As the world races to achieve net-zero carbon emissions, the financial services sector is facing the challenge of reducing its financed emissions. Against this backdrop, ESG fintech, which leverages data and technology for environmental, social, and governance (ESG) purposes, will be playing a crucial role in helping the sector achieve its ambitions, a new report by KPMG Singapore says.

The paper draws on the insights of industry leaders at the KPMG Singapore Business Foundry’s “Race to Zero: Decarbonizing the Financial Markets with ESG Fintechs” event which took place last month. It highlights how the role of ESG fintech is becoming increasingly important for financial institutions and their clients in accelerating their decarbonization and transformation journeys.

According to the report, Southeast Asia is seeing momentum build up to mobilize green and transition finance, prompting a greater need for new green technologies and more sustainable solutions at scale.

ESG fintech can simplify sustainability data capture, support risk-reward frameworks, and drive the adoption of decarbonization technologies, effectively helping financial institutions and their clients achieve their decarbonization and net zero targets, the report says.

In particular, these new tech-enabled solutions can support financial institutions by addressing their ESG data challenges and providing better ways for these organizations to collect, analyze and verify data for their reporting needs.

This can be done, for example, by utilizing and aggregating real-time data from alternative sources, such as drone and satellites, and employing big data to help companies identify ESG risk factors, such as deforestation, land use change, air quality and water quality or availability. Financial institutions would then be able to leverage these additional information, along with their client’s self-reported data, to better contextualize the environmental risks associated with their clients and monitor their progress towards their sustainability goals.

The report also explores how sustainability-linked financing has experienced significant growth in recent years, but notes that the deployment of transition finance has been slowed down by the complexity and proliferation of taxonomies and frameworks across jurisdictions.

Transition finance refers to financing provided to high carbon-emitting industries such as coal-fired power generation, steel and cement to fund their transition to decarbonization.

In this context, ESG fintech can help overcome this complexity by utilizing artificial intelligence (AI) and machine learning (ML) to identify commonalities and differences among various taxonomies and frameworks, develop solutions to transform data sets, and streamline the assessment process, the report says.

These are just some of the possible applications of fintech in the climate and ESG space and many other opportunities exist in the domain. For example, many small and medium-sized enterprises (SMEs) want to report sustainability data, and yet most lack the resources to implement decarbonization initiatives independently. This presents an opportunity for the adoption of digital tools and platforms that can simplify and standardize the process of reporting and capturing data for SMEs, the report says.

Looking ahead, the report notes that the shift in investor and consumer preferences towards sustainable products and services will incentivize more companies to embrace decarbonization and lead to higher demand for ESG-linked products and services. This will ultimately result in increased investments in this area by venture capital (VC) and private equity firms. This will in turn prompt large-scale commercialization of more decarbonization technologies and present increased opportunities for the sector, particularly around private-public collaborations.

