Since January, Workday has signed three new offtake agreements with carbon projects, committing to purchase over 300,000 carbon credits over the next six years. By guaranteeing future demand, the enterprise software provider is helping to close the finance gap that holds back many high-impact carbon projects.

The projects include forest protection in the Amazon with remote sensing, carbon removal via biochar in Namibia and an innovative approach to plugging orphaned oil and gas wells.

In 2023, Workday also joined Frontier Climate, a coalition of more than a dozen companies that together have committed to purchase $1 billion in durable carbon removal (CDR) by 2030, helping to scale the removals industry. Frontier signed a new offtake agreement on May 1, for over 150,000 tons of carbon removals over the next three years.

Workday’s climate targets have long been among the most ambitious in its industry, combining aggressive supply chain emission reductions with compensation for residual emissions via carbon credits, and support of projects beyond the company’s value chain that contribute to global net zero. It made its cloud carbon neutral in 2017. It began sourcing 100% renewable electricity in 2020, mitigated the company’s entire historical emissions in 2021, and now plans to transition its whole carbon credit portfolio to removals by 2031.

“The carbon removal part is where we are now but we’ve been on this journey for a long time… This is sort of the natural evolution of that journey,” said Erik Hansen, Workday’s chief sustainability officer.

Why carbon offtakes matter

Many projects with the potential to reduce greenhouse gas emissions or to remove carbon from the atmosphere — like preventing landfill methane emissions, restoring native ecosystems, or building direct air capture hubs — require upfront capital to develop and scale. But that upfront investment can be hard to come by before projects have proven their ability to deliver verified carbon credits.

“Feasible financing terms are often unavailable to these projects without a demand signal,” said Brennan Spellacy, CEO & co-founder of Patch, a carbon credit marketplace. As a result, many climate projects spend years stuck in an endless cycle of chasing financing.

