In the realm of clean energy, the fusion sector is witnessing a shift marked by notable trends that promise to reshape the landscape of sustainable power generation. Fusion stands out as a promising technology, but it has remained elusive, with seemingly insurmountable technological challenges and high upfront costs impeding its widespread adoption.

Building off research presented in the Global Cleantech 100 and APAC Cleantech 25, we see continued interest and investment in fusion. Trends to watch for the rest of 2024 include APAC’s growing role in the fusion sector, the advancement of stellarator technologies, and further investment in novel and new fusion reactors and companies.

Fusion Technologies and Research Accelerate in the APAC Region

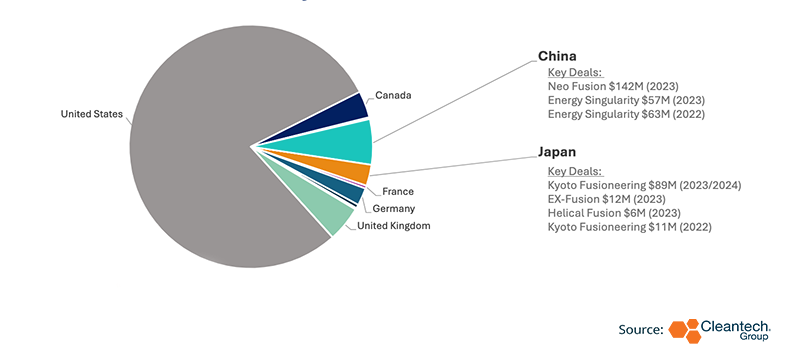

Kyoto Fusioneering (KF), Helical Fusion, Ex-Fusion, Energy Singularity, Neo Fusion, OpenStar Technologies, HB11, and other public research and component manufacturers, are rapidly accelerating fusion technologies outside North America and Europe. As seen in Figure 1, APAC fusion companies have been able to raise close to $400M since 2020. Kyoto Fusioneering recently raised another Series C extension round of $9.9M increasing their total Series C Funding to $88M. This will go to further develop KF’s UNITY-1 and UNITY-2 tests sites where fusion power plant technologies will be tested and simulated.

Kyoto Fusioneering also secured various grants and joined new partnerships. KF secured an impressive three INFUSE awards from the U.S. Department of Energy to support research on liquid metal blankets, tritium breeding, and liquid lithium materials. KF partnered with the UK Atomic Authority to collaborate on gyrotrons, advanced blanket systems, and high temperature superconducting magnets. They also partnered with General Atomics to supply advanced gyrotron systems and General Fusion to support magnetized target fusion technologies.

Other companies in Japan also raised funds in 2023 including Helical Fusion, which raised a $6M Seed round and Ex-Fusion which raised $12.6M. China also saw a substantial investment in Neo Fusion, with at least $142M invested, but little else has been disclosed (see Unknown reactor type in Figure 2 and Figure 3).

Outside of the private sector, on April 10 the United States government and Japanese government announced a partnership to collaborate on scientific and technical challenges, share facilities for R&D, accelerate international supply chains to support commercial deployment and support fusion workforce development programs.

In Korea, records were also broken in April where plasma temperatures of 100 million degrees Celsius were sustained for 48 seconds at the KSTAR tokamak (Korea Superconducting Tokamak Advanced Research) at the Korea Institute of Fusion Energy. This broke their previous record of sustaining 100 million C.

Figure 1: Venture Investments by Region (2020 – 2024)

Moving Away from Tokamaks and Towards Stellarators

Compared to tokamaks, stellarators have intrinsically better plasma stability, which makes them more suitable for the steady power generation and reliability expected by electrical grids. However, while much of the underlying technology can be transferred from tokamak concepts, stellarators are still more complicated to engineer which is why companies must secure strong partnerships and utilize best-in-class engineering expertise if they aim to rapidly replicate their models for grid connection. The relative sizes of components such as the magnets and vacuum vessel and the need to develop supply chains for these components, mean that it is not yet clear which concept might be cheaper to construct.