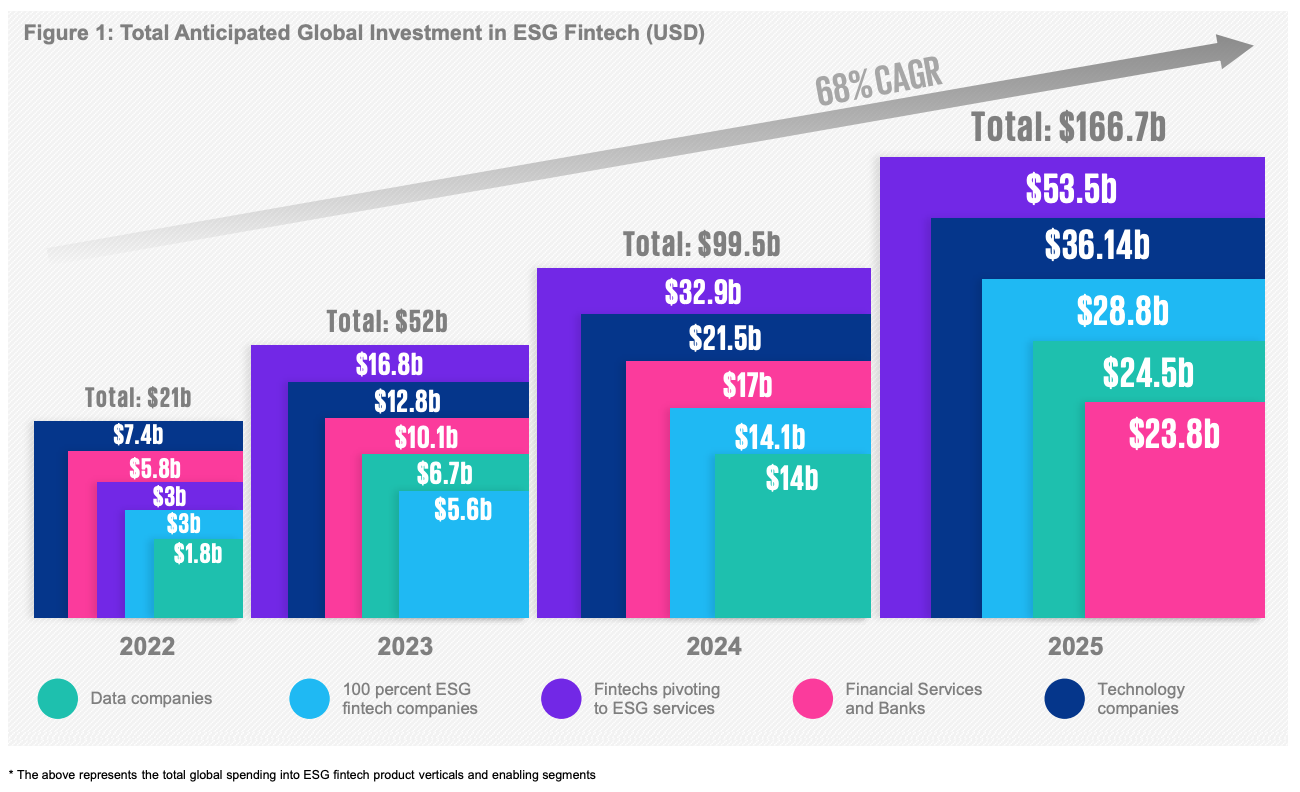

KPMG Singapore partner and global fintech head Antony Ruddenklau expects the global ESG fintech market to grow from US$21 billion in 2022 to over US$160 billion within the next five years, driven by new directives and regulators’ efforts to make sustainability a core priority for businesses. This will be accompanied by soaring ESG fintech spending, which is projected to grow at a compound annual growth rate (CAGR) of 68% between 2022 and 2025.

In this burgeoning landscape, Singapore is rapidly becoming a key hub for ESG fintech development, supported by various industry stakeholders including the Monetary Authority of Singapore (MAS), investors, the startup community and ecosystem partners, a November 2022 report by the consultancy says.

Notable startups and initiatives in the space include RegASK, a digital platform that uses AI to augment regulatory research and management of ESG issues, ESGenome, a joint initiative by MAS and Singapore Exchange (SGX Group) to develop a common disclosure utility for SGX-listed companies, and AirCarbon Exchange, a global trading platform focused on the voluntary carbon trading market.

Singapore launched in 2021 the Green Plan 2030, a national plan that sets targets for sustainability. Ambitions include making the country the leading center for green finance and services, and helping facilitate Asia’s transition to a low-carbon sustainable future.

KPMG expects Singapore to continue playing a significant role in fostering ESG fintech innovation and will continue to attract investment. The firm anticipates total annual investments in the city-state’s ESG fintech sector to reach US$6.59 billion by 2025.

Global investment in ESG fintech innovation is projected to reach US$52 billion this year, more than double 2022’s US$21 billion total, KPMG says. By 2025, it projects that global ESG spending will total US$166.7 billion. Of this, US$28.8 billion will go towards ESG fintech companies.

Total anticipated global investment in ESG fintech, Source: KPMG Singapore, November 2022

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/75674/green-fintech/esg-fintech-to-play-critical-role-in-net-zero-journey/