In today’s landscape, safeguarding your customers from threats and ensuring a seamless payment experience is more critical than ever before. Enter Know Your Customer (KYC) and Strong Customer Authentication (SCA) – two pivotal components in achieving these goals.

In this article, we’ll delve into the ways in which these processes can elevate your customer experience while fortifying payment security. We will also provide insights into 3DS2 and elucidate the distinctions among various KY terminologies, such as KYC, KYB, and KYT, and their significance.

Understanding KYC: Verifying Customer Identities

KYC’s primary function is to validate customer identities, thwarting fraudulent activities such as identity theft and money laundering. This practice is mandatory for B2B enterprises, financial institutions, and even select federal banks, necessitating the collection of essential identification documents like passports and address proofs for identity verification.

This procedure, often referred to as the

Customer Identification Program (CIP), plays a pivotal role in adhering to financial regulatory standards. Much like KYC, CIP involves the collection and validation of customer identity details such as name, date of birth, address, and other pertinent information.

Financial institutions must institute a Customer Acceptance Policy (CAP) that ensures the identity of potential customers before engaging in any business transactions with them. Together, CAP and KYC establish a comprehensive customer due diligence program, mitigating the risk of financial crimes and ensuring regulatory compliance.

In Europe, KYC carries particular weightage as it is mandated to align with the Anti-Money Laundering Directive (AMLD). By adhering to KYC protocols, businesses can insulate themselves against fraudulent activities and maintain a secure and legitimate business environment.

- However, KYC’s relevance extends beyond Europe.

The U.S. Financial Crimes Enforcement Network (FinCEN) imposes KYC standards on both customers and financial institutions to combat illegal activities, particularly money laundering.

Decoding SCA: Enhancing Online Payment Security

Strong Customer Authentication (SCA) is a security mechanism designed to shield customers by employing two or more authentication factors. In Europe, compliance with SCA is obligatory under the revised Payment Services Directive (PSD2).

SCA is applicable to customer-initiated online payments within Europe and online card payments within the European Economic Area. The latest iteration of 3DS2 augments protective layers and liability assurances.

With the global adoption of SCA on the horizon, it is expected that SCA initiatives will emerge in the United States, either at the federal or state level. U.S. e-commerce vendors and processors should prepare accordingly by incorporating SCA capabilities and exploring avenues for transaction-based exemptions.

This might entail a review of existing payment processor agreements to optimize the availability of exemption or a transition to a cost-effective processor equipped to offer such capabilities.

The Confluence of KYC, KYT, and KYB

A burgeoning trend in the realm of Anti-Money Laundering or Countering the Financing of Terrorism (AML/CFT) involves the amalgamation of Know Your Customer (KYC), Know Your Transaction (KYT), and Know Your Business (KYB) processes.

KYC entails identifying and verifying customer identities, KYT scrutinizes and evaluates customer transactions for potential suspicious activities, and KYB verifies the legitimacy of business entities.

By amalgamating these processes, businesses can construct a more comprehensive and streamlined AML/CFT program that spans the entirety of the customer journey. This amalgamation holds the potential to reduce the risk of financial crimes, enhance compliance, and bolster customer trust.

Trends in KYC and SCA for 2024

In the digital age, crafting a secure and seamless customer experience (CX) stands as a paramount concern for businesses. The integration of Know Your Customer (KYC) and Strong Customer Authentication (SCA) plays a pivotal role in elevating CX.

As we venture into 2024, several noteworthy trends emerge within the KYC sphere, including e-KYC, AML, digital KYC, and forensic checks, harnessing biometric data, distributed ledgers, and AI.

Biometric Authentication

One of the prominent trends is the incorporation of biometric authentication, such as facial recognition and voice verification, to augment KYC procedures. This provides an additional layer of security and convenience, facilitating smoother authentication processes.

Artificial Intelligence

The adoption of AI and machine learning to automate KYC processes is gaining momentum, resulting in time and resource savings, augmented accuracy, and heightened efficiency.

