Key Points

- GAL token launched in September 2020, reached an all-time high of $33.63 in May 2021, but experienced significant volatility.

- Trading at $2.85 with a recent 47.70% 24-hour decline but a 25.08% weekly increase; market cap at $27.44M.

- Influenced by broader crypto trends, major cryptocurrencies’ movements, and high stablecoin trading volume.

- Recent trading range between $2.64 and $5.80, showcasing high short-term volatility.

The Galatasaray Fan Token (GAL) is a unique digital asset designed to enhance fan engagement and reward loyalty within the sports ecosystem. GAL has experienced significant volatility as a relatively niche cryptocurrency, reflecting broader market trends and specific influences within the sports industry. Let’s delve into the historical performance of GAL, its current market status, and the potential implications of prevailing trends on its future trajectory.

Rollercoaster Ride: GAL’s Highs and Lows

Since its inception, the Galatasaray Fan Token has exhibited a rollercoaster-like performance, marked by substantial highs and lows. Launched in September 2020, GAL initially struggled to find its footing, reaching an all-time low of $1.45 shortly after its introduction. However, as interest in fan tokens surged and the cryptocurrency market experienced a bull run, GAL hit an all-time high of $33.63 in May 2021. This meteoric rise underscored the potential for fan tokens to capture market attention and investor interest.

Following its peak, GAL’s price experienced a sharp decline, mirroring the overall downturn in the crypto market during the latter half of 2021 and 2022. This period highlighted the token’s susceptibility to market volatility and external factors influencing both the sports and crypto sectors.

Today’s Market: GAL at $2.85 with 47.70% Decline

As of today, the Galatasaray Fan Token is trading at $2.85, reflecting a significant 24-hour decline of 47.70%. Despite this recent drop, GAL has shown resilience over the past week with a 25.08% increase, suggesting fluctuating investor sentiment and trading activity. The 24-hour trading volume stands at an impressive $81,899,991.34, indicating robust market interest and liquidity.

The market capitalisation of GAL is $27,442,677, positioning it at rank #961 on the market. This modest ranking reflects the niche appeal of fan tokens compared to more established cryptocurrencies. The circulating supply of 9.6 million GAL out of a total supply of 9.975 million further emphasises the token’s limited availability, which can drive both scarcity and demand.

