Welcome back to BitPinas Key Points: easily digestible news in concise formats for easy reading. Let’s check the latest crypto news stories in the last 24 hours.

Table of Contents

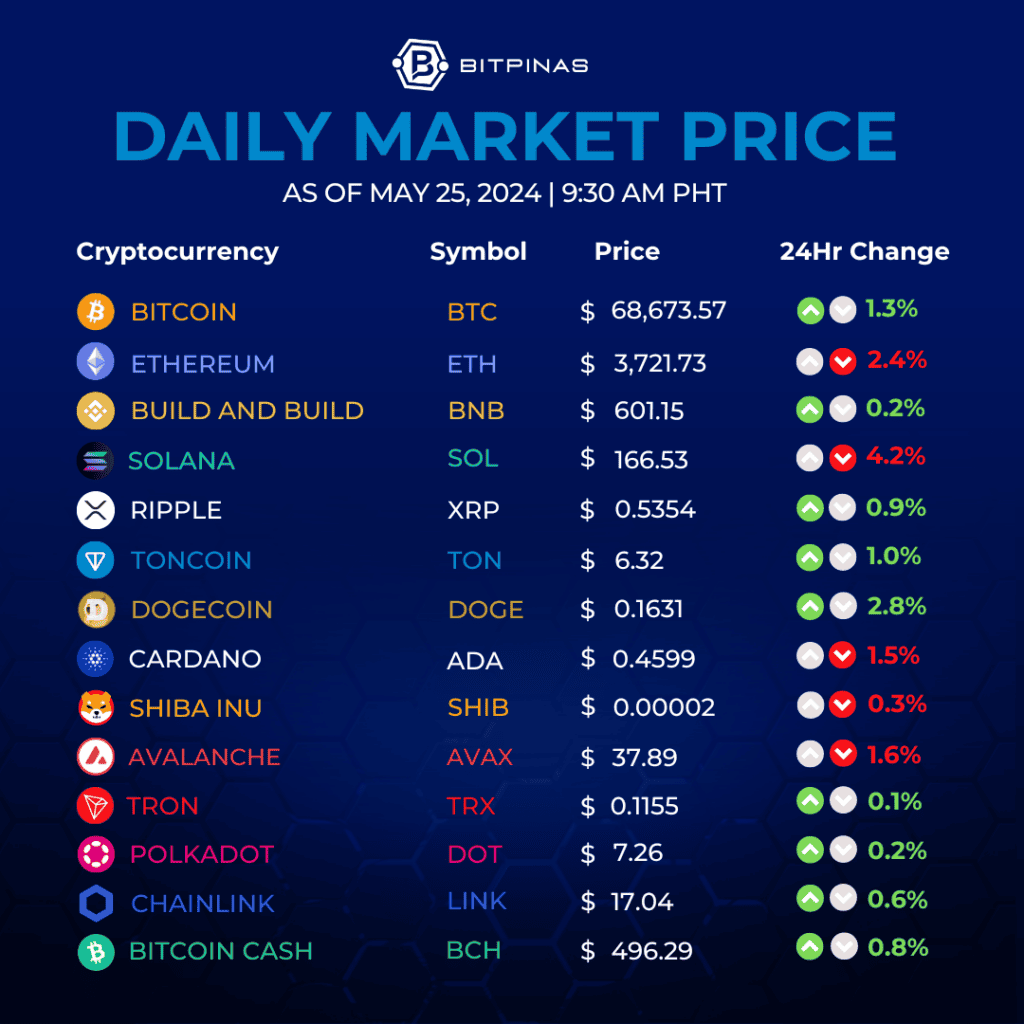

Crypto Price Update

Feature News: Why Ether Price Didn’t Move Despite ETF Approval

- The U.S. Securities and Exchange Commission (SEC) cleared 19b-4 filings for eight spot ether exchange-traded funds (ETFs) from BlackRock, Bitwise, Grayscale, Van Eck, Ark 21Shares, Fidelity, Franklin Templeton, and Invesco Galaxy, Unchained reported.