Forensic Checks with AI Algorithms

Forensic checks, powered by AI algorithms, authenticate uploaded documents during digital onboarding, enhancing consumer identification and verification. This, in turn, mitigates fraud risks, prevents money laundering, and validates document authenticity.

Advanced ML/AI algorithms are adept at detecting fraud more effectively compared to traditional client screening tools, albeit within well-defined parameters.

Blockchain Technology

Another trend involves leveraging blockchain technology to create a shared KYC repository accessible to multiple stakeholders. This minimizes duplication, bolsters efficiency, and enhances security and privacy, thanks to the immutable nature of blockchain.

eKYC

eKYC signifies the digitization of KYC procedures, facilitating remote, paperless identity verification. It stands for Electronic Know Your Customer and offers a cost-effective and streamlined alternative to conventional KYC processes.

Document-Free Verification

The adoption of document-free verification is poised for wider acceptance, allowing users to confirm their identity swiftly through facial authentication.

Stringent Global Requirements

On a global scale, regulatory requirements are set to become more stringent, with additional countries implementing the Travel Rule and enforcing stricter data protection measures. Companies must prepare accordingly, ensuring adherence to regulatory stipulations, including the incorporation of ESG factors into KYC due diligence.

KYC Crypto Regulations

KYC regulations in the crypto sphere are evolving, with expectations of introducing rules akin to Switzerland’s identity verification for transactions exceeding $1,005 in other countries.

Verification Orchestration

Companies will need to tailor their KYC processes to different customer profiles through verification orchestration, enabling the creation of custom user verification workflows aligned with specific risk scenarios.

Digital Identity in Daily Services

Heading into 2024, a surge in the utilization of digital identity in everyday services is anticipated. Passive biometry, characterized by ‘always-on’ identity confirmation, will take precedence over one-time face recognition checks. Additionally, digital KYC verification modes, such as video-based and non-assisted approaches, are poised for greater acceptance in digital onboarding.

While these changes offer opportunities for forward-thinking banks to enhance compliance and deliver a seamless customer experience, it’s imperative to remain vigilant against advanced fraud techniques expected in 2024. Robust anti-fraud measures will be vital in detecting and preventing these increasingly sophisticated fraudulent activities.

KYC as a Profit Center with Automated CLM

In 2024, the transformation of KYC from a cost center to a profit center is projected to continue. Fintech companies can capitalize on this shift by providing enhanced KYC experiences to attract and retain customers. Automated Contract Lifecycle Management (CLM) tools enable a holistic view of customers, facilitating the provision of tailored products at the right time, ultimately enhancing customer value.

Lessons from KYC Failures

Recent instances of financial institutions such as Danske Bank Estonia and Santander UK facing substantial penalties due to inadequate KYC measures and ineffective AML control frameworks offer valuable lessons.

Danske Bank’s failure to exercise adequate oversight in 2022, allowing high-risk customers to transfer large sums of money with minimal scrutiny, exposed the bank to significant financial and reputational risks.

Similarly, Santander UK’s inability to establish and maintain an effective risk-based AML control framework, coupled with inadequate transaction monitoring, resulted in a

£108 million penalty. This stemmed from permitting a money service business to operate through one of its accounts.

These examples underscore the paramount importance of ongoing KYC and transaction monitoring in mitigating the risk of financial crimes and regulatory penalties.

Several other financial institutions, including BitMex, Commerzbank AG, Deutsche Bank AG, Skandinaviska Enskilda Banken, Goldman Sachs, and Westpac, have faced substantial fines in the past five years due to similar KYC shortcomings.