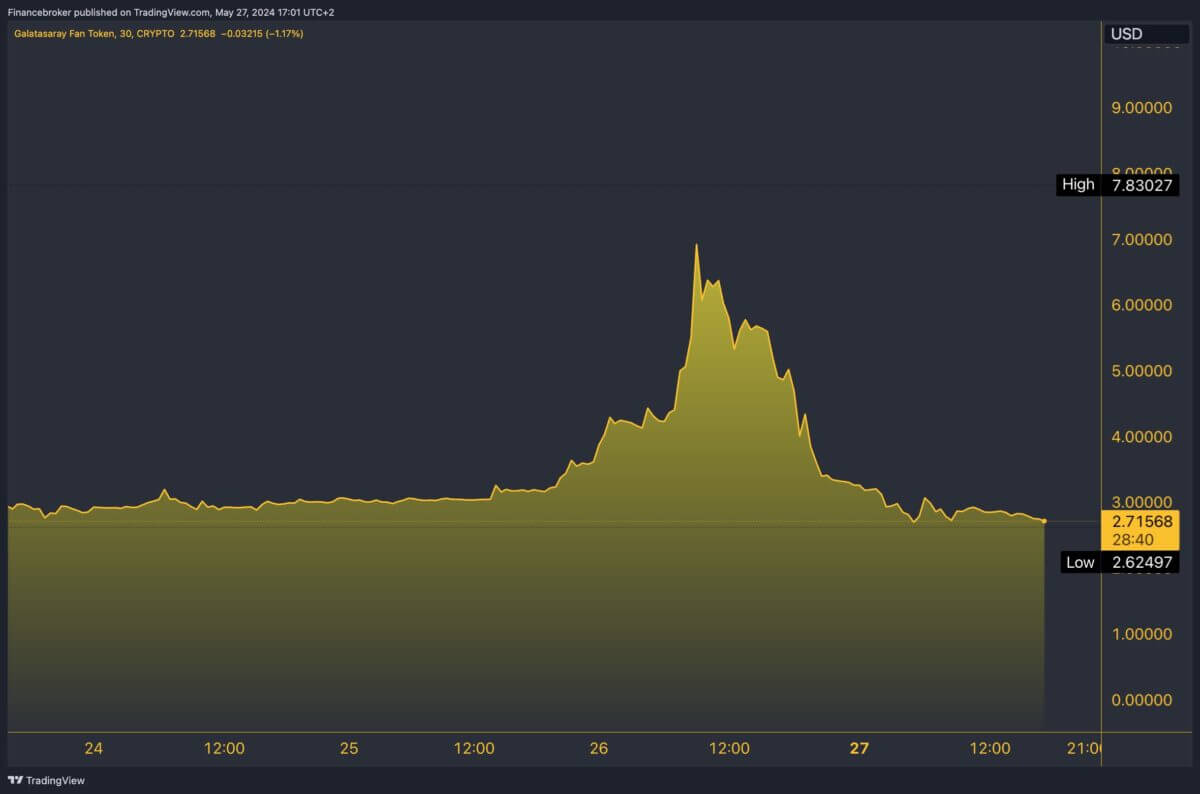

24-Hour Price Range: $2.64 to $5.80

GAL’s price movements have been particularly volatile in the short term. Over the past 24 hours, the token has fluctuated between $2.64 and $5.80, showcasing a wide trading range. Similarly, GAL’s price varied from $2.28 to $6.38 in the past week. These fluctuations indicate speculative trading and the dynamic nature of investor sentiment in the crypto space.

The recent sharp decline could be attributed to various factors, including market corrections, changes in investor sentiment, or specific developments within the Galatasaray community or broader sports industry. Conversely, the week-long positive performance suggests underlying bullish sentiment.

Global Market Trends and GAL Impact

The current global crypto market trends provide a contextual backdrop for GAL’s performance. The cryptocurrency market remains highly active, with a total market cap of $2.58 trillion and a 24-hour trading volume of $67.98 billion. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have shown mixed performances, with BTC experiencing a slight decline and ETH seeing a notable uptick. These movements in major assets often influence the performance of smaller tokens like GAL.

Stablecoins dominate trading volumes, accounting for 90% of total trades, highlighting a preference for stability amidst market volatility. This trend could impact GAL, as investors might seek safer assets during uncertain periods, potentially leading to reduced demand for more speculative tokens.

GAL vs. Major Cryptocurrencies: A Comparison

Comparing GAL with other cryptocurrencies and trending gainers provides further insights into its market position. For instance, major cryptos such as Bitcoin and Ethereum command substantial market caps of $1.35 trillion and $472.2 billion, respectively. In contrast, GAL’s market cap of $27.44 million underscores its relatively niche market presence.

Trending gainers like BounceBit (BB) and Notcoin (NOT) have seen significant 24-hour gains of 30.63% and 18.59%, respectively. These tokens benefit from specific market catalysts driving short-term interest, a dynamic also observed in GAL’s recent performance. Understanding these comparative dynamics helps contextualise GAL’s market movements and potential investor behaviour.

Future Outlook: Can GAL Hit $10?

The future prospects of the Galatasaray Fan Token will likely hinge on several key factors. Firstly, continued fan engagement and innovative uses of the token within the Galatasaray community can drive sustained interest and adoption. Initiatives that enhance utility, such as exclusive fan experiences or voting rights on club decisions, can strengthen the token’s value proposition.

Secondly, broader market trends will play a crucial role. If the overall crypto market experiences a renewed bull run, GAL could benefit from increased investor interest and speculative trading. Conversely, prolonged market downturns or shifts towards more stable assets could pose challenges.

Given the current market conditions and historical performance, predicting GAL’s future price involves considering both optimistic and conservative scenarios. In a bullish market environment, GAL could potentially reclaim higher price levels, possibly reaching the $10 mark if significant positive catalysts emerge. Conversely, in a bearish scenario, the token might struggle to maintain its current levels, potentially dipping below $2.00 if market sentiment worsens.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.financebrokerage.com/galatasaray-fan-token-plunged-by-47-70-whats-happening/