA crude oil data to be released on Tuesday and Thursday, respectively. If inventories are on the decline, it could signal a busy summer of travel in the US and boost optimism that WTI may continue to rise. Geopolitics should also be monitored as hostilities between Hezbollah and the IDF continue to intensify in norther Israel. Any sign of an Israeli offensive into Lebanon or further attacks by Hezbollah threaten a spillover in the region, something which could add a risk premium to oil prices moving forward.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

WTI Oil Technical Outlook

Looking at WTI Oil from a technical perspective, the weekly chart is on course for a massive bullish engulfing candle close, off a key support level while at the same time printing a morningstar candlestick formation. All of the above hinting at a bullish continuation in the week ahead.

Dropping down to the daily timeframe chart and price appears to be flirting with a break of the descending trendline which is in play, another sign of bulls taking control. There is a just reason to approach with caution as just above the current price we have both the 100 and 200-day MAs resting around the 79.50 handle with the 80.00 psychological level the next resistance area. In simple words, there are a lot of hurdles for WTI to overcome if it is to find acceptance above the $80 a barrel mark.

WTI Oil Daily Chart – June 14, 2024

Source: TradingView.Com

Key Levels to Consider:

Support:

-77.90

-76.40

-75.00 (Psychological Level)

Resistance:

-79.50

-80.00 (Psychological Level)

-82.03

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/commodities/wti-oil-week-ahead-wti-eyes-80-a-barrel-on-demand-optimism/zvawda