Moving Beyond the Robotaxi Dilemma

Autonomous vehicles (AVs) have captured public imagination for years, conjuring science-fiction-worthy images of self-driving cars, buses, and hovercrafts. In recent years, driverless vehicle technologies have cruised from utopian science fiction to reality as autonomous software solutions hit the market and autonomy-enabled vehicles hit the streets.

The AVs receiving the most media coverage are driverless taxis or rideshare vehicles, otherwise known as robotaxis. In this case, not all publicity is good publicity, as news of high-profile crashes and accidents, suspension of operations, and regulatory uncertainty have engendered significant concerns about public safety and very low public acceptance.

In terms of sustainability, while robotaxi companies (e.g., Waymo, Cruise) purportedly provide sustainable transportation solutions and reduce overall city emissions, some studies suggest that the effect may be the reverse, shifting customer tendencies away from less convenient but lower-emissions transportation options such as public transport, and increasing urban congestion and emissions.

AVs and robotaxis have become conflated in much of the public eye and sentiment, with controversies regarding the latter leading many to write off the practicality and sustainability potential for all autonomous vehicles. However, while robotaxis capture the public eye (and outrage) and generate flashy headlines, AVs are quietly gaining a foothold in niche sectors with a clear business and sustainability case.

Where Can AVs Actually Have Impact?

Autonomous vehicles can significantly increase operational efficiency in specific environments and are already being deployed for industrial use-cases, taking over monotonous, repetitive tasks in such areas as warehouse operations and yard operations (e.g., Outrider). These tasks can be performed more efficiently and effectively by automated vehicles, while reducing safety risks for human personnel.

Although on-road AV applications are more complex—as evidenced by the regulatory and safety challenges associated with robotaxis—innovators are providing generative-AI-based solutions to enable autonomous capabilities for an increasingly wide range of vehicles and use-cases.

Company Feature: Oxa

One of the most active innovators in the autonomous vehicle space is Oxa, developer of autonomy software that can be integrated with any vehicle type, and requires significantly less system power than similar platforms (200 watts compared to 4 kw).

Oxa states that its goal is to enable universal autonomy—and while it initially began exploring applications for mining vehicles, its current focus is on autonomous shuttles for university campuses, hospitals, and residential complexes. Autonomous software reduces operational and labor costs for fleet operators, which in turn can offset the upfront costs of purchasing electric vehicles, facilitating overall fleet electrification.

The Oxa Driver autonomous software manages vehicle operations to optimize energy use, and leverages generative AI to scout and plan routes, as well as to identify passenger patterns and optimize vehicle deployment to meet passenger transportation needs. Oxa works with fleet operators as well as transport authorities to outfit vehicles with autonomy-enabling software, while collaborating with vehicle manufacturers and OEMs to develop turnkey automation solutions for specific vehicles.

The Sustainability Case for AVs

“It´s all about delivering autonomy where it´s needed,” explains Sheelpa Patel, Chief Marketing Officer at Oxa, in this case, shifting users from single occupancy vehicles to shared vehicles that can operate around the clock. A study of taxi occupancy rates show that roughly half of the distance travelled by taxis is “deadheading”, where the vehicle travels, unoccupied, between pick-ups. The occupancy rate falls as low as 30% in some U.S. cities.

In comparison, initial data from shuttles using Oxa Driver show that 86% of shuttle journeys are occupied by passengers. Electric autonomous shuttles represent a first step towards shifting transport patterns towards electric, shared mobility: the goal is not simply to replace every ICE vehicle with an EV but to reduce the overall number of vehicles on the roads and optimize vehicle use.

Addressing the practicalities of achieving this goal, closed-loop circuits offer less complex routing and regulatory barriers than city centers and present an ideal environment for autonomy innovators to prove their solutions. Currently Oxa has partnered with Beep, a developer of electric passenger shuttles, to deploy autonomous electric shuttles in college campuses and residential centers in Florida, with additional deployments across the U.S. planned for the coming months.

Patel notes that the broader challenge AVs tackle is access to sustainable transportation. As highlighted by the UN Sustainable Development Goals, globally about 50% of urban residents do not have access to convenient public transport. While deploying or expanding a city-wide transport system is a logistical and fiscal nightmare, autonomous electric multi-passenger vehicles such as shuttles, vans, and buses can supplement existing public transport systems, helping cities meet decarbonization goals, reduce congestion, and establish transportation services that respond to passenger needs.

Looking Forward: Future Markets and Milestones

The autonomous vehicle market is a volatile space for innovators, with as many high-profile investments, such as Wayve’s recent $1B Series C raise, as bankruptcies, closures, and significant loses. In the generative AI for autonomous driving space, identification of key demand sectors and structured engagement with OEMs emerge as key success factors.

