Hispanics are an emerging American economic force, and demographics show they will be for decades. Tricolor founder and CEO Daniel Chu has a plan to serve them.

According to McKinsey, financial services revenue from Hispanics will triple from north of $90 billion to $265 billion by 2030. If the more than 60 million Hispanics in the United States were their own economy, it would be the world’s eighth-largest. More than 80% of the workforce growth is because of Hispanics; by 2060, they will represent 30% of the workforce. Their average age is three decades younger than that of whites.

(Chu stressed this isn’t a border issue. The average Tricolor customer has lived in the United States for 15 years.)

Despite being near the bottom of the labor hierarchy, or perhaps because of it, Hispanics withstood the pandemic in decent shape. Chu said they benefited from the supply imbalance, emerging with higher incomes than before COVID-19. They’re resilient, and with an average household size 2.5 times larger than non-Hispanic households, there are natural safeguards against collapse.

The solutions shortage facing Hispanics

The American economy has been slow to respond. More than 50% of Hispanics are unsatisfied with their financial services. One-third cannot access affordable credit.

“Hispanics are closing the income gap versus the white population in the U.S.,” Chu said. If you look at the combined educational attainment, Hispanics are maybe 15% behind, but household wealth for the white population is six times greater than Hispanics’.

“So the real key is that Hispanics have to participate in homeownership. That’s how the low-income population can ultimately accumulate some wealth, and that fits squarely in our business. Around 60% of our customers who don’t have a FICO score, don’t have a social security number, we can build a credit score as a result of our financing.”

Tricolor thrived during the pandemic

Despite challenging economic times, Tricolor has posted 40% annual growth rates, with 2024 revenue projections of $1.3 billion. Losses didn’t explode during the pandemic. Chu attributes that to Tricolor’s customer moat.

