Corporates have historically faced challenges in accessing real-time information on payment transaction status and account positions, especially in complex cross-border transactions

***

Insights

***

Corporate payments: Identifying key pain points for corporates and banks

Limited visibility on end-to-end transaction status for cross-border payments

Corporates have historically faced challenges in accessing real-time information on payment transaction status and account positions, especially in complex cross-border transactions involving multiple intermediaries. This lack of visibility has led to inefficiencies

in cash flow forecasting and difficulty in understanding the fees charged by banks. Although initiatives like SWIFT Global Payments Innovation (GPI) aim to address these issues, the adoption by banks remains slow.

✅ Lack of aggregated view of fund positions and bank accounts

Corporates have complex organisational structures, with regional offices spread across the globe. Each regional office prefers to use its local bank account for payments to vendors and employees, as well as for the management of internal expenses. In addition,

corporates have multiple banking relationships and use different bank accounts to process their payments. Hence, keeping track of collections and payments becomes a challenge, leading to a lack of aggregated view of fund positions across multiple banks accounts.

✅ Inconsistent payments experience for corporates due to diverse payment needs

Corporates have complex payment requirements. They need to make payments to their suppliers, subsidiaries, and employees, as well as collect payments from their customers, all of whom can be spread across multiple countries. To support these diverse payments

needs (real-time payments, cross-border payments, Foreign Exchange [FX] payments, etc.), which require different messaging standards (domestic and cross-border clearing and settlement), banks must set up multiple teams/payment systems, which at times could

lead to inconsistent experience for corporate customers.

✅ Complex integration requirements for seamless corporate connectivity

Corporates manage multiple banking relationships and rely on various communication methods, like ERP-to-bank integration, to conduct payments. However, this integration is intricate and time-consuming due to security, format, and protocol challenges. While

larger corporations can invest in these solutions, smaller ones struggle. To address this, banks are exploring standardized connectivity options, such as APIs, to simplify access to their services for all corporate clients, thereby easing the burden on smaller

businesses.

✅ Cumbersome bank statement reconciliations

Corporates must maintain large accounting teams for the reconciliation of their bank statements with ERP accounts, as it is a time-consuming and complex process. In addition, there are limitations in ERP systems for supporting auto reconciliation and multiple

statement formats.

