“`html

Significant volatility struck the digital currency market recently, with Bitcoin’s valuation plunging beneath the $65,000 threshold, which instigated broad-scale liquidations.

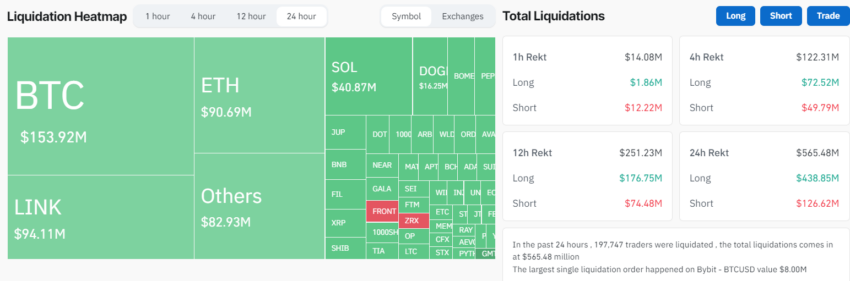

This precipitous drop led to an estimated $565 million erosion in market capitalization, adversely affecting both bullish and bearish market participants.

Enormous $400 Million Hit for Long Position Holders

Bullish speculators were taken by surprise due to the rapid downturn, with losses surpassing the $400 million mark for those individuals on that single day.

CoinGlass data highlights that speculative price investors endured a combined setback of $565 million in that timeframe. The more considerable portion of that figure was shouldered by those in long positions at $438 million, while a smaller sum of $126 million was attributed to liquidations of short positions.

Specifically, investors holding long positions in Bitcoin were hardest hit, shouldering a staggering $153 million loss. Traders backing Chainlink followed with a $94 million loss. Aggregate losses for traders of Ethereum and Solana reached upwards of $130 million.

These market movements adversely affected approximately 200,000 investors, with the majority, more than half, trading on the Binance and OKX platforms.

Explore further: Top 10 Cryptocurrency Exchanges and Apps for Newcomers in 2024

The market’s downturn is largely linked to the transient decline in Bitcoin’s value, dipping below the $65,000 mark for the first time since the early days of March. As Bitcoin is a bellwether for the sector, its price fluctuations are indicative of the overall trend in the cryptocurrency market. This reverberated across leading cryptocurrencies like Ethereum, Avalanche, BNB, Cardano, and Chainlink, leading to marked price dips.

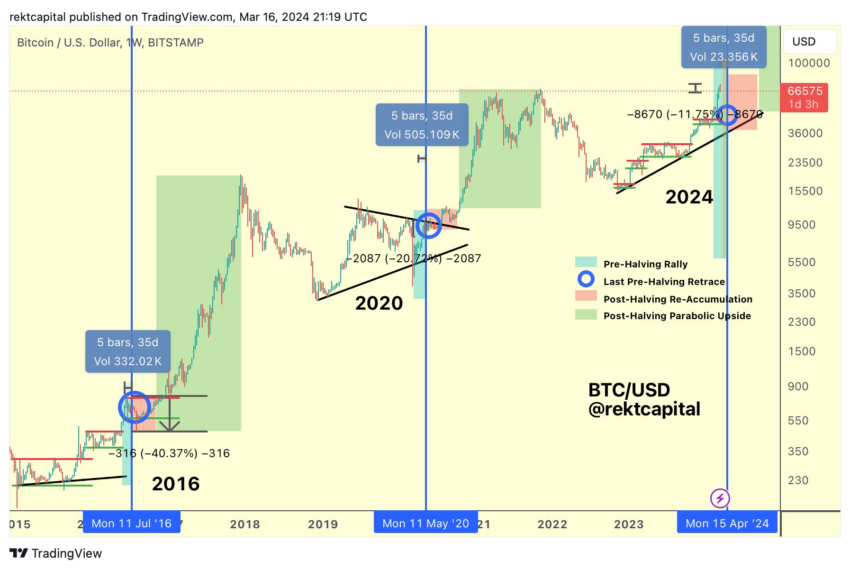

Various cryptocurrency pundits view this decline as a characteristic dip in the market. For instance, Rekt Capital pinpointed that despite the debut of Bitcoin-based spot ETFs, the prevailing bullish market is still prone to a retraction preceding the halving. Historically, such contractions tend to occur about two to four weeks ahead of the Bitcoin halving event.

Further reading: Bitcoin Price Forecast for 2024/2025/2030

Comparing past halving cycles, the analyst remarks that the recent 11% pullback Bitcoin experienced 31 days prior to the halving aligns with previous patterns, where the retracements were 20% and 40% in the years 2020 and 2016, respectively.

“Expect Bitcoin to retract sufficiently to provoke doubts about the continuation of the Bull Market. After this phase, its upward trajectory shall resume,” noted Rekt Capital in a recent statement.

Accordingly, the expert cautioned that Bitcoin could be approaching a high-risk period, dubbed the “Danger Zone,” within the impending three days, advising traders to remain vigilant.

Disclaimer

Under the principles of the Trust Project, BeInCrypto stands by its commitment to honest, forthright journalism. Although this news piece is cultivated to transfer information accurately and in a timely manner, we advise our readership to independently corroborate the details and consult a professional prior to making any investment decisions. We have updated our Terms and Conditions, Privacy Policy, and Disclaimers.

“`

#Million #Liquidated #Bitcoin #Price #Drops #Expect

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoinfonet.com/crypto-trading/565-million-wiped-out-in-liquidations-amid-bitcoin-price-dip-future-projections/