Today, launching card programs for end-users is a seamless process without any hassles. However, in the past, there were bureaucratic and infrastructural barriers that made it a distant dream for small companies.

In this article, we explore the key steps on how to launch a card programme and provide a solution to accelerate this process.

The basics of card issuing

Before launching your card programme, it’s crucial to have an understanding of card issuing steps for making informed decisions and implementing a successful program.

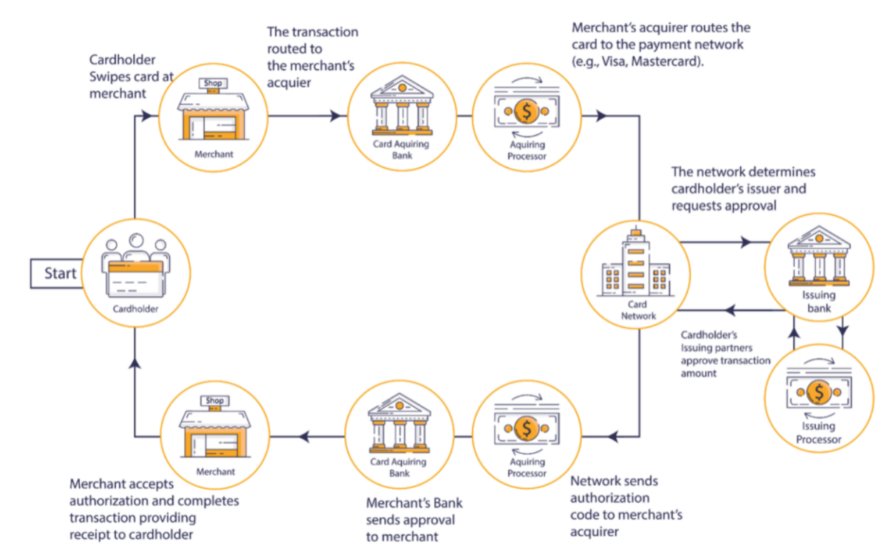

Card issuing is the process of creating and distributing payment cards, such as credit or debit cards, to end-users and card networks. This involves a series of steps to ensure the cards are securely produced, personalized, and activated for use. Card issuing allows individuals or businesses to access various financial products and services, make electronic transactions, and conduct various monetary activities.

How does the card issuing system work?

Source: EY

Below we explain key steps to provide a comprehensive understanding on how to become a credit card issuer.

Initial planning and feasibility

This step is paramount for a successful program launch and involves the definition of program objectives, where the specific goals, compliance considerations, and financial sustainability are crystallized.

You also have to conduct market research to identify and segment the target audience, ensuring that the card program meets your customer’s needs. User experience, risk assessments, and alignment with regulatory requirements define the planning process.

That’s why, this phase serves as a background for a card-issuing card program, that not only meets compliance standards but also meets the demands of your target market.

Seamless virtual and physical card issuing

Start issuing and managing debit cards hassle-free via our API

Compliance and regulatory requirements

It is impossible to explore the journey on how to become a debit card issuer, without understanding card issuing regulations. The FinTech sector, whether it involves credit, debit, or prepaid cards, is subject to various compliance and regulatory requirements to ensure security for cardholders.

The specific requirements can vary by country, sponsor banks and financial institutions must adhere to the regulations set forth by relevant regulatory bodies. Below we highlight the common regulatory aspects you need to know before become a debit card issuer:

PCI DSS

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit customer credit card information maintain a secure environment. Card issuers need to comply with these standards to protect sensitive cardholder data from fraud.

For example, a leading card issuing provider Marqeta, offers customizable widgets that allow secure card activities in customer applications. Additionally, it provides a JavaScript library to display sensitive card data while also fraud monitoring minimizing data security compliance requirements.

SEPA cards framework

The SEPA Cards Framework (SCF) sets out the guidelines that payment service providers, card systems, and other market participants must follow for card payments and cash withdrawals within the Single Euro Payments Area. The aim is to ensure that these transactions are processed as quickly, safely, and efficiently as they would be in the home country.

How to become a credit card issuer with SDK.finance?

The SDK.finance platform offers a seamless solution for both virtual and physical card issuing, thanks to its integration with Marqeta, a leading card issuing provider. This integration service app simplifies the process of debit and credit card issuing, including card management processes. It allows our clients to launch a card programme without having to go through the lengthy process of integrating with banks payment networks or card-issuing platforms.

Our integration service app is designed to handle the backend system’s complexities and is versatile enough to be used for front-end applications, providing a comprehensive approach to card issuance. Moreover, we have a set of external APIs for integrating the other key services components and operations necessary for card issuance, such as the creation of Card products, Users, Cards, and Status transitions.

Clients can access features based on their business model, unique requirements and agreements with Marqeta, whether through source code or cloud-based clients. Therefore, our system acts as a facilitator, ensuring a swift and efficient integration process and enabling clients to take advantage of Marqeta’s full array of card-issuing capabilities.