Source Deloitte

***

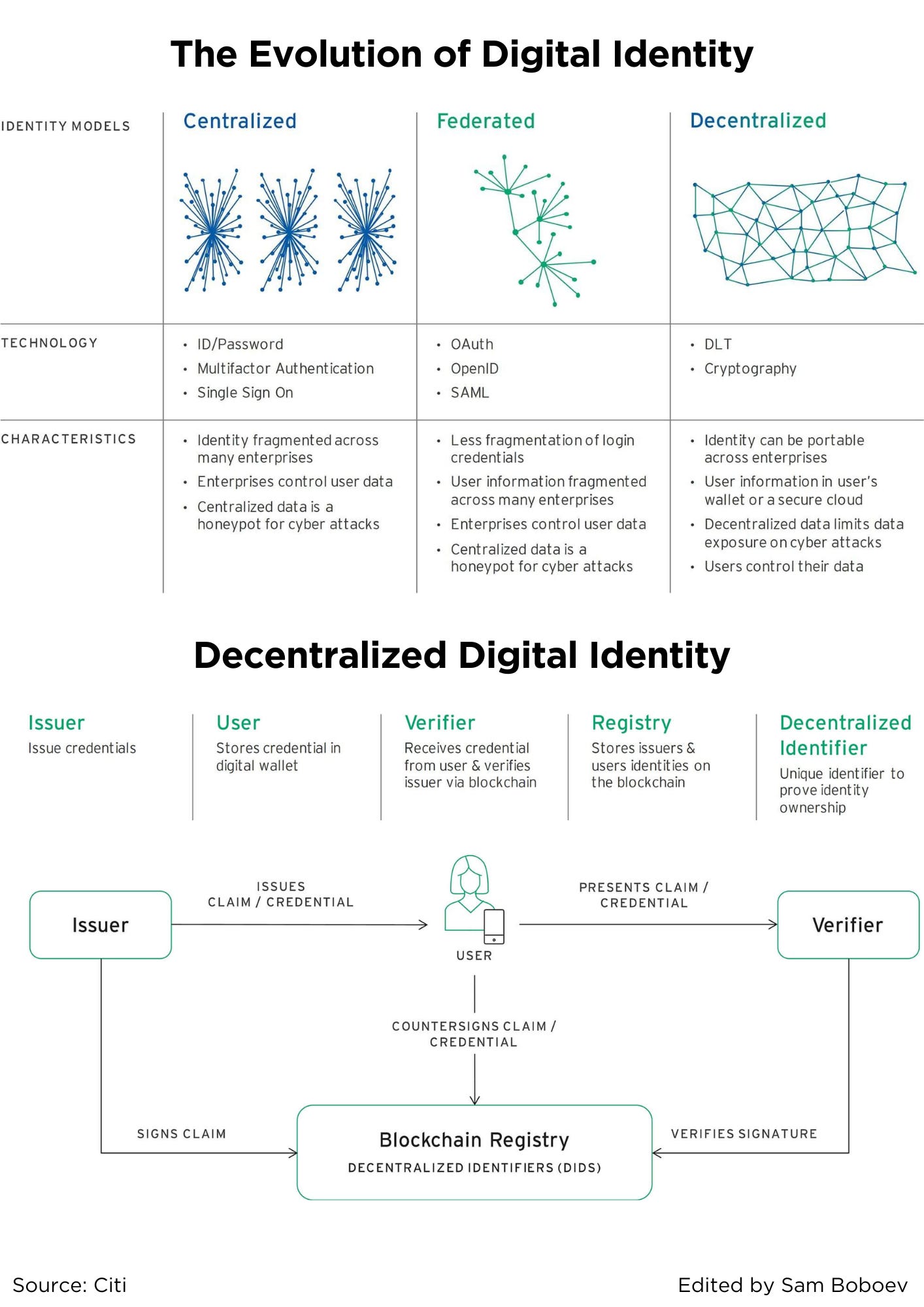

The Evolution of Digital Identity

The first and still most common form of digital identity is the siloed shared-secret model that anyone who has ever used a username and password is familiar with. Service providers use a combination of online and offline processes to onboard users, then

authenticate their identity for future interactions via secrets such as passwords, mothers’ maiden names, and confirmation emails. In this centralized model, user information is fragmented across a pool of service providers. This method is inconvenient for

users, who must remember an ever-growing list of usernames and passwords, and makes it easier for hackers to commit identity theft.

For service providers, this solution is neither secure nor efficient. User passwords are often compromised (in part because users repeat passwords across services) or forgotten, leading to costly security breaches and password reset customer service calls.

All of these drawbacks gave rise to the second solution, the federated model, where a single party in charge of both the onboarding and authentication of users offers identity solutions to different enterprises.

The most popular providers of federated identity services are social media sites, and their primary offering related to identity is portability. People can have the same username and password combination across multiple services, and online services don’t

need to build their own identity management infrastructure.

This approach has several major drawbacks. It’s not very useful for high-touch services such as banking that have more stringent onboarding requirements. It also creates massive pools of user data that can be monetized by social media sites at best and serve

as honeypots for hackers at worst.

Some of the more shocking online developments in recent years (Table 1), including the Cambridge Analytica scandal1 and the Equifax data breach, can be traced to the limitations of the centralized and federated approaches to digital identity. The economic

and personal cost of such scandals and breaches have opened the door to a better solution.

✅ Back to the future of with Decentralized Digital Identity

The next generation of digital identity uses a blend of the old and the new. As in the predigital era, it returns control to users by issuing them digital credentials that can be self-custodied and shared only with trusted parties. Unlike in the past, it

provides infrastructure for such credentials to be issued, stored, and verified at scale and regardless of whether two parties are meeting in person or interacting online. Two innovations make this possible—the process innovation of verifiable credentials

and the technological innovation of distributed ledger technology (DLT). The decentralized nature of the infrastructure moves digital identity from an application to an ecosystem.

Source Citi

***

Advantages of Embedded Finance for everyday users

A couple of days ago, I engaged in a captivating conversation with Deepak Kumar, concerning the advantages of Embedded Finance for everyday users.