While Oxa has begun to deploy their technology in the electric shuttle sector, other innovators such as Gatik and Waabi are focusing on middle-mile and long distance trucking. Others such as Starship Technologies are exploring last-mile delivery solution. Engagement with OEMs will be crucial for these companies to make the transition from product pilots to widespread deployment.

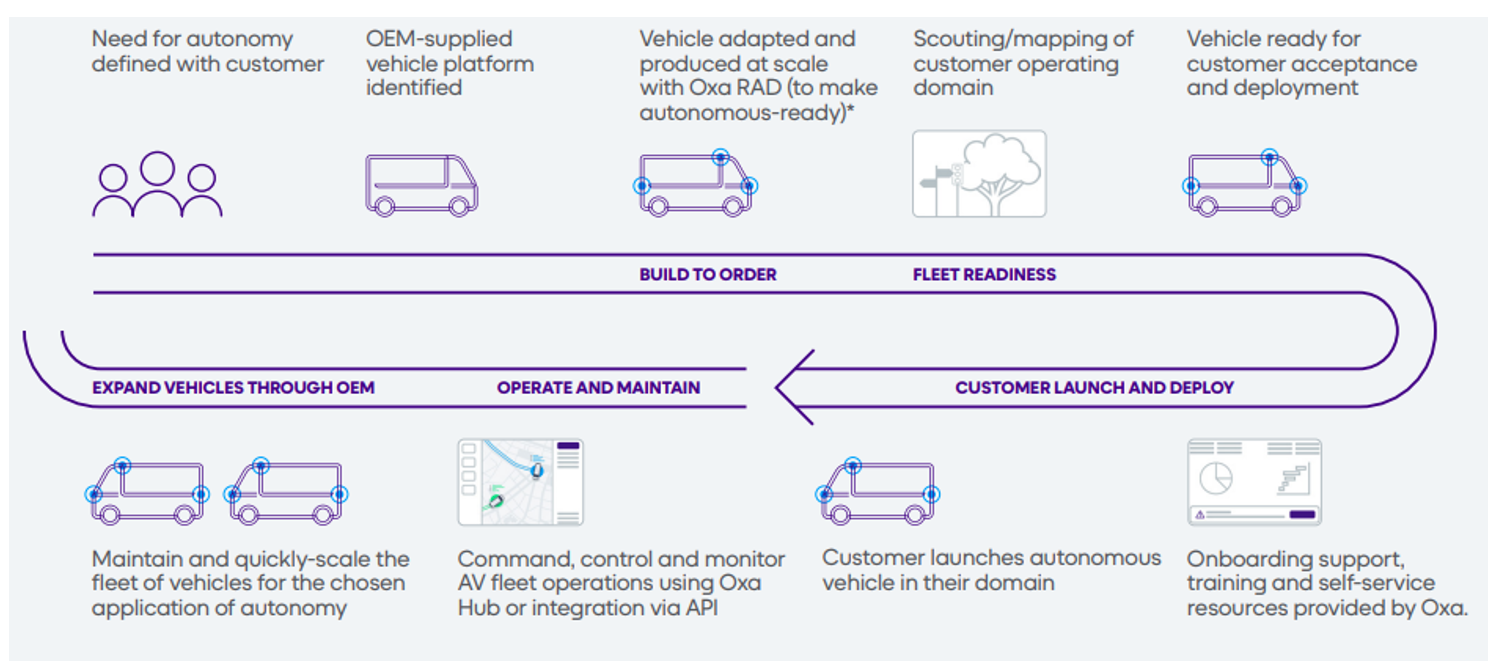

Autonomous Vehicle Deployment Roadmap with OEMs

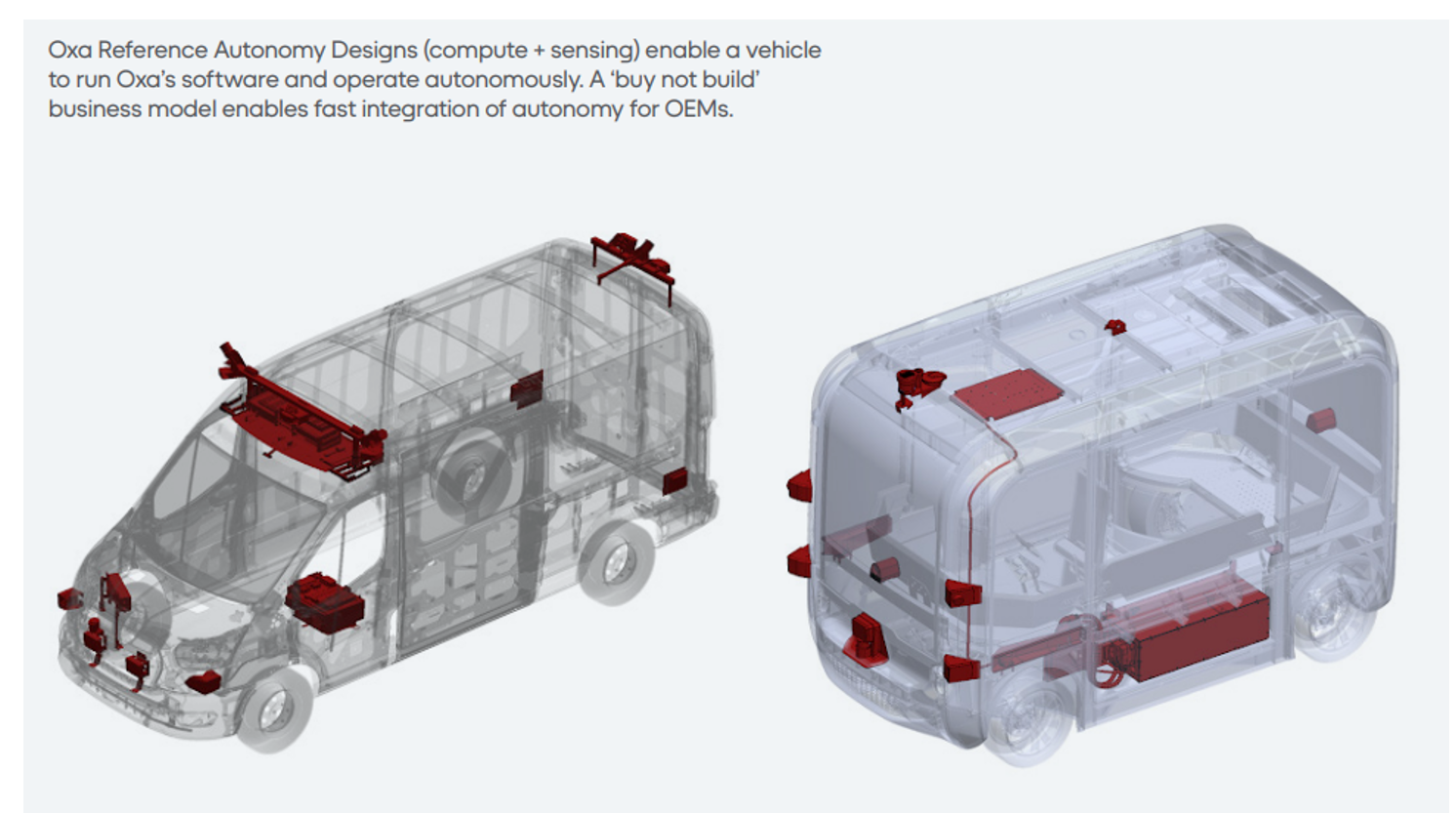

There are several different ways for innovators and OEMs to collaborate in this space. Innovators provide clear value to OEMs when they can model and carry out the integration of autonomy software into existing vehicles. Oxa highlights the “buy not build” model for OEMs in its recent industry report. For example, Oxa develops turnkey Reference Autonomy Designs (RADs), blueprints for OEMs to produce off-the-line autonomous vehicles.

OEMs are already accustomed to integrating value-add services into vehicles, and this structure both minimizes costs for OEMs who do not have to alter their production processes and reduces time-to-market for autonomous vehicles and solutions. Vehicle OEMs are not the only key partnerships—Gatik has recently partnered with Isuzu to mass-produce autonomous trucks, Waabi, developer of AI for self-driving, has partnered with NVIDIA to develop its autonomous trucking solutions, as well as Uber Freight, which will integrate Waabi technology into its logistics platform to provide a turnkey driver-as-a-service platform.

Oxa Reference Autonomy Designs

Look out for…

- Regulations enabling higher levels of autonomy-specific sectors such as port vessels, ferries, shuttles, and long-haul delivery

- Electric ferries: clear fuel and operations cost savings, set route, pressure to reduce emissions, and sustainable urban mobility use-case (e.g. Zeabuz, Hyke Smart Ferries)

- Trucking: fuel savings and emissions reduction can be up to 10%, addressing driver shortage and safety issues, operations and energy optimization offset up-front cost of electric HDVs particularly in light of incoming ICE HDV bans

- New markets for autonomous vehicles related to the energy transition (e.g., solar farm maintenance, environmental monitoring and sensing)

- Collaborations between vehicle OEMs and autonomy providers—key milestones for innovators include integration of proprietary solutions at the factory stage

- Markets that are ready for AVs include airport, port, and warehouse operations—expect an increase in autonomous vehicle deployment especially to offset the cost of electrification

- Autonomy innovator differentiation points that include system power requirements, simulation-based validation and verification of routes to reduce on-road driving and testing, and retrofitting process/integration into new or existing builds

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cleantech.com/the-future-of-autonomy-is-here-and-its-not-robotaxis/