Card design and branding

When it comes to designing and branding cards, Marqeta is a standout in the market due to its wide range of options and flexibility in card issuance branding. By working together, Marqeta and SDK.finance enable clients to take advantage of comprehensive branding options, but the extent of this capability is dependent on the specifics outlined in the client’s agreement with Marqeta.

The configuration of the card product, including the type of cards issued, is a critical aspect determined by the terms established between the client and the Marqeta. From a technical standpoint, SDK.finance supports all card branding options available, ensuring that the full spectrum of branding possibilities can be seamlessly integrated.

The success and richness of the card branding customer experience will depend on the collaborative understanding and agreement between the client and Marqeta, facilitated by the robust support provided by SDK.finance in the integration process.

API-driven neobank software

Build your neobank on top of SDK.finance platform faster and cheaper

Activation

Card activation within the SDK.finance system is an effortless and efficient process that guarantees a quick and hassle-free experience for users. The entire process, from the initial setup to card activation, is designed to be completed within just 1-2 minutes.

Below is a breakdown of the process:

1) System setup

The first step involves setting up the SDK.finance system, where users can initiate the process of creating their payment cards. The user-friendly interface and intuitive design of the system make it easy for individuals to navigate through the setup process.

2) E-wallet creation

Upon entering their accounts, users have the option to create an in-system eWallet. This digital wallet serves as the funding source for their new card. Creating an eWallet in the system is straightforward and adds to the user-friendly experience.

3) Top-up process

To activate and fund their new card, customers can effortlessly top up their eWallet using their existing debit card. This step is seamlessly integrated into the process, allowing users to complete the transaction swiftly and securely.

4) Card issuance and customization

Once the eWallet is topped up, users can proceed to issue their new card. SDK.finance offers a range of design options for users to choose from, allowing them to personalize their cards to align with their preferences and branding. Users can also add a nickname to their card, adding a personal touch to the overall experience.

5) Activation

The final step involves activating the newly issued card. With just a simple click on the “Activate the Card” button, users can swiftly activate their cards for immediate use.

As a result of this streamlined process, the card becomes ready for use within minutes. Users gain instant access to view their transactions, customize settings, and review card details. SDK.finance‘s commitment to efficiency and user satisfaction is evident in this expedited card activation process, making it a standout feature for individuals who prefer a swift and straightforward experience in managing their payment cards.

Watch this video to explore the seamless process of card activation by SDK.finance`s users:

[embedded content]

Technologies integration

The process of technology integration involves the use of the SDK.finance Platform to initiate the issuance of a card (either physical cards or virtual cards) through a front-end application, which can be either web or mobile. The front-end application utilizes API calls to create a Business Process within the SDK.finance system based on certain conditions. This Business Process triggers an integration service, which then makes requests (via REST API) to the service provider’s system to issue a card.

On the provider’s side, a user account and a card are created, with a selected schema and program that is agreed upon between the client and provider. The card is then linked to the user account‘s profile. Marqeta, as the service provider, handles all necessary communication with the card network or bank that owns the card and provides the issue, according to the agreement and card product settings.

Seamless virtual and physical card issuing

Start issuing and managing debit cards hassle-free via our API

Once the card is created, the provider returns the card ID to the SDK.finance system, which then links the card to the initial user’s profile. This allows the user to see the issued card within the SDK.finance system and access card management functions (such as de/activating, un/blocking, un/freezing, and setting limits). The user can also use the card to top up accounts or make physical card payments elsewhere, provided that a card payments provider has been configured in the system.

Security measures

The security measures are intricately linked to the card programs offered by Marqeta. The company offers two distinct options for its clients to manage their card programs. The first option, “Powered By,” allows clients to independently use the platform by providing specific configuration elements. This option offers flexibility, letting businesses shape their card program management as per their requirements while Marqeta provides expertise in configuring crucial resources.

The second option, “Managed By,” positions Marqeta as the Program Manager, taking charge of handling the program on behalf of the client. This full-service experience goes beyond assistance, as Marqeta configures the majority of critical resources necessary for the production environment. This option offers a comprehensive and hassle-free solution, allowing clients to focus on their core business while entrusting Marqeta with the intricacies of program management.

Marqeta is a top card issuing provider and it considers security as its top priority. The company follows the latest hardware and software security best practices to ensure the safety of its customers. Marqeta has PCI DSS level 1 and SSAE-18 compliance certifications, which shows that it meets the highest standards of security.

Additionally, the company uses bank-grade encryption for PII, PCI, PIN data-in-transit, and data-at-rest to protect sensitive information. When communicating with Marqeta platform services, TLS 1.2 or higher is required to ensure secure communication.

Conclusion

The journey on how to launch a card programme has been made easier, thanks to the innovative solutions provided by SDK.finance and its integration with Marqeta. As technology continues to shape the landscape of card programs, these key steps serve as a roadmap for businesses seeking to embark on this transformative journey. With a ready-to-use integration service app by SDK.finance becoming a credit card issuer is more accessible and efficient.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://sdk.finance/how-to-launch-a-card-programme/