CCA 2022 Investment Crowdfunding Report: 7 Charts Highlight Growth and Impact

Crowdfund Capital Advisors | Sherwood Neiss | Feb 8, 2023

2022 was a challenging year for venture-back companies but there were many silver linings for investment crowdfunding. Last week, Crowdfund Capital Advisors released their 7th annual Year in Review report. 105-page report (our longest yet) contains 100 charts, tables, images, and maps.

2022 was a challenging year for venture-back companies but there were many silver linings for investment crowdfunding. Last week, Crowdfund Capital Advisors released their 7th annual Year in Review report. 105-page report (our longest yet) contains 100 charts, tables, images, and maps.

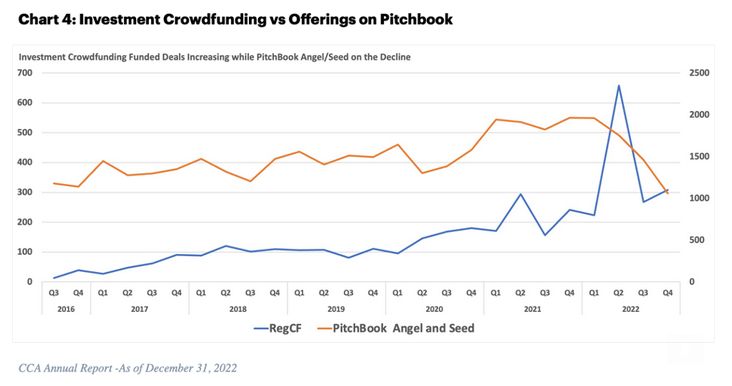

- Pitchbook Angel/Seed deals are trending down while alternative investment crowdfunding deals hit a record high:

- Pitchbook released the “Q4 Venture Monitor First Look” that breaks down its data. This trendline continues to show an increase in funded deals. As more issuers find it challenging to access capital in 2023, we expect to see them turn online for capital.

- Investment crowdfunding has bridged the the ‘Valley of Death’

- The average raise since the industry launched has grown to $365K, expanding beyond where the Valley existed previously; $25K to $250K.

- With the maximum issuers can raise now at $5 million, there is much room for successful issuers to perform follow-on raises to not only get them through the Valley of Death but beyond it.

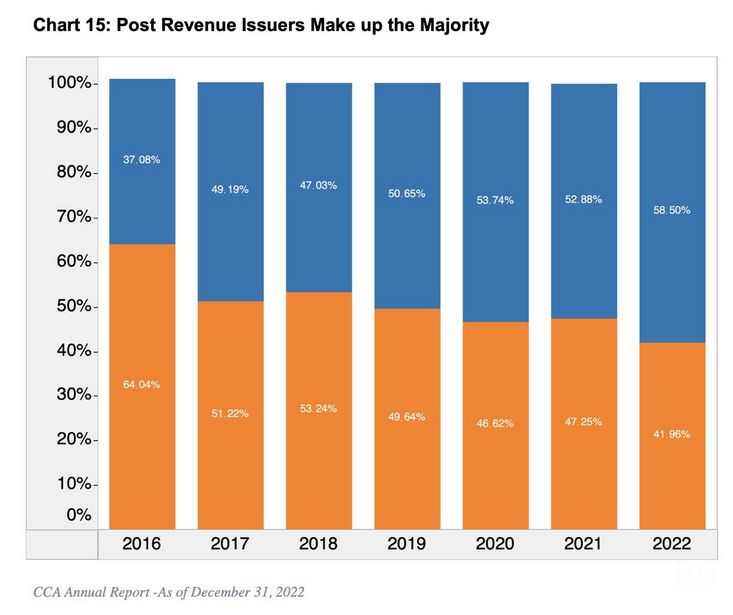

- Equity crowdfunding issuers are becoming less risky; the profile of the average successful investment crowdfunding issuer is changing

- Demographic: They tend to be older, are post-revenue, and have average revenues over $1 million.

- Investors see the logic. The more established issuers raised more money and had more investors than their startup counterparts.

- As larger, more established issuers come online, this will further derisk investment in this space.

See: Reg CF Update: Interview with Sherwood Neiss on Investment Crowdfunding

- Truly has democratized access to capital

- It used to be that if you wanted to access Venture capital, you needed to reside in or near Silicon Valley, New York, or Boston. However, thanks to Investment Crowdfunding, we see that it has successfully been able to democratize access to capital across the country.

- More importantly, the data shows that women and minority entrepreneurs (that routinely struggle to access capital) have had greater success within Investment Crowdfunding and are raising up to 50% of the capital.

- Investment Crowdfunding is a growing and important economic driver for the economy:

- Issuers successful with Investment Crowdfunding are scaling startups and small businesses. They create products and services. Pay business, sales, and payroll taxes. And are massive consumers of local and regional products and services. Investment Crowdfunding issuers are responsible for pumping more than $4 billion into our economy since the industry launched in 2016. All of this capital is going into over 1,600 communities across the USA. This is a local economic stimulus unlike we’ve ever seen. If our government officials are looking for ways to promote economic development, they should focus their attention on Investment Crowdfunding issuers.

See:

JOBS Act of 2012: Ten Years of Legalized Investment Crowdfunding

Fintech Fridays EP57: 10 Years of Investment Crowdfunding: Past, Present & Future Since the JOBS Act

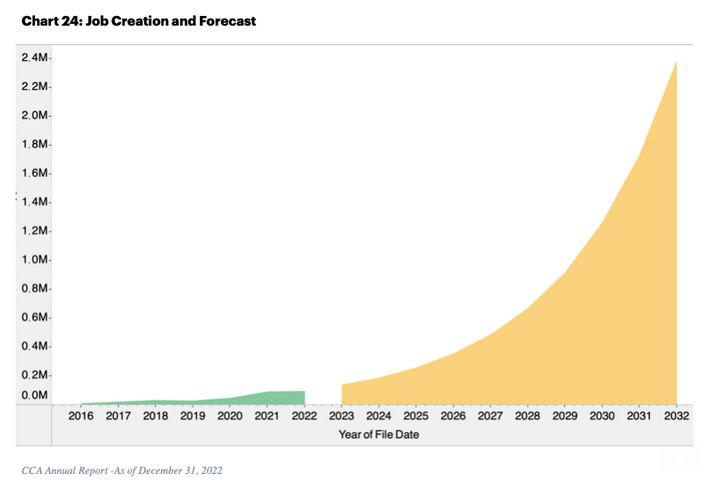

- Since Investment Crowdfunding began, Issuers successful with Investment Crowdfunding are responsible for supporting over 226,000 jobs:

- We believe this is an underestimate because it doesn’t take into account issuers that reported no full-time employees but either have grown to support them or outsource jobs altogether.

- Either way, we went to Washington, DC, and promised jobs. And one can see the industry is delivering on it! Whoever came up with the acronym “The JOBS Act” deserves an award!

- Generate wealth and opportunities for the average investor

- Investment Crowdfunding allowed the average American to play the role of mini-VC and invest in pre-IPO startups that they believe in for the first time in history. A small percentage of these will most likely go on to phenomenal exits.

- Over $54B of value is currently sitting inside successful Investment Crowdfunding issuers. Only $1.6 billion has been invested to date by Investment Crowdfunding investors.

Continue to the full article –> here

Purchase the full 2022 Investment Crowdfunding report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/cca-2022-investment-crowdfunding-report-7-charts-highlight-growth-and-impact/