Published 2023-12-22 10:15

Brazil is looking to regulate their booming gambling market, which today, is considered a grey market. This is to get control of its gambling market, and through a licensing system, gain control over the operators, including applying taxes.

It’s a hot topic in the country, where political discussions have been going on for a long time. Even the more dedicated Catholics in Brazil are involved, making themselves heard, and wanting the sin of gambling made completely illegal.

From zero to a top market

Brazil can’t wait any longer, the market is growing too fast, and it’s growing big!

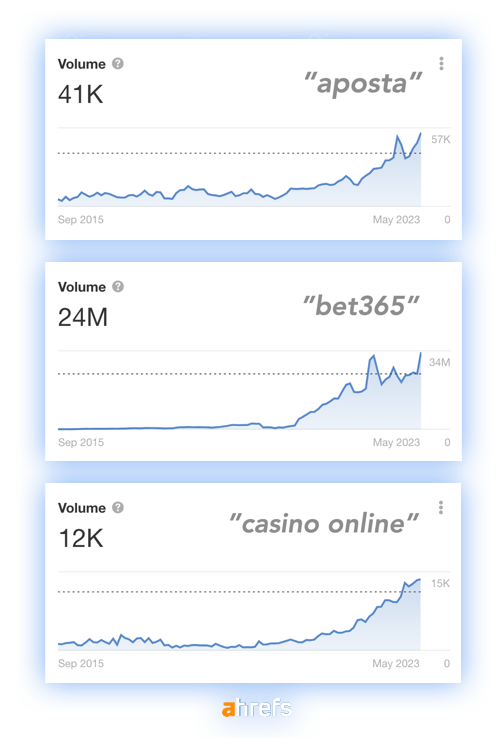

President Lula is pushing hard to get started with the regulation, and no wonder, minding the financial amounts that Brazil could get in taxes. In just 3-4 years, the online search volume related to betting, casino, bingo and all other gambling game categories, has grown from close to non-existent to becoming a top 3 country with the highest online searches for gambling products.

Being a grey market means that Brazil has gambling laws today, but old laws include a monopoly for the governmentally run gambling and lottery operator, Caixa. But the biggest difference, and the main reason to why Brazil is pushing to regulate is to be able to tax the operators.

The background explained

like many other non-regulated countries, their outdated laws don’t cover all the aspects of today’s online gambling, including betting, casino games, poker, bingo, lotteries and more. The operator’s licenses work as a global certificate and give access to basically all countries that do not yet have gambling regulations in place. No grey authority can touch the gambling operators, since none of the operators are based in Brazil.

In short, the gambling activities do not take place in Brazil, but in the country where the operator is based and runs their business.

Propositions and changes create confusion

Brazil’s Commission on Economic Affairs approved the proposition for the new Brazilian gambling regulation earlier this year, which was handed to the senate this week.

The senate then made a number of changes and adjustments, including something as extreme and unwise as prohibiting online casino and other types of “igaming”, as they incorrectly called the prohibited category of games. And luckily, in the following instance for review and additional revisions, the deputies, removed the prohibition of online casinos from a tax perspective.

A very, very wise decision!

The proposition for the upcoming legislation and regulation of the Brazilian gambling market that now stands, includes:

Each licensed company may operate three brands.

The operator tax proposal was 18% GGR (gross gaming revenue) but has been reduced to 12%.

Bettors must pay a 15% tax on net profits from winnings of R$2112 (€390) or more.

Companies must verify the identity of all new customers, by using facial recognition technology.

Prize payments may be suspended due to suspected fraud.

Payment of bets and prizes only between institutions authorized by the Central Bank.

Not all betting sites will apply

The most popular betting sites in Brazil which holds the biggest market share, will be very fast with handing in their application. Because the betting sites that have the highest number of Brazilian bettors in their database will most likely be the only ones that can secure profits, in a not-too-distant future.

The betting sites that don’t have the financial resources to pay the outrageous license fee will simply drop out. There is also a big portion of gambling companies that focus on unlicensed, so-called “grey” markets, and stay away from all regulated markets.

Some have the financial resources but might not yet have a sufficient amount of Brazilian customers to be able to make sense of investing €60 million, and then deduct 12% tax on their profits.

