Corporate Venture Capital | May 17, 2024

Image: The State of Corporate Venture Capital in Canada 2024, Deloitte and BDC

Image: The State of Corporate Venture Capital in Canada 2024, Deloitte and BDCThe State of Corporate Venture Capital (CVC) in Canada 2024

Published this week, “The State of Corporate Venture Capital in Canada,” produced by Deloitte Ventures in collaboration with BDC Capital, highlights the potential for growth and innovation that CVC can bring to Canadian corporates, startups, and the broader economy. However, it also underscores significant challenges and areas where Canada lags behind its international counterparts, particularly the United States. Read the release

Key Findings

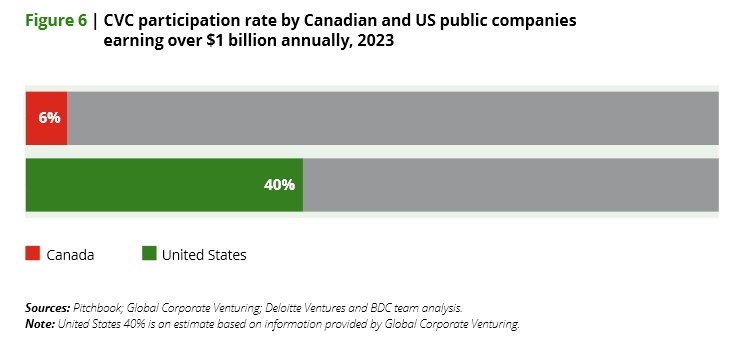

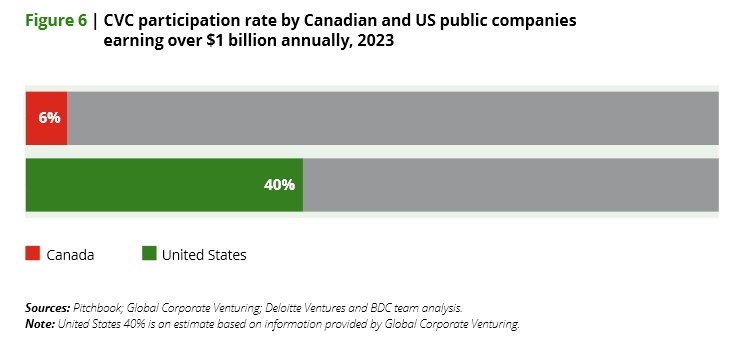

- Despite the growing number of CVC initiatives, only 6% of Canadian public companies with over $1 billion in annual revenue participate in direct VC investments, compared to 40% of similar U.S. companies. This stark contrast highlights the need for greater engagement by Canadian corporates in venture investing. Slower adoption.

- CVC offers a “triple win” of strategic benefits for corporates, startups, and the economy. Corporates gain access to new technologies, markets, and diversified profit streams. Startups benefit from the resources, expertise, and brand recognition of large corporates. The economy enjoys job creation, productivity gains, and competitive innovations. For example, Deloitte Ventures’ $150 million initiative aims to catalyze growth in important verticals such as fintech and worktech, fostering innovation and job creation.

See: AI Metamorphosis in Venture Capital

- Canadian CVCs have seen significant growth in deal activity, nearly tripling between 2019 and 2022. However, this momentum slightly waned, with a drop in the total number of deals from 141 in 2022 to 68 in 2023. This fluctuation suggests the need for sustained efforts to maintain and grow CVC participation.

- Canadian CVCs are active on the global stage, with 53% of their deals in 2023 involving foreign companies. This reflects the smaller size of the Canadian market and the necessity for Canadian corporates to look globally to stay competitive.

Image: Figure 6 from The State of CVC in Canada 2024 (Deloitte/BDC)

Image: Figure 6 from The State of CVC in Canada 2024 (Deloitte/BDC)Food for Thought

The report is a thorough examination of the current landscape and potential future of CVC in Canada. However, there are some notable exclusions that would have been interesting to discuss:

- The report does not address why CVC in Canada significantly lags behind the U.S. Understanding these reasons is crucial for developing strategies to close the gap. For instance, the participation rate of U.S. public companies in CVC is approximately six times higher than that of Canadian companies.

See: Insights and Challenges of Raising Capital via Reg A+

- The report lacks a detailed analysis of the financial performance (ROI) of CVC initiatives in both Canada and the U.S. which one would think is what investors including CVCs would be interested in knowing. For many corporates, financial returns are the primary driver of investment decisions.

- The report could have benefited from direct feedback from the 94% of Canadian publicly traded companies that do not have a VC subsidiary? Understanding their reasons for not engaging in CVC could provide valuable insights for encouraging broader participation. A direct survey of these companies could reveal barriers such as risk aversion, lack of expertise, or insufficient capital.

Richard Remillard, President of RCG Group and Board Director NCFA Canada says it well:

” This Deloittte paper prepared in conjunction with BDC points to some revealing information about the state of corporate venture capital(CVC) in both the US and Canada. Unsurprisingly, Canada trails significantly behind the US on this front. The paper notes that a mere 6% of publicly-traded Canadian corporations have CVC’s versus 19% of those in the US. This gap has long been noted and decried by venture capital industry participants, including BDC. Where the paper is lacking is in identifying the source(s) of this weakness in the Canadian risk capital ecosystem. It could be a function of Canada simply not having a substantial number of publicly-traded firms compared to the US – and, many of the latter having received venture capital funding previously. Another factor might be the greater corporate concentration in Canada than in the US that is visible in many industries from banking to telecom, airlines, retail grocery and rail transportation. Or, it could be the business culture in Canada, long considered more risk averse than it is south of the 49th parallel. As well, and importantly, it could simply be the result of the relative lack of transparency about the return on investment(ROI) of the CVC segment of the venture capital asset class to say nothing of the relative illiquidity of venture investments. ROI is missing in action in the Deloitte paper which does spend some time and effort in discussing the overall benefits of investing in tech in Canada – a curious omission. Finally, the paper would have been strengthened if some of the 94% of corporations in Canada had been canvassed about their decision(s) to avoid the CVC route or to get out of the asset class, as some have done in years gone by, in light of the internal management challenges pertaining to remuneration of CVC managers relative to managers in the parent firm.”

Outlook

Corporate Venture Capital holds promise for Canada. This requires addressing the barriers to entry, providing clear financial performance metrics, and fostering a culture that values long-term strategic investments. By doing so, Canada can unlock the potential of its startups, drive economic growth, and become more competitive on the global stage.

Download the 32 page PDF report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/corporate-venture-capital-in-canada-insights-and-challenges/