From our discussion, it became apparent that one shouldn’t anticipate a single “Wow” factor in Embedded Finance. While there are numerous benefits, two standout advantages for everyday customers, in my opinion, are “Cost Efficiency” and “Personalized Services”.

✅ Cost Efficiency

Embedded finance has significantly enhanced the affordability of financial services by enabling a broader array of companies to offer them. For instance, Banking as a Service empowers nearly any company with the necessary resources, technology, and compliance

standards to launch their own cards, checking accounts, and other financial products. Consequently, this intensifies competition within the market, leading to reduced prices and an improvement in service quality.

According to Statista’s data as of January 2024, the Americas boasted the highest number of fintech companies globally, totaling approximately 13,100—almost 1,500 more than the previous year. Comparatively, the EMEA region had 10,969 fintechs, while the

Asia Pacific region had 5,886. It’s reasonable to assume that many of these companies are utilizing Banking as a Service or Embedded Finance solutions in some capacity.

This proliferation of Embedded Finance serves as a noteworthy counterbalance to the increasing consolidation seen in the banking industry. For instance, the U.S. banking sector has experienced over 16,000 mergers in the past four decades, averaging around

400 bank mergers annually. This consolidation has ultimately resulted in the Big 4 U.S. banks collectively owning over 40% of the industry’s assets.

✅ Personalized Services

Embedded Finance has enabled a wide array of companies to access financial services that were previously out of reach for various reasons. One of the main beneficiaries of this accessibility are companies that are building their ecosystem of products and

already have an established customer base.

A prime example of this is Apple, which has actively integrated various payment services into its ecosystem. Initially, Apple started with Apple Pay services; however, as Embedded Finance technologies and regulations continued to evolve, Apple added cards,

Buy Now, Pay Later options, and savings accounts.

From the perspective of personalized services, which Apple excels at delivering, the integration of financial services into its ecosystem allows for a more seamless customer experience. Apple can better assess customer behavior, tailor its financial services,

and offer more detailed insights and discounts.

While there are numerous benefits of Embedded Finance to explore, we shouldn’t expect “Wow” products or services because the goal of Embedded Finance is to make finance seamless and invisible.

***

What is payment orchestration?

Payment orchestration, also known as a payment orchestration platform (POP) or a payment orchestration layer, is a software solution that connects merchants to multiple PSPs, acquirers, payment partners and allows merchants to manage everything from one

interface. It unites most aspects of the online payment process in one place, including payment authorization, transaction routing, reconciliation, payouts, ledgers, analytics and payment settlement details.

The purpose of payment orchestration is to remove complexity for merchants by enabling them to take advantage of working with multiple payment service providers without having to integrate them all one by one. This streamlining allows merchants to route

payments in a variety of different ways and based on a variety of factors, including: payment processor availability, best fee conditions, highest authorization rates, and locality. Connecting to multiple providers can help protect against failed payments

and reduce costs associated with payment processing. Payment orchestration also saves merchants the trouble of maintaining all integrations separately after they have been added. With a payment orchestration layer, merchants can easily manage all of their

integration from one central place.

Though a payment orchestration layer is a crucial part of any good payment infrastructure, not all solutions on the market include important features like native token vault storage or payment analytics. Businesses, especially enterprise merchants with high

transaction volumes, should look beyond payment orchestration for solutions that cover the entire spectrum of payment needs and can be deeply integrated into their systems and workflows.

How does payment orchestration work?

As you can see in the image below, a payment orchestration solution acts like a layer between the merchant’s already existing payment technology and third party payment technologies, including payment processors, gateways and payment methods. This layer

makes it possible for merchants to connect to all of these payment partners without having to integrate them each one by one. They also can all be managed centrally in the payment orchestration platform, which facilitates and monitors all aspects of the payment

operations.

Payment orchestration has different functions for different industries, however its most basic purpose is to direct transactions along the best possible route. What determines “best” depends on a variety of factors and can change from transaction to transaction,

the business needs of the merchants and how they configured the rule engine of their payment orchestration layer. This is determined by the merchant in the set-up process and can be finetuned and updated at any point.

Source Payrails

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25885/corporate-payments-identifying-key-pain-points-for-corporates-and-banks?utm_medium=rssfinextra&utm_source=finextrablogs