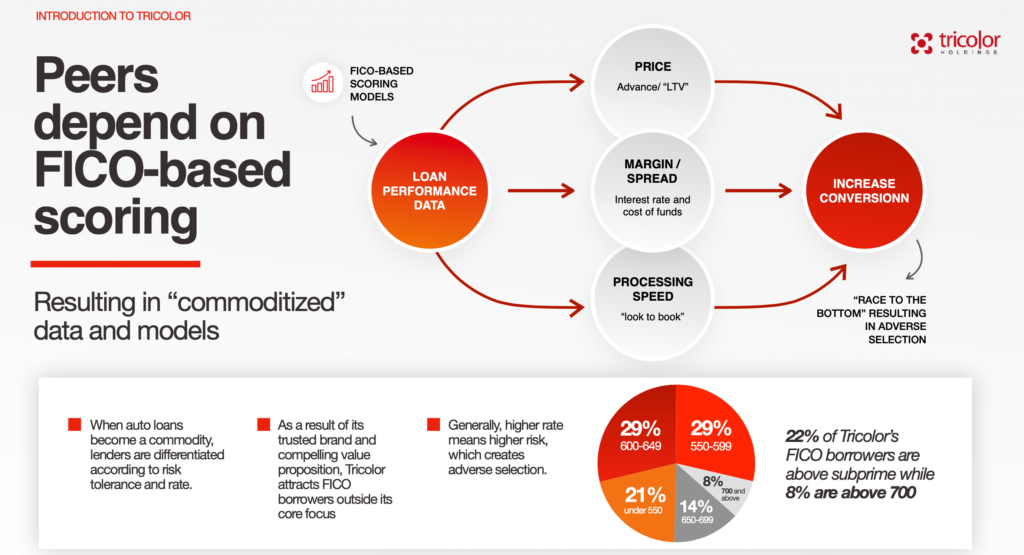

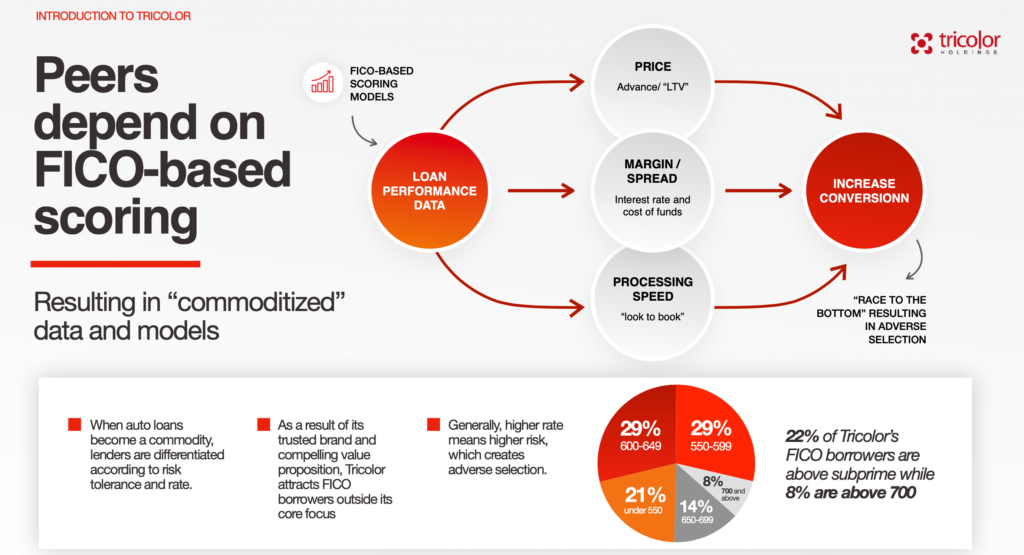

“Everybody else is chasing the same general market consumer. Again, we are addressing a consumer that has this vast, competitive moat around them,” he explained. “All the other models are really commoditized models, and their commodity is capital, the commodity is FICO data, and they don’t have any ability to distinguish themselves.”

Tricolor’s technology isn’t proprietary, but Chu doesn’t share it. That exclusivity and 45 million unique data points Tricolor correlated over the years is the key to its success, driving profitability from almost day one.

Philosophy also played a role. Chu said Tricolor moved the risk to the top of the funnel by using technology to segment early. That augments lead generation and improves underwriting.

It drastically improves the traditionally adverse relationship between automotive dealers and lenders. Dealers seek profit maximization, while lenders want to underwrite a good loan.

“Because we have an integrated model, we can align marketing and risks,” Chu said. “We can use our data to say that this combination of attributes will grade and perform well. You can push them through social media with Facebook or other digital campaigns, and we can work with the customers we know will perform.

“So unlike the traditional model, where dealer and lender are adverse, we market to customers we know we want to finance. We align sales and marketing with risk and underwriting, and that’s a powerful dynamic.

Alternative data improvements

“If we can segment that customer earlier and give them an offer, give them an idea of what they can qualify for earlier in the process, their chances of moving through the funnel successfully increase.”

Strides in interpreting alternative data have assisted that process. Two years ago, Chu said there was no benefit. Today, there are more sources, even for non-bureau customers, that have correlative value and can reduce fraud by as much as 20 basis points.

AI considerations

Chu’s biggest concern about AI is maintaining data integrity. All data incorporated into models must be collectable, verifiable, and validated. Tricolor only uses previously validated data in credit decisions.

It’s a successful method that regulators approve of. Chu said they want to see vulnerable consumers like Hispanics gain access to more and better financial services.

It beats sticking with easier bets, ones with enough mainstream data to help predict performance.

“We’ve been more consistent than any issuer in subprime auto loans for the last four years,” Chu said. “That speaks to our ability to validate our model. If you’re not doing constant model validation in a volatile environment, you could be subject to some unintended consequence of a trend that everybody else is missing.”

One such example is the masking effect of pandemic stimulus and forbearance. Chu said Tricolor conducted constant model validations that suggested they were on target.

“When we did model validations during the lockdown, we asked customers how many people lived in their household,” Chu said. “I mean, I don’t think that question on a credit app, but we could see a big correlation. So we weighted that a little bit heavier.”

Also read:

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnexus.com/tricolors-plan-to-serve-hispanics-an-emerging-economic-force/