Betting sites likely to become licensed

Exchange

PROS

Betting exchange platform

🇨🇦 🇬🇧 🇳🇿 🇩🇪 🇳🇴 🇸🇪 🇫🇮 🇪🇸 🇷🇺 🇧🇷 🇭🇺 🇮🇳 +

BONUS

Bet €10 – Get €30 Free bet

PROS

Betting exchange platform

🇨🇦 🇬🇧 🇳🇿 🇩🇪 🇳🇴 🇸🇪 🇫🇮 🇪🇸 🇷🇺 🇧🇷 🇭🇺 🇮🇳 +

Bonus terms: 18+ Gamble responsibly – Terms & conditions apply PRODUCT LABEL GET €30 IN FREE BETS When you place a €10 bet on Sportsbook. New customer offer. Bet min €10 on min odds 1.50 (1/2), get €30 in Free Bets. Valid for 30 days. Only deposits via cards or Apple Pay will qualify.

PROS

🇬🇧 🇳🇿 🇩🇰 🇮🇸 🇸🇪 🇮🇹 🇧🇷 🇵🇪 🇨🇱 🇲🇽 🇬🇷 🇵🇱 🇹🇷 +

BONUS

€100 + €10 free bet

or country specific

PROS

🇬🇧 🇳🇿 🇩🇰 🇮🇸 🇸🇪 🇮🇹 🇧🇷 🇵🇪 🇨🇱 🇲🇽 🇬🇷 🇵🇱 🇹🇷 +

Bonus terms: Wagering demand: 6x bonus + deposit at min odds 1.50 within 30 days.

★ GREAT CHOICE

BONUS

€50 free bet

or country specific

PROS

🇨🇦 🇬🇧 🇳🇿 🇩🇪 🇫🇷 🇳🇴 🇸🇪 🇩🇰 🇪🇸 🇧🇷 🇰🇷 🇯🇵 🇮🇳 +

Bonus terms: 18+ Gamble responsibly -T&C apply. New customers only. Min Deposit: €5 with debit card only. Maximum bet: €50 on overall odds: 1.50 (1/2) or higher. Valid 7 days from registration.

★ GREAT CHOICE

BONUS

100% up to €50

or country specific

PROS

🇬🇧 🇨🇦 🇧🇷 🇫🇷 🇳🇴 🇸🇪 🇩🇰 🇩🇪 🇳🇱 🇨🇿 🇯🇵 🇨🇳 🇺🇦 +

Bonus terms: €5 min deposit. Wagering requrement is 1x deposit (max €50) on min odds 1.20 (1/5) within 30 days.

Conclusion – The regulation will happen

After many years of discussing a regulation of the Brazilian gambling market, it’s now basically done and dusted. It will happen, soon. A date is now to be set, and then the Ministry of Finance will establish a process- and trial period. Within that timeframe, operators must apply, receive approval, and adapt to all laws and rules.

Failure to follow the new gambling laws will surely result in hefty fines, and time will tell how harsh the Brazilian authorities will be. Time will also tell when it comes to how many applications Brazil will get initially, especially minding the very high fee of up to €30 million.

Knowing how the bettors have reacted to different rules and laws in other countries, it’s probably safe to say that there will be an unlicensed market, and how big will depend on how unbalanced the operators and the Brazilian players think that the new gambling regulations and the laws are.

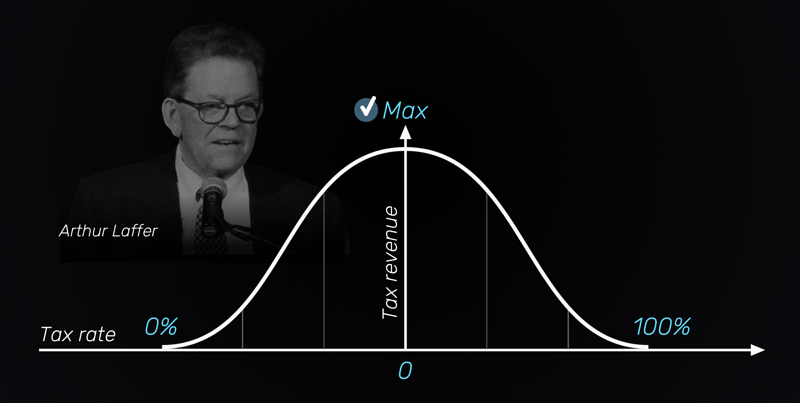

The theoretical balance between tax rates and tax revenue

I have a feeling that Brazil isn’t familiar with the Laffer Curve, a tool that can show the theoretical relationship between tax rates and the results in tax revenue. By setting the graph data from a realistic estimate, the curve will show the maximum tax rate that will generate the highest amounts of tax revenue.

Increasing the tax rates beyond that certain point should result in lower tax revenue, despite increasing the rates. It’s all about balance, about finding the sweet spot, and the maximum rate that the payers feel comfortable with.

How balanced will the regulation be in Brazil? Time will tell…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://esportsbetting.gg/brazil-booming-gambling-market-set-to-be-regulated