- The approval surprised many in the industry, leading to a 30% rally in ether’s price. However, the price has since declined, with ETH trading at around $3,600, down 4% in the last 24 hours.

- Market participants noted that the approval of 19b-4 filings does not immediately mean spot ether ETFs will start trading. The SEC still needs to approve S-1 documents, which could take weeks or months.

- Some traders believe the news of the 19b-4 approval was already priced in, and significant price movements will occur once the ETFs begin trading. Notably, crypto trader “@DaanCrypto” pointed out that large orders being pulled from Binance may have contributed to the price drop.

- Jesse Pollak, creator of Base, emphasized that the importance of the ETH ETF lies in its political implications, highlighting the growing recognition of crypto as a positive technology.

Local News: Bitcoin Pizza Day Celebrations Continue

Regulation

- The Reserve Bank of India (RBI) warned retail investors in its May 2024 bulletin about the lack of accountability and stability in the crypto ecosystem, citing regulatory ambiguity and the speculative nature of investments. The bulletin highlights concerns that some cryptocurrencies may lack transparency and be backed by unstable digital assets, potentially leading to crises without safeguards.

- Gate.io’s Hong Kong arm, Gate.HK, has halted its operations and withdrawn its application for a cryptocurrency trading license in response to evolving regulatory changes in the region. The decision reflects the forthcoming deadline set by Hong Kong’s Securities and Futures Commission (SFC), which requires only licensed crypto exchanges to operate after May 31.

DeFi

- Multipool, a blockchain and cryptocurrency innovator, has partnered with Mobilum to offer users a fiat-to-DeFi on/off ramp without centralized exchange involvement. This partnership aims to provide users with easier access to the DeFi world while bypassing centralized exchanges.

- Transak, a fiat-to-crypto on-ramp, integrated USDT on The Open Network (TON) Blockchain, enabling over 5 million users across 160 countries to purchase USDT using fiat currencies directly via Transak’s platform. This integration, following a strategic collaboration between the TON Foundation and Tether, aims to enhance P2P payments within decentralized applications and leverage Telegram’s massive user base.

Web3 Gaming

- Anomaly raised $1.45 million for its AI-driven Layer 3 web3 gaming platform, which integrates with Telegram to offer accessible mini-games with a “play-to-airdrop” reward system. The funding round, led by Decasonic and supported by Shima Capital, Round 13, and others, values Anomaly at $11.4 million post-money.

- Gunzilla Games integrated Fireblocks’ enterprise platform to manage digital assets, providing secure, non-custodial wallet options for GUNZ users and enhancing the in-game digital economy. This partnership aims to set a new standard for blockchain-enabled games, starting with Gunzilla’s upcoming battle royale game, Off The Grid.

Noteworthy

- Binance Research presents the “Breakthrough DeFi Markets” report, highlighting the significant growth in decentralized finance (DeFi) sectors. With a 75.1% increase in total value locked (TVL) to $94.9 billion YTD, various sectors like yield markets, stablecoins, money markets, and prediction markets have seen substantial growth.

- The decentralized finance (DeFi) platform Uniswap Labs disclosed details about the SEC’s Wells notice, revealing the regulator’s concerns about its Uniswap Protocol and UNI token. Uniswap refutes the SEC’s assertions, arguing that its protocol and token are not securities, but rather file formats and governance tokens, respectively.

- Lin Rui-siang, a 23-year-old Taiwanese IT specialist who trained St. Lucia police in combating cybercrime, was arrested for allegedly running the Incognito dark-web drug market, facilitating $100 million in narcotics sales, and later extorting his own users by threatening to release their transaction details. Despite his supposed expertise in cryptocurrency tracing, Lin’s own financial trails led the FBI to identify and apprehend him.

This article is published on BitPinas: Why Ether Price Didn’t Move Despite ETF Approval | Key Points | May 25, 2024

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/feature/key-points-may-25-2024/