In the burgeoning landscape of the carbon market, a tapestry of strategies emerges as companies strive to pave the way to a net-zero emissions future. Amidst this vibrant ecosystem, a particular group of entities—publicly listed companies dedicated to carbon reduction and sustainability—plays a pivotal role.

Close-up of a tree seedling. Hongera Reforestation Project, DGB.

Close-up of a tree seedling. Hongera Reforestation Project, DGB.

In this market, there are traditional players that primarily finance projects and trade in carbon credits (also known as carbon units). Some companies, such as DGB Group, take a proactive stance by directly developing carbon projects. This hands-on approach not only demonstrates a deeper commitment to environmental restoration but also highlights the unique advantages of being publicly listed to serve broader societal goals.

Public listing offers these companies unparalleled access to capital markets, enabling them to rapidly scale their efforts and expand their environmental project portfolios. It democratises the opportunity for investors worldwide to contribute to meaningful nature restoration efforts, marrying financial investment with tangible ecological impact. Moreover, the transparency and rigorous governance standards required of public companies bolster investor confidence and public trust, showcasing the real-world effectiveness of their initiatives. The global visibility that comes with being a publicly traded entity further amplifies these companies’ ability to spread awareness and advocate for carbon compensation and sustainability, inviting broader participation in these critical endeavours. This article will explore how certain publicly listed companies in the carbon market landscape make a difference for nature.

Carbon Streaming: financing green futures

Carbon Streaming Corporation is a listed Canadian company that aims to accelerate a net-zero future by funding a portfolio of high-integrity carbon credit projects. It operates on an innovative model of ‘carbon credit streaming’, where it provides upfront capital to carbon credit (carbon unit) projects in exchange for a share of the future credits these projects generate. It also sells the credits from these projects to buyers.

Landscape view of The Rimba Raya area. AI generated picture.

Landscape view of The Rimba Raya area. AI generated picture.

This financing model allows project developers to receive the necessary funding to bring their green initiatives to life while ensuring a continuous flow of carbon credits to the market. Carbon Streaming’s focus on creating long-lasting partnerships aligns with the broader goals of environmental sustainability and advancing the United Nations Sustainable Development Goals (SDGs).

Read more: The voluntary carbon market’s journey through 2023 and beyond

Base Carbon: focused capital for a greener tomorrow

Base Carbon is a listed company based in Toronto. It aims to bridge the gap between carbon project developers and capital markets by providing finance solutions to global voluntary markets and connecting project developers requiring financing with buyers seeking quality carbon credits. It directly allocates capital to carbon reduction projects and companies focusing on this area.

Landscape view of rural farmlands in the northern Indian state of Uttar Pradesh. AI generated picture.

Landscape view of rural farmlands in the northern Indian state of Uttar Pradesh. AI generated picture.

Their approach is rooted in the principles of natural resource financing, applied to the carbon credit market to ensure the development of projects with meaningful co-benefits for local communities. Base Carbon’s formulaic risk-to-reward evaluation and project co-benefits not only enhance the quality of their projects but also mitigate investment risks, providing a clear path towards impactful carbon reduction.

Read more: The importance of carbon offsetting in achieving net zero

Klimat X: scaling nature-based solutions

Klimat X is a carbon exploration and development company listed on the Frankfurt Exchange. It aims to revolutionise the carbon market by developing jurisdictional-scale, nature-based solutions to environmental issues. Their strategy focuses on leveraging the vast potential of forestry and marine carbon sequestration projects, aiming for industrial-scale carbon credit production.

Mangroves ecosystem of Sierra Leone. AI generated picture.

Mangroves ecosystem of Sierra Leone. AI generated picture.

With a strong leadership team experienced in carbon markets and resource sectors, Klimat X’s model prioritises rapid development and diversification of its portfolio to address natural challenges on a global scale.

Read more: The interconnected world of carbon: exploring key carbon market concepts

DevvStream: technological innovations for environmental assets

DevvStream, a listed company based in Canada, takes a technology-focused approach to environmental sustainability. By advancing the development and monetisation of environmental assets, primarily through carbon markets, DevvStream supports projects that generate renewable energy, improve energy efficiencies, and sequester carbon.

Close-up of marine biodiversity. AI generated picture.

Close-up of marine biodiversity. AI generated picture.

These projects then generate quality carbon credits, which the company sells to organisations that want to meet net-zero goals. Its emphasis on technology-based solutions alongside nature-based solutions showcases a commitment to using innovation for nature restoration techniques aligning with key international sustainability goals and standards. Its business model is based on investments that provide it carbon credit rights for periods of 10–30 years, enabling it to benefit from the expected increase in demand for carbon offsets.

Read more: Bullish growth projections in the carbon market

DGB Group: pioneering nature restoration

In the constellation of companies contributing to carbon mitigation and environmental restoration, DGB Group shines with a distinctive approach. As a publicly traded entity listed on Euronext Amsterdam and deeply rooted in nature-based solutions, DGB stands out for its direct involvement in developing, financing, and managing high-impact nature-based projects with a boots-on-the-ground approach.

Aerial view of a tree nursery in Kenya. Hongera Reforestation Project, DGB.

Aerial view of a tree nursery in Kenya. Hongera Reforestation Project, DGB.

