It’s been a rough month or so for mortgage rates.

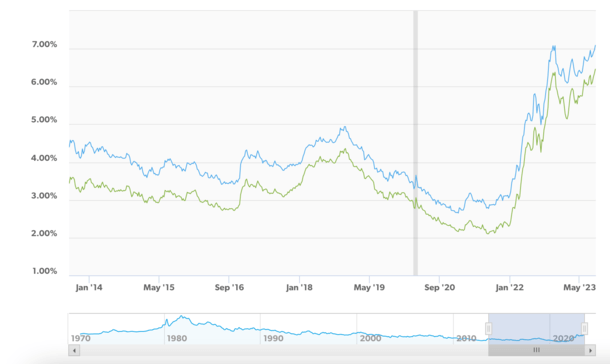

If we zoom out even further, it’s been a horrendous 18 months, with the 30-year fixed as low as 3% in the spring of 2022.

Today, you might be looking at an interest rate in the 7% range, or even the 8s if you have a particularly challenging scenario.

This has eroded affordability and ground the housing market to a halt, driven mainly by the Fed’s ongoing inflation fight.

So what will it take for mortgage rates to fall again? And how soon can we expect meaningful downward movement?

Will Mortgage Rates Go Back to 3%?

First things first, it’s doubtful mortgage rates go back to 3%. The 30-year fixed hit a record low of 2.65% in January 2021, per Freddie Mac.

The blue line above is the 30-year fixed, the green line the 15-year fixed.

The chances of rates returning to those ridiculously low levels seems unlikely, though you should never say never.

Anything is possible, though if we do get back there, it’s probably not going to happen anytime soon.

Ultimately, the Federal Reserve engineered those record low mortgage rates by purchasing trillions in mortgage-backed securities (MBS) and lowering its own short-term fed funds rate to near-zero.

The process is known as Quantitative Easing, or QE for short, and took place for much of the past decade.

Unfortunately, this accommodative rate environment was artificial, and eventually led to massive inflation, perhaps because it ran for too long.

The COVID pandemic certainly made things worse, with billions of dollars floating around in aid, coupled with these low rates.

As such, the Fed more recently launched QT, or Quantitative Tightening, which works in opposite fashion.

Instead of buying MBS, the Fed sells them. Of course, right now they’re only letting them run off from their portfolio, meaning they don’t reinvest in more if they’re prepaid, either by a refinance or home sale.

Theoretically, this puts upward pressure on rates, since the Fed is no longer a buyer and supply is ostensibly higher.

Long story short, we probably won’t see mortgage rates go back to 3%. But that doesn’t mean they need to stay at 7% either.

Will Mortgage Rates Go Down in 2024?

At the moment, there is an expectation that mortgage rates will go down in 2024.

While it might not feel that way, given the higher highs we’ve experienced over the past month, forecasts still predict that relief is on the way.

In case you hadn’t noticed, the 30-year fixed hit its highest point in over 20 years recently, hovering around 7.5%.

And it could be going higher before it moves lower. The highest the 30-year has ever been in the 21 century was 8.64%, back in May 2000, per Freddie Mac.

It’s possible we could test those levels again if inflation continues to be an issue. Or if the Fed indicates that it’ll need to resume raising short-term rates.

But there’s currently no indication that will be necessary given some positive steps on the inflation front in recent months.

Still, it’s not out of the question given the current mortgage rate environment, which has been volatile to the upside.

Anyway, the Mortgage Bankers Association (MBA) just released its latest Mortgage Finance Forecast for August. And there’s some good news in there, if you believe they’ll get their predictions right.

They currently expect the 30-year fixed to fall into the 5% range for all of 2024.

Q1: 5.9%

Q2: 5.6%

Q3: 5.3%

Q4: 5.0%

What’s more, they predict that the 30-year fixed will average 4.6% in 2025, which sounds too good to be true.

And it certainly might be, as their forecast for 2023 has already missed the mark. They expected mortgage rates in the mid-6s this year.

As noted, we’re closer to the mid-7s right now, so if that’s any indication, these 2024 forecasts might not carry much weight.

But the fact that they’re at least aiming that low can be taken as a positive.

Meanwhile, Fannie Mae released its latest housing forecast for August 2023 and they see relief on the horizon as well.

While not as aggressively optimistic, they still have the 30-year firmly back in the 6s in 2024.

Q1: 6.5%

Q2: 6.3%

Q3: 6.2%

Q4: 6.0%

For what it’s worth, the National Association of Realtors (NAR) also has the 30-year fixed averaging close to 6% even for much of 2024.

So the consensus seems to be mortgage rates in the 5-6% range for 2024, which would be welcome news given current market rates.

It Might Take Longer for Mortgage Rates to Fall (Just Like It Took Longer for Them to Rise)

If you recall the low mortgage rate years, which lasted over a decade from around 2012-2022, you may remember that year after year the forecasts called for higher rates.

But each year, mortgage rates defied those predictions and moved lower.

In other words, the same economists I highlighted above were wrong when rates were on the way down, and might be wrong as they move higher.

We’ll hope they’re right for the sake of the housing market, but there’s certainly no guarantee.

In fact, we could be stuck in a similar dynamic where mortgage rates have a tough time coming back down to earth.

The only way we see big downward movement is if inflation actually cools off and stays cool. And mortgage spreads tighten, for much the same reason.

If the economy doesn’t cooperate over the coming months, we might be in for higher mortgage rates, or simply the status quo in the high 6s and low-to-mid 7s.

The best way to approach this mortgage rate environment is to hope for the best, but prepare for the worst.

These higher rates could go higher, and may stay there longer than expected. But if they do fall as predicted, the housing market should find its footing again before long.

Read more: Why Are Mortgage Rates Still Going Up If the Fed Is Done Hiking?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.thetruthaboutmortgage.com/what-will-it-take-for-mortgage-rates-to-fall-again/