- Data revealed a bigger-than-expected drop in Canada’s inflation.

- The dollar initially weakened after a dovish FOMC meeting.

- Next week, traders will get to assess GDP data from the US and Canada.

The USD/CAD weekly forecast remains optimistic, fueled by the relentless strength of the US economy showcased in the latest data.

Ups and downs of USD/CAD

After fluctuating in the week, USD/CAD ended up, with the dollar closing the week on the front foot. As the week began, data revealed a bigger-than-expected drop in Canada’s inflation, leading to increased bets for a rate cut. As a result, the Canadian dollar weakened.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Meanwhile, the dollar initially weakened after a dovish FOMC meeting where Powell maintained that inflation was declining. However, as the week ended, it recovered amid upbeat US economic data, allowing USD/CAD to close on a bullish candle.

Next week’s key events for USD/CAD

Next week, traders will get to assess GDP data from the US and Canada. Moreover, there will be a report from the US on durable goods orders. The GDP reports for both countries will have a big impact on USD/CAD as they will reveal the impact of higher interest rates. Therefore, lower-than-expected readings could put pressure on the Fed and the Bank of Canada to cut interest rates. On the other hand, upbeat readings would allow the central banks to keep higher interest rates for longer.

Meanwhile, the US durable goods orders report will show the state of manufacturing and consumer spending in the country. These will also show whether higher interest rates are having an impact on the economy. Therefore, the results will affect rate-cut bets.

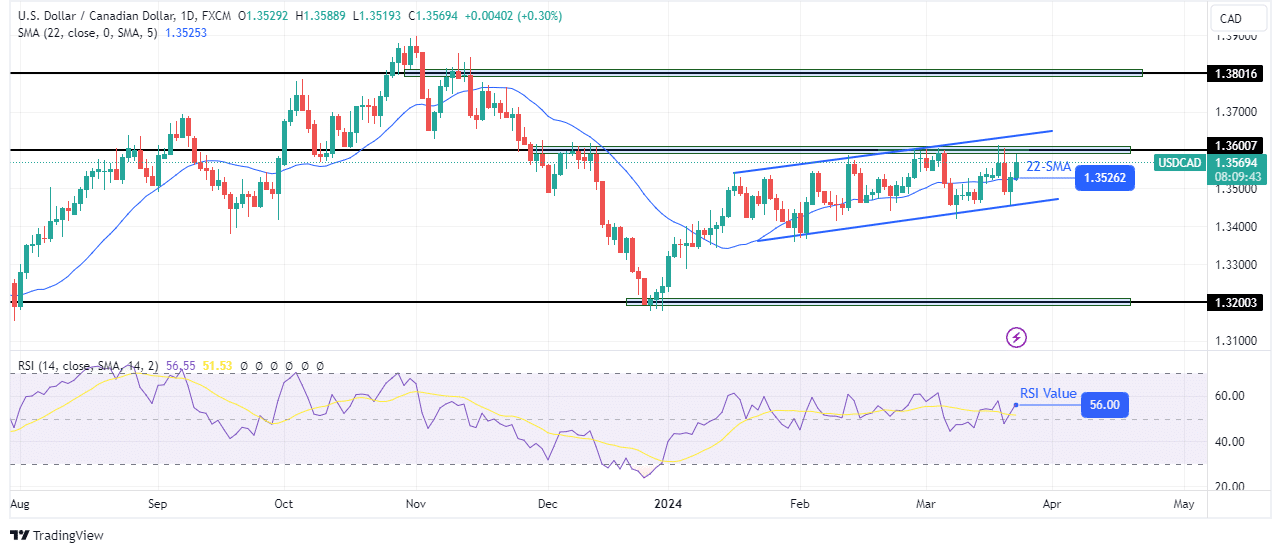

USD/CAD weekly technical forecast: Weak bullish momentum faces 1.3600 barrier

On the technical side, USD/CAD has traded in a shallow and tight bullish channel since mid-January. Although bulls have tried to make higher highs, the price is sticking close to the 22-SMA. At the same time, the RSI has stayed near 50 and has not touched the overbought region. This is a sign that although bulls are in control, they have weak momentum.

-Are you interested in learning about the forex indicators? Click here for details-

The shallow, bullish move is now facing strong resistance at the 1.3600 key level. Given the weak bullish momentum, the price might fail to break above. This would allow bears to take over by breaking out of the channel. If bears take control, the price will likely drop to 1.3200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/03/23/usd-cad-weekly-forecast-resilient-economy-boosts-greenback/