Guest Post | Jan 31, 2023

Image: Pexels/Nicola Barts

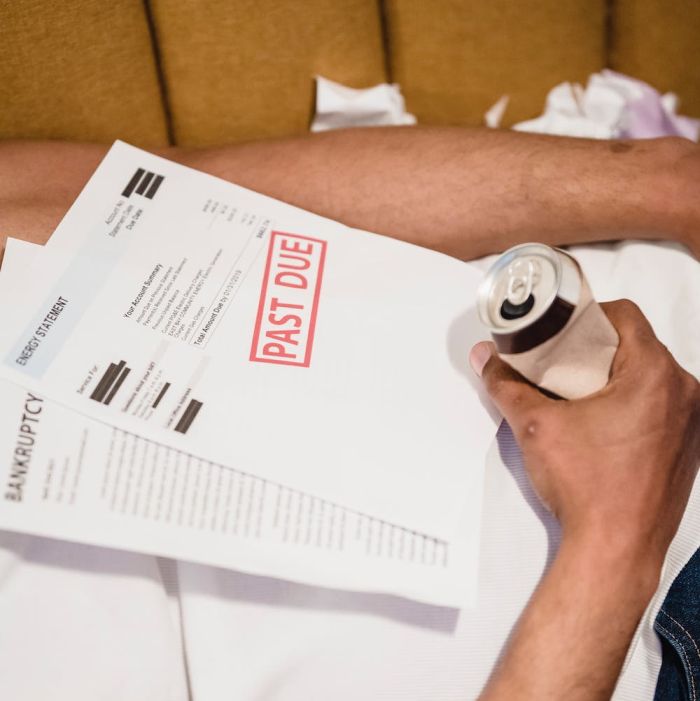

The global pandemic has left many people in dire financial straits. Therefore, most of the leading companies put themselves in the shoes of their customers and suspended debt collections, reduced or canceled interest rates, and lowered prices. However, they also need to restore and stabilize their income. Therefore, debt collection is resumed. According to what strategies to implement them and how to effectively work with debtors – read on.

The best ways to collect the debt in 2023

According to the statistic, the average US household has $15,000 in credit card debt. This is a colossal amount and loads of work for financial companies.

Create an information hub for customers

Having complete information about each client makes it easier for company employees to work with them. These are data on payables and receivables, balances, etc. However, this data must be verified, accurate, and constantly updated.

Definition of the communication channel

Properly configured communication with the client allows you to create effective cooperation. You can communicate with a person using messages, calls, and e-mail. However, it is better to discuss these communication pitfalls in advance, because, with the appearance of a large number of scammers, people are afraid of messages and calls from unknown numbers.

Support for vulnerable customers

In order for cooperation with a person to be as effective as possible, you can offer flexible conditions, for example, suitable payment options or time. To do this, you need to set up a dialogue with the client and find out how it will be convenient for him to pay the funds.

Payment methods

The client should be offered several options and payment methods. Then there will be more chances that a person will pay on time and avoid debts. After all, she will be able to do it conveniently from the phone or terminal.

The only strategy for debt collection

It is best to work with all clients according to a single strategy. This is not only a systematic coverage of the entire base but also constant monitoring of the situation, and the ability to regulate payment methods and methods.

Causes of debt collections

Debts can arise for various reasons and not only because of the pandemic that has gripped the world in the last few years. Here are some reasons that lead to debt:

- Objective reasons (loss of income, liquidation of a business, etc.)

- Lack of a communication channel with the client and a reminder about the need to pay the debt

- The company did not offer convenient payment methods

- A high loan amount became unaffordable for the client

Each of these reasons can lead to deep debt. The company can choose the method of debt collection by debt collectors or internal employees. But apply various methods, most of which later turn out to be ineffective. And the company has to spend more time than it’s worth on refunds. Persistence shown in relation to the client is perceived by him as pressure and intrusiveness, and a misunderstanding arises.

Therefore, you need to choose a solution that will create interaction between the company and the client. And it should be automated digital software that will speed up time and effort. For example, sending messages to the client at a time that is optimal for him.

Should I use outdated collection methods?

Chaotic calls are considered such methods, which only annoy a person, and eventually, he will stop answering. And also hundreds of letters to e-mail and regular mail that no one reads. Undoubtedly, they are ineffective and ineffective. In today’s world, methods that bring the most interaction and reduce the operating costs of companies have long been used.

In order to have a reliable client base, you need to keep in constant contact with it. It should be a large-scale automated communication, where it is easy to track the state of the client’s affairs, the nuances of payment, and, if necessary, change the conditions or methods of payment. For their part, clients appreciate such an attitude, so they will stick to their commitments.

See: What You Need to Know About Employee Loans in Down Round Times

As for the software, it is worth choosing comprehensive tools that will help track all the necessary behavioral data of different customer segments and help track the profitability of the company’s internal activities and development. And all this can be monitored by one manager, which significantly reduces human resource costs.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/how-to-maximize-debt-collection-efficiency-in-2023/