DGB Group is not just another company in the carbon credit market; it is a mission-driven company focused on reversing environmental degradation and restoring nature at scale. Specialising in nature-based solutions, DGB manages projects that are not only aimed at carbon sequestration but also emphasise ecosystem restoration, conservation, and biodiversity enrichment. These projects, accredited by third-party verifiers, underscore DGB’s dedication to creating sustainable environments and thriving communities. With operations spanning various continents, predominantly in Africa, and a vision to expand globally, DGB is laying the groundwork for a greener, more sustainable future.

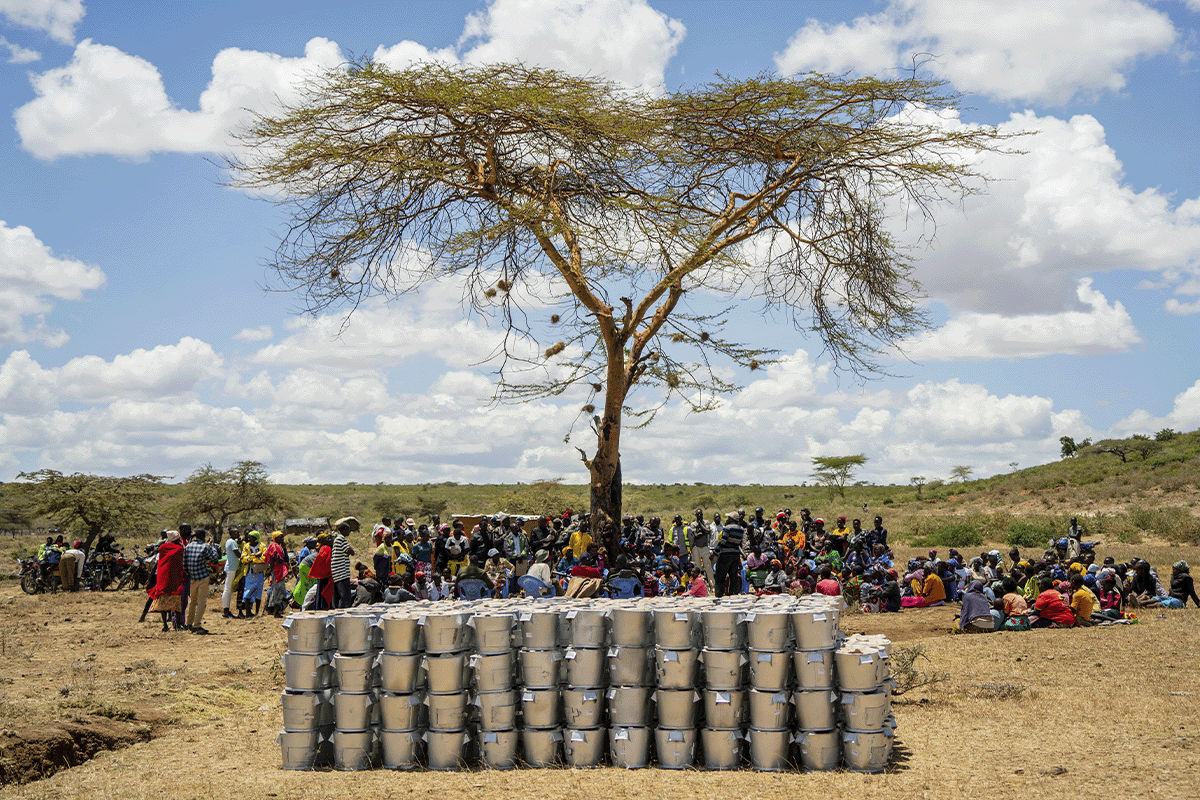

Rows of energy efficient cookstoves and local community during cookstoves distribution. Hongera Energy Efficient Cookstoves Project, DGB.

Rows of energy efficient cookstoves and local community during cookstoves distribution. Hongera Energy Efficient Cookstoves Project, DGB.

DGB takes a hands-on approach to environmental restoration. Unlike companies that solely finance projects, DGB is actively involved in developing and managing initiatives that yield tangible environmental and social benefits. From reforestation projects, which emphasise local involvement and biodiversity protection, to the distribution of efficient cookstoves that improve the wellbeing of local communities, DGB’s projects are comprehensive, addressing both carbon mitigation and environmental and societal needs. This involvement ensures that each initiative not only contributes to global carbon emissions reduction but also enhances local communities and ecosystems.

Read more: Our journey to a greener future: DGB Group’s strategic expansion into the French market

DGB’s efforts in nature restoration are nothing short of transformative. With over 31 million trees being planted, 250,000 hectares of land scouted to be restored, and an expected 60+ million tonnes of CO₂ to be captured, DGB’s projects make a significant impact in reducing carbon emissions and restoring nature. These initiatives are also a boon for local communities, creating jobs and improving living standards through additional income streams, training programmes, and other sustainable practices. The public listing of DGB amplifies these impacts, offering transparency and credibility and inviting global participation in these vital environmental efforts.

DGB exemplifies how businesses can play a pivotal role in addressing the carbon emissions crisis through actionable, nature-based solutions. By partnering with DGB, stakeholders contribute to a portfolio of projects that not only capture or reduce carbon emissions but also restore and protect the planet’s biodiversity. As the world grapples with environmental challenges, DGB’s model of direct involvement in project development sets a benchmark for effective, sustainable action. In partnership with DGB, companies and individuals can take decisive steps toward achieving their net-zero goals and fostering a healthier planet.

Learn more about DGB’s green solutions

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.green.earth/blog/trading-carbon-trading-up-the-public-companies-transforming-sustainability