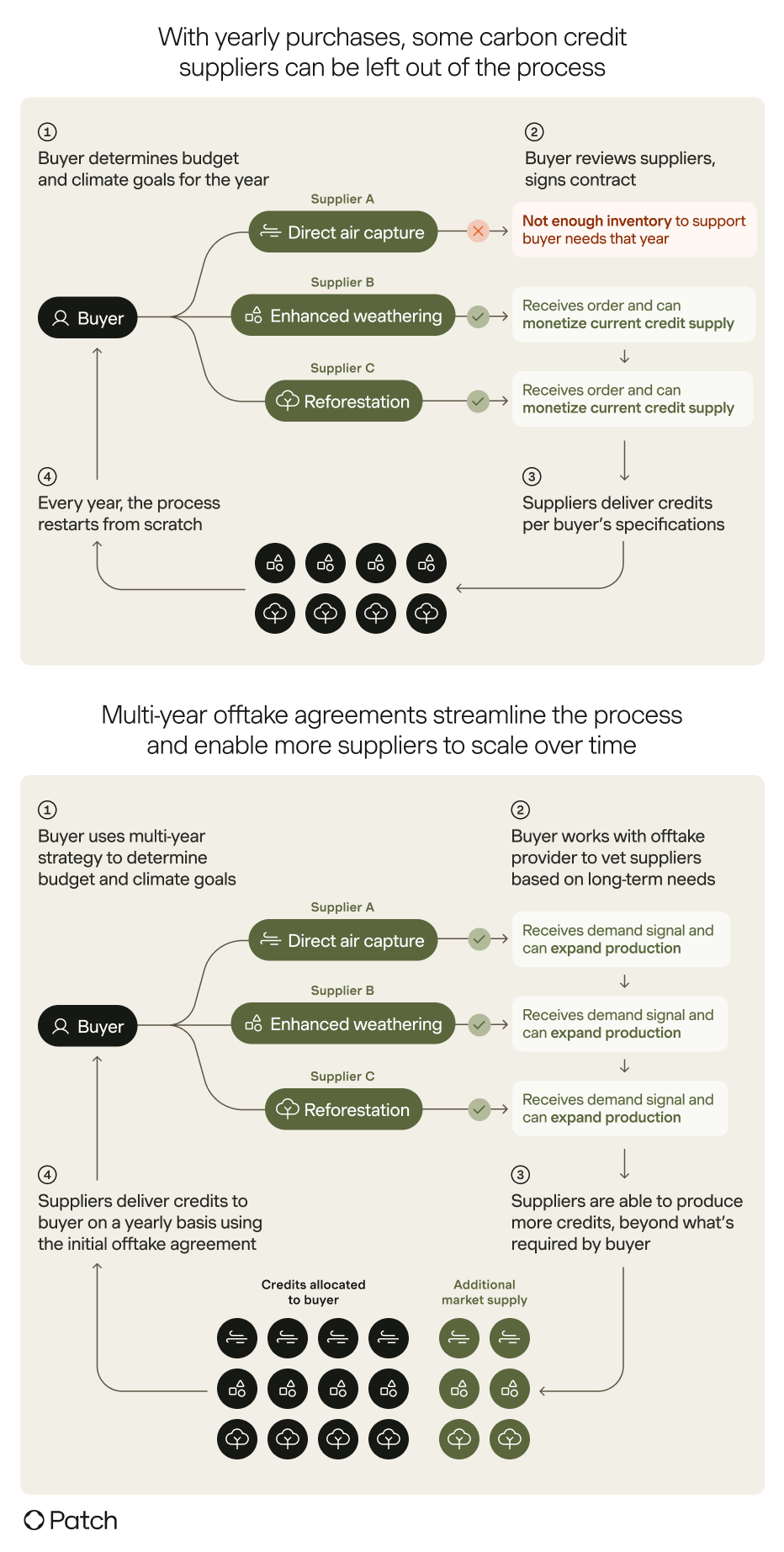

Offtake agreements help fill this climate finance gap. In these agreements, carbon buyers commit to future purchases of carbon credits from specific projects once those credits are verified. Often the agreements span years and help carbon buyers secure predictable, long-term carbon credit supply. With an offtake agreement in hand, guaranteeing an end buyer, carbon project developers are better positioned to secure development capital to get up and running.

How to enter a carbon offtake agreement

While some carbon buyers with large sustainability teams source, vet and contract with early-stage carbon projects themselves, most carbon buyers don’t internally handle the entire offtake process. Instead, buyers either join offtake coalitions like Frontier or utilize a third-party platform to facilitate the transactions.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Patch, a carbon credit marketplace, is one such platform. It supports buyers throughout the offtake process, from evaluating and selecting projects to providing contracts, negotiating terms, processing payment and managing carbon credit retirement. It does not require a minimum investment and also facilitates offtakes with innovative project types for which there are not yet established methodologies.

Patch facilitated Workday’s most recent offtakes to be delivered over the coming six years. The company says that offtake agreements like Workday’s are on the rise: Based on the volume of inquiries this year so far, Patch estimates that it will receive three times as many inquiries from carbon buyers about offtake agreements in 2024 as it did in 2023.

Benefits of offtake agreements

Workday has pursued carbon offtake agreements for three core reasons.

- Access to world-class climate expertise: By pooling resources with other carbon buyers to execute long-term offtake agreements, Workday is able to work with world-class project due diligence teams. That was the main reason Workday joined Frontier, which has an extensive technical review committee that vets and evaluates projects for the Frontier portfolio. That technical review team meant “partnering with Frontier was a no-brainer,” said Hansen.

- Catalytic climate impact: By facilitating early-stage project finance, offtakes can help launch carbon projects that may not otherwise have gotten off the ground. Buyers “understand that providing bankable contracts unlocks capital that’s essential for these solutions to actually scale,” said Spellacy.

- Greater project transparency: Multi-year offtake agreements allow carbon credit buyers and project developers to build long-term relationships that facilitate deeper insight into project development and progress. “Multi-year offtakes generally allow for that ability to request more transparency at project milestones, which is always a benefit for the corporate buyer,” said Hansen.

Integrity is the North Star

Stories of over-crediting and poor quality projects consistently plague the voluntary carbon market. That’s led many companies to wrestle with reputational concerns from utilizing carbon credits in their climate strategies; some have backed away from mitigating their ongoing emissions altogether.

That has not been the case for Workday. “I think integrity is that north star that leads to that pathway of stakeholder trust,” said Hansen. As the company continues its science-based emission reductions, offtakes are its next step in supporting high-quality climate action, closing the climate finance gap while scaling catalytic projects that will move the planet toward a net zero future.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.greenbiz.com/article/how-workday-uses-carbon-offtake-agreements-scale-climate-impact