In a Nutshell

The article explores the transformative evolution of payment rails in finance, predicting a reshaped landscape with key trends such as e-commerce surge, Open Banking adoption, and real-time payment shifts. It delves into unbundling financial services, the rise of innovative providers, and dynamic changes, examining the influence of open banking, real-time transfers, Super Apps, big techs, cryptocurrencies, and central bank digital currencies. The conclusion emphasizes the ongoing redefinition of payment infrastructure, stressing the need for banks to adapt and innovate for success in this dynamic environment.

Payment Rails Gaining Ground

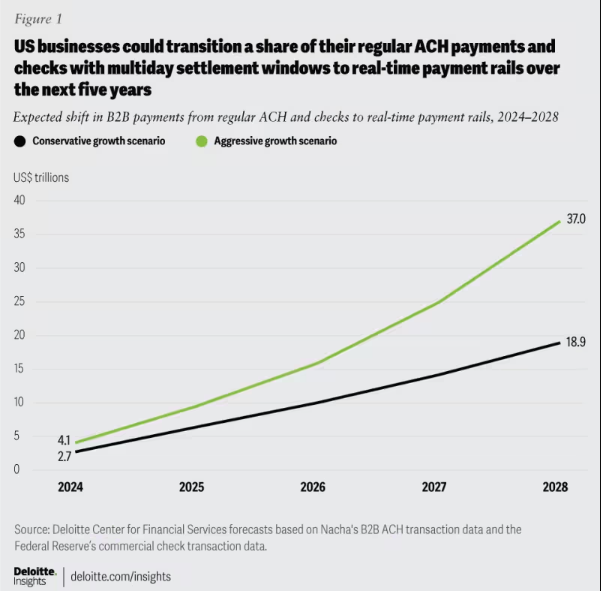

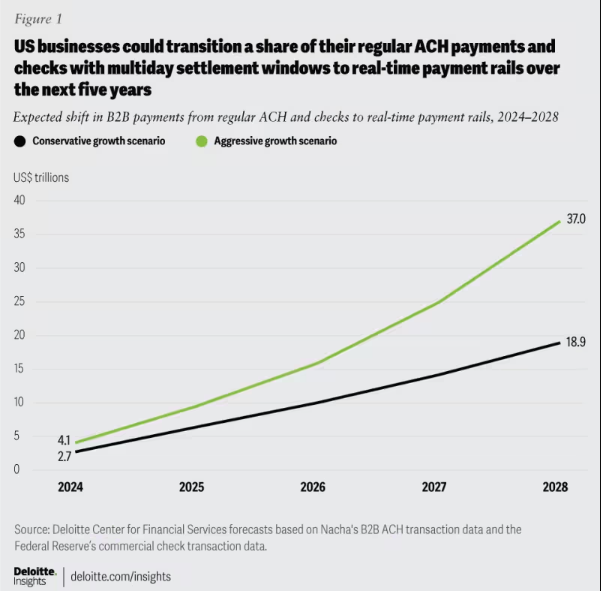

Payment rails form the foundational infrastructure for secure and efficient fund transfers between individuals, businesses, and financial institutions globally, playing a vital role in the financial ecosystem. In 2024, the financial landscape will undergo a transformative shift in the evolution of payment rails, reshaping the industry with significant implications for businesses and consumers. Global electronic payment transactions grew by 19% in 2021, exceeding pre-pandemic expectations. McKinsey projects a 9% average annual growth in the global payments industry over the next five years, fueled by an e-commerce surge, Open Banking adoption, real-time payment trends, and the acceptance of ISO 20022 for enhanced data and standardization.

Figure 1: Expected B2B payment shift: Moving from ACH and checks to real-time payment rails, 2024-2028.

As payment rails advance for speed, efficiency, and security, staying informed is crucial for banks. Adapting architecture to evolving customer needs is paramount, fostering resilience, adaptability, and long-term success in payments.

