Most companies don’t report the “hidden” carbon emissions generated by how their corporate cash deposits are invested, but it’s larger than many realize.

If Apple, Google and Salesforce included that data in their disclosures, their total emissions would rise by 128 percent, 207 percent and 206 percent, respectively, according to an analysis published this week by a group of NGOs.

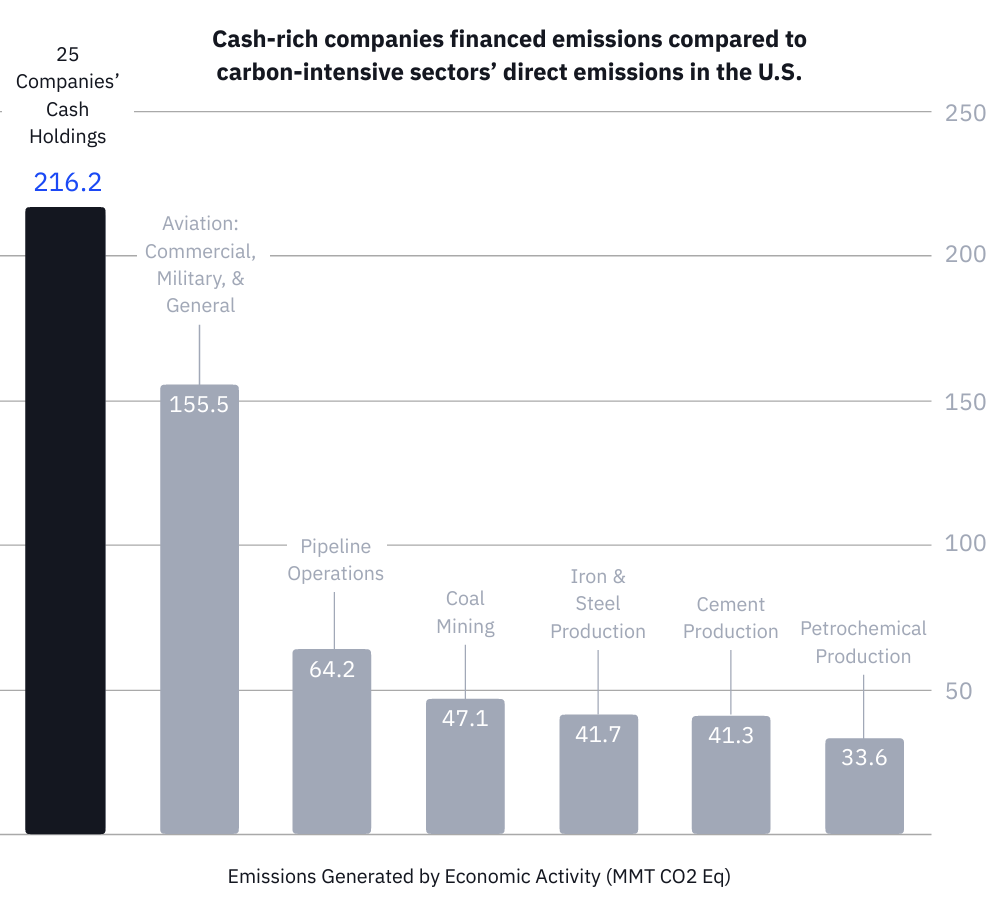

Their analysis found that non-financial companies in the United States cumulatively hold $7 trillion in cash and investments. The cumulative emissions enabled by those cash holdings account for more than 20 percent of all U.S. emissions, according to the Carbon Bankroll 2.0 report. By engaging with their financial partners to decarbonize those portfolios, those corporations could facilitate major emissions reductions, the report concluded.

![]()

![]()

![]()

![]()

![]()

![]()

Emissions linked to financial investments are part of a company’s Scope 3 footprint, which includes emissions related to upstream and downstream business activities over which a company doesn’t have direct control.

The ‘most important’ supply chain partner

Most companies don’t disclose their “financed emissions” information voluntarily, but the numbers were “a bit shocking” for Patrick Flynn, former global head of sustainability for Salesforce, when he learned of the scale of these emissions for the company in 2021. Salesforce is considered a pioneer in supplier engagement on decarbonization.

“We had analyzed our supply chain emissions every which way,” wrote Flynn, now corporate climate action lead at Topo Finance among other roles, in the new report’s preface.

Financial firms are the “most important supply chain partner for climate action,” wrote Flynn.

Some of the most powerful levers for climate actions can be found in what have been traditionally seen as mundane administrative decisions. In the Carbon Bankroll 2.0 report, the nonprofits suggest more companies examine the potential impact of their banking relationships and take steps to manage their cash differently.

“I urge treasurers globally to open dialogue with their bankers … taking action can and will make a difference,” said Joanna Bonnett, president of the Association of Corporate Treasurers, commenting on the report.

Consider changes in the context of your business

Companies such as Seventh Generation and Patagonia are taking some steps necessary to pull this lever.

Patagonia, for example, has been “continuously engaging with our banks … pushing them to align with global climate goals just like we do with our manufacturing supply chain partners,” said Charlie Bischoff, the company’s director of treasury.

Sustainability officers haven’t been “socialized” to consider their companies’ financial supply chain emissions, Ashley Orgain, chief impact officer at Seventh Generation, a subsidiary of Unilever, told GreenBiz last year.

To get started, it’s important for corporate sustainability leaders to “think about this in the context of all the other decarbonization activities … like Unilever moving its money from one account to another versus having to go find an entirely new low-carbon ingredient for detergent that is also more sudsy,” Orgain told me.

Roadmap for results

Corporate sustainability leads can build on past work on supply chain decarbonization to increase awareness and then take action. Among the steps outlined in greater detail in the report:

- Create internal alignment — harmonize the sustainability and finance teams around key climate objectives and identify financial management needs.

- Evaluate the financial supply chain — assess financial firms’ emissions profiles, the credibility of their climate policies and their performance over time.

- Calculate the financial footprint — estimate the emissions enabled by corporate cash deposits and investments, using internal information about bonds and other investments.

- Engage with financial firms — asking them to improve their climate performance will send a market signal.

- Prioritize green products — suggest banks shift some investments into “green” financial cash management products such as those from BNP Paribas and MUFG.

Through actions such as these, corporate sustainability leaders and their treasury colleagues can create incentives for financial institutions to align with their corporate climate goals. It starts by having the conversation.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.greenbiz.com/article/how-patagonia-and-seventh-generation-include-banks-their-climate-action-plans