The popularity of meme coins on decentralized venues also contributed to the declining trading activity on centralized exchanges.

The combined spot and derivatives trading volume on centralized exchanges fell 15.7% to $2.41tn in May, recording the second consecutive decline in monthly trading volume, according to CCData, the provider of historical and real-time cryptocurrency data.

The price of crypto assets stayed largely rangebound during the month of May, and volatility fell to levels not seen since the start of the year, with the popularity of meme coins on decentralized venues also contributing to the declining trading activity on centralized exchanges.

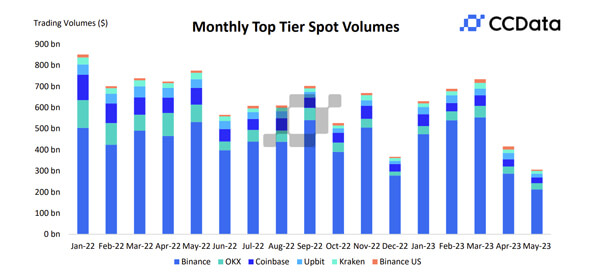

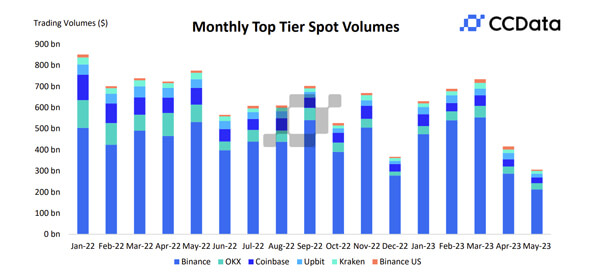

CCData noted that, in May, centralized exchanges experienced a 21.8% drop in spot trading volume to $495bn, marking the lowest monthly trading volume recorded by centralized exchanges since March 2019.

Binance’s spot market share fell for 3rd consecutive month

Binance, the world’s largest spot crypto exchange, saw its spot market share fell for the third consecutive month, to 43.0% in May amidst the halting of zero-fee trading for USDT pairs, general weakness in the market, and increased scrutiny from regulators. Overall, spot trading volume on Binance fell 26.0% to $212bn in May.

Trading activity across spot markets decreased in May, with the price action of Bitcoin and Ethereum being restricted to a narrow range for a sustained period during the month, CCData explained. As a result, the 30-day annualized volatility of the assets dropped to levels not seen since the start of the year. A daily volume maximum of $24.0bn was traded on the 5th of May.

CCData’s Level 2 Order Book data on Refinitiv’s Data Platforms

CCData has recently added its Level 2 (L2) Order Book data on Refinitiv’s Data Platforms. Level 2 (L2) Order Bood is CCData’s comprehensive collection of outstanding buy and sell orders for an asset. This expanded dataset joins CCData’s existing suite of offerings on Refinitiv’s platform which include real-time and historical aggregated market data as well as full trading data from various licensed exchanges.

CCData provides multiple order book metrics, including slippage, spread, and depth powered by its automatic order book calculator. All metrics are calculated at precise and widely-distributed percentage intervals to provide insight into digital asset markets.

The firm’s proprietary research-backed aggregate price methodology is based on real-time and historical market data covering the most liquid cryptocurrency pairs traded on 300 exchanges. CCData also brings live trading data from 34 individual exchanges to the Refinitiv platform.

CCData offers full aggregate and trade level history dating back to 2010 for more than 6,000+ coins and 250,000+ crypto and fiat trading pairs on a daily, hourly, and minute-by-minute basis.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://financefeeds.com/crypto-spot-trading-volumes-in-cexs-hit-hard-in-may-falling-to-2019-levels/