Figure 2: A Simplified View of Payment “Rails” Ecosystem

Unbundling of Financial Services: Taking Stock of the Payment Landscape Transformation

The payment landscape transforms through the unbundling of financial services, driven by fintech innovations like Venmo, Klarna, and PayPal. While focusing on optimizing legacy processes, the phenomenon breaks down traditional bundled products, allowing non-banks to specialize in functions like fund holding and transfer. This extends beyond B2C, reshaping the industry with new forms of competition and collaboration. Unbundling accelerates innovation, introducing real-time payment rails and integrating technologies like cryptocurrencies and open banking, leading to a more efficient and secure payment infrastructure.

Emergence of Innovative Payment Providers: Towards Transmogrification of the Payments Landscape

A new generation of innovative payment providers, like Square, Adyen, and Stripe use cutting-edge technology to simplify payments for merchants, capitalizing on the e-commerce boom. Disrupting the traditional ecosystem, they offer efficient, secure, and cost-effective solutions, expanding payment methods. The global APM market is booming, with over 85% of large US merchants planning to accept new methods, projecting a CAGR of 11.6% to reach $27.8 billion by 2028.

Figure 3: Some Key Players in Alternative Payments Method Space in Europe

The ascent of these payment providers is further propelled by the introduction of new payment rails, such as real-time payment rails and open banking. These advancements facilitate faster, more efficient, and more secure payment processing, allowing these providers to integrate seamlessly into the payment ecosystem. This integration enables them to offer value beyond payments, evolving into comprehensive “one-stop shops.”

Dynamic Shifts Influencing the Payment Landscape

Several pivotal developments are intricately shaping the payment ecosystem, introducing complexity and fostering innovation:

Open Banking: This paradigm shift empowers smaller players to innovate in financial services by allowing third-party developers access to financial data, leading to the creation of inventive payment solutions and value-added services.

Real-time A2A Schemes: Successful schemes like iDEAL, BLIK, and Pix enable instant account-to-account transfers, driving innovation and competition within the payments industry.

Super Apps: Dominant in Asia, Super Apps like Alipay and WeChat Pay offer a diverse range of services, including payments, investments, and lifestyle services, gaining popularity among consumers and merchants alike.

BigTechs in Financial Services: Tech giants like Apple and Google are creating closed-loop financial services ecosystems around their wallet and payment capabilities, intensifying competition and innovation.

Cryptocurrencies: While not revolutionary in payments, cryptocurrencies persist and may influence the future of money. Some banks explore their potential for payment solutions and cross-border transactions.

CBDCs: Central banks globally are developing Central Bank Digital Currencies (CBDCs) with the potential to replace traditional fiat currencies, offering advantages like faster transactions, lower costs, and increased financial inclusion.

Intricate developments reshape payments, driving innovation and creating opportunities. Staying informed is crucial for banks to stay competitive in the evolving industry.

Revolutionizing Payment Infrastructure

The current wave of redefining payment infrastructure marks a departure from traditional models with two key evolutionary developments:

Construction of New Payment Infrastructure: A shift towards a next-generation setup, where new and old capabilities coexist in a multi-rail mix, is underway. Incumbent and challenger players compete for a redefined role in the value chain.

Companies deploy new payment infrastructure, such as PayPal’s Commerce Platform for multi-currency payments and Square’s all-in-one Terminal for various payment methods.

Exploration of New Payment Rails: Companies explore real-time payment rails and open banking. Mastercard’s Mastercard Send and Visa’s Visa Direct enable real-time payments, driving blockchain innovation for cross-border and micropayments. AI and machine learning enhance payment fraud detection.

The Bottom Line

On the whole, the evolving payment rails are reshaping the future of financial services, fostering innovation and disruption. The battle around payment rails drives unprecedented changes amidst surreal solidarity and singularity of purpose of key players in the fintech and financial services space, ushering in a new era in the payments landscape. Greasing the wheels to this dynamic environment will position banks and financial institutions to find their feet for monumental success.

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnexus.com/evolution-payments-rails-shaping-future-financial-services/