Ensuring the Highest Level of KYC Compliance

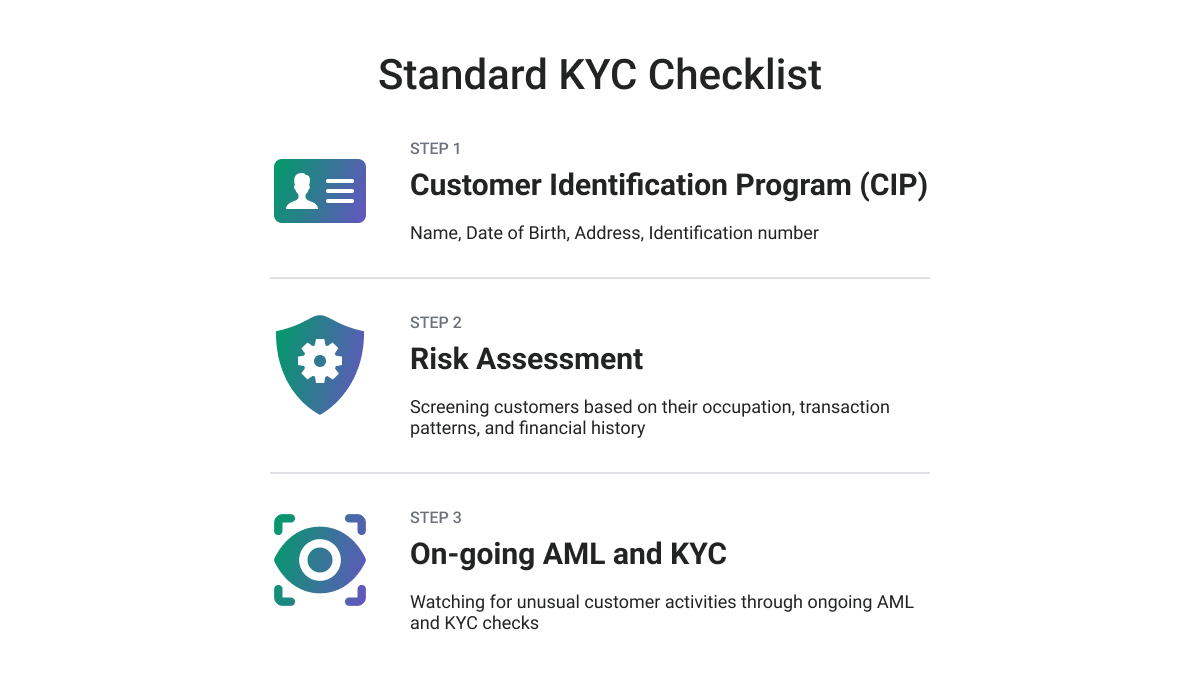

To devise a robust strategy for KYC compliance, we recommend following a comprehensive KYC Due Diligence checklist, comprising the following steps:

- Identify the Customer and Verify True Identity

- Implement a rigorous customer identification process, including the collection of necessary information.

- Scrutinize whether the customer is a politically exposed person or is listed on the Sanctions List.

- Validate the ownership of identity documents with an image of the document and the customer.

- Assess Customer Requirements and Risks

- Evaluate the potential for customers to engage in criminal activities like money laundering or terrorist financing.

- Estimate the risk of reputational damage.

- Gather information on the rationale and intended nature of the business relationship.

- Identify the Beneficial Owner and Verify Their Identity.

- Perform Ongoing Monitoring and Record-Keeping

- Investigate the activities of existing customers and maintain consistent monitoring, akin to the customer onboarding process.

A Final Word

To navigate the ever-evolving landscape of KYC compliance successfully, companies should adopt a holistic approach and leverage

payment security technologies. Forward-thinking banks that anticipate these changes and proactively adapt stand to gain a competitive edge.

By developing a next-generation KYC program with a well-thought-out strategy and persistent effort, companies can realize several benefits, including reduced costs and risks, minimized penalties, improved customer and employee experiences, and increased revenue.

The journey toward effective KYC and SCA compliance is a dynamic and evolving one. Staying attuned to emerging trends, embracing innovation, and adhering to stringent compliance measures are key to ensuring the security of payments and maintaining customer trust in the digital age.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25207/why-including-kyc-and-sca-compliance-in-your-payment-security-strategy-is-crucial?utm_medium=rssfinextra&utm_source=finextrablogs