Only 5 percent of first-time millennial MF investors came directly on their own.

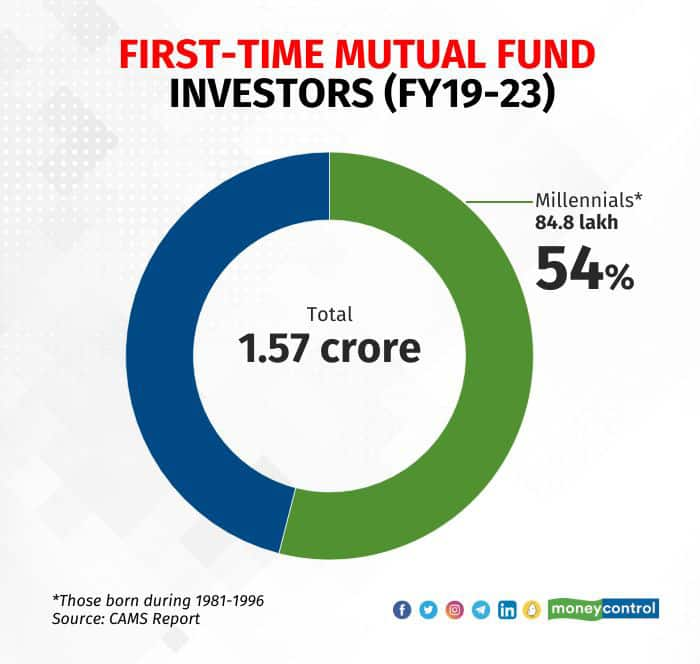

More than half the first-time mutual funds (MF) investors over the last five years have been millennials. This is one of the findings from a recent report by CAMS (Computer Age Management Services), the country’s largest registrar and transfer agent for mutual funds.

Going by the report, 54 percent of the 1.6 crore new investors — about 85 lakh — that started investing in MFs during FY19-23 were millennials. The millennials who stayed invested through this entire period had assets worth Rs 96,000 crore as of March 2023.

The report, ‘The emerging force of the millennial investor is here to stay & grow’ was released by CAMS at the 17th CII Mutual Fund Summit held in Mumbai on May 3, 2023. All insights in the report are based on data of the MFs serviced by CAMS. These account for 69 per cent of the Indian MF industry.

The report focuses on millennials who entered the MF space for the first time during FY19-23. Millennials are those born between 1981 and 1996.

Here are a few interesting insights from the report.

Sectoral funds attract new millennial investors

It comes as no surprise that a bulk of the millennial investors marked their entry into the MF space via equity funds. In FY23, 90 percent of the first-time millennial investors went into equity funds. The proportion of investors choosing equity schemes remained around this level over the period of the study, barring FY20 and FY21, when it fell to 78 percent and 66 percent, respectively.

What’s surprising is that in terms of fund categories, sectoral or thematic funds accounted for the largest share. Between FY19-FY23, 21 percent of new millennial investors started their MF journey by investing in sectoral funds.

These funds follow a concentrated investment strategy, investing at least 80 percent of their corpus in stocks from a specific sector or theme. They also require you to time your entry and exit in line with the sector’s changing fortunes. Most experts recommend putting not more than 5-10 percent of one’s equity portfolio in such funds.

In contrast, the sector-agnostic large cap funds, which were the first MF investment for 15 percent of millennials in FY19, dropped to 8 percent by FY23.

Also see: MC30 List of funds

Very few new DIY investors

In contrast with what one would expect, a vast majority of millennials (95 percent) did not take the do-it-yourself, or DIY, route. They chose advisors or distributors to invest in MFs for the first time. Only 5 percent of first-time millennial MF investors entered the market on their own.

Thirty-five percent chose SEBI registered investment advisors (RIA), and 60 percent came via MF distributors (MFD) and banks.

Furthermore, 99 percent of those who chose RIAs were based out of the T30 (top 30) locations. MFDs (includes largely individual distributors) and banks accounted for a smaller share of such investors. On the other hand, for the B30 (beyond the top 30) locations, MFDs and banks were the preferred route to start investing in MFs.

As of March 31, 2023, direct and regular plans accounted for 45 percent and 55 percent of the overall MF industry assets, respectively. Regular plans are those that have been bought through an intermediary, like a distributor.

Also read: Performance-based fee for mutual funds: What stakeholders say

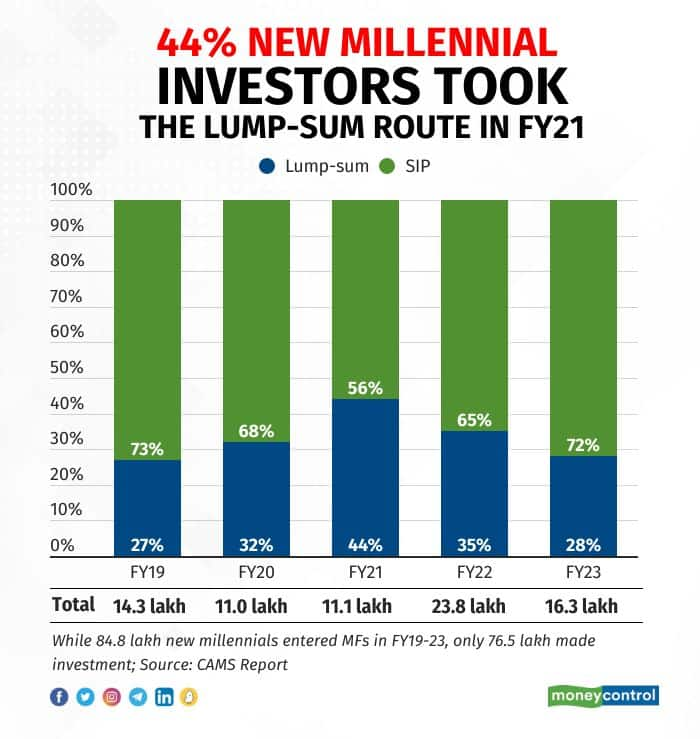

A third of millennials invest lump sum

The mutual fund industry swears by the systematic investment plan (SIP) route for investing in MFs. However, according to the CAMS report, one-third of millennials, that is, 25 lakh of them, began investing in MFs between FY19-FY23 by taking the lump sum route. The remaining started their journey via the SIP route.

In fact, in FY21, that is, the year following the March 2020 fall, 44 percent of millennial investors began their MF investment journey via the lump sum route — a likely attempt to time the market even as the Sensex and the Nifty began their ascent. This number tapered to 35 percent in FY22 and 28 percent in FY23.

As the report highlights, while a majority of these lump sum investors choose to invest Rs 5,000 or less, a good 20 percent of them made investments in the range of Rs 10,000-50,000.

Diversification across fund houses

Interestingly, 57 percent (43.9 lakh) of the millennial investors that started between FY19-FY23 did not go beyond the first fund house they started with, and only 3 percent (2.4 lakh) investors had exposure to more than five fund houses. That is, on the one hand, 57 percent investors had a concentrated exposure to only one fund house, while on the other, a minority had over-diversified beyond five fund houses.

One interesting data point (that the report did not present) would have been to see how many millennial investors are invested in more than 4-5 mutual fund schemes.

Also read: AMFI asks fund houses to stop training programmes based on SIP targets for distributors

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.moneycontrol.com/news/mutual-funds/54new-mutual-fund-investorsmillennials_16989111.html