“Stellarators have traditionally been considered too complex to be viable alternatives to tokamaks for fusion, but recent advances in physics understanding, and new tools for optimizing the geometry and engineering – helped by the success of Wendelstein 7-X at the Max Planck Institute for Plasma Physics – now really allow us to take advantage of their benefits in the design of a fusion power plant in the near future.” Richard Kembleton, Gauss Fusion Chief Scientific Officer.

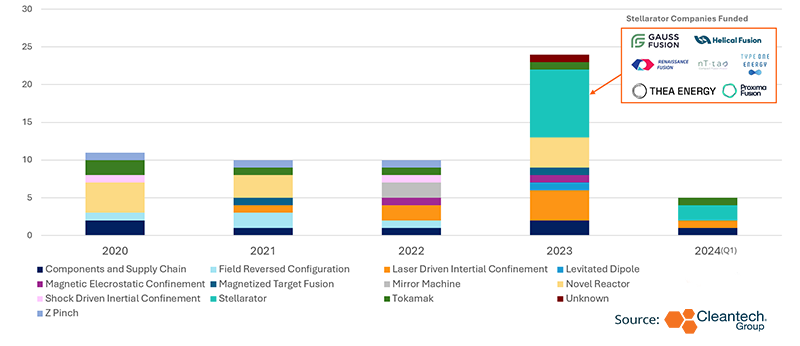

While traditional tokamak systems have previously raised large rounds of funding, recently stellarators have seen a significant uptick in the number of investments received. Gauss Fusion, Helical Fusion, Proxima Fusion, Renaissance Fusion Thea Energy, and Type One Energy, have recently raised funds to advance their stellarator systems.

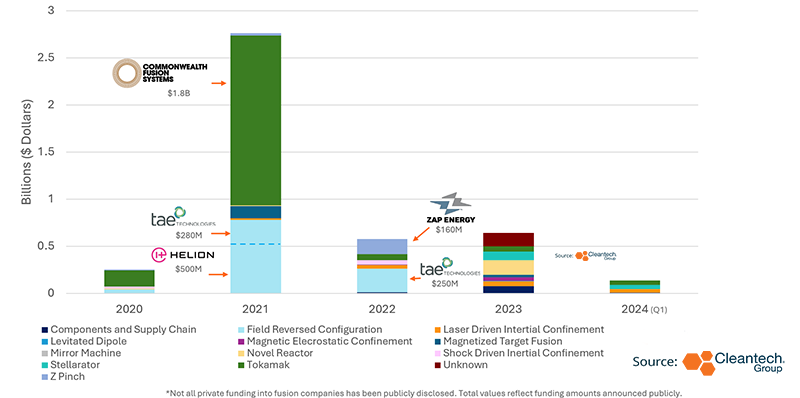

As seen in Figure 2, 2023 saw a significant uptick in the number of stellarator companies that received investments with at least eight investment rounds funding stellarators that year and at least $130M of private funding going into stellarators since the start of 2023. This is slightly more than the $107M of venture dollars going to tokamaks during the same time frame. However, Commonwealth Fusion, one of the world’s leading tokamak developers, had a significant $1.8B Series B round completed in 2021(Figure 3).

Figure 2: Venture Investment by Reactor Type (Number of Deals) 2020 – 2024

Novel Fusion Methods Advance and Newly Established Companies Receive Funding, Despite the Presence of Larger Players

Although certain companies like Commonwealth Fusion, TAE Technologies, and Helion have had a large presence in the media and received substantial investments, novel fusion reactor systems and smaller fusion players are still receiving funding from venture capital and private investors. As seen in Figure 3, 2021 saw significant investments in tokamaks like those from Commonwealth Fusion and field reversed configurations like Helion with TAE Technologies a also raising a large round in 2022. However, investments in 2023 and now 2024 are showing that various new players like Blue Laser Fusion, Shine Technologies, Novatron Fusion, and Openstar Technologies received funds to accelerate their radically new and novel reactor technologies and designs.

There have also been a number of grants, partnerships and research that also bolstered the work of various players. Recently, MIFTI, a company accelerating staged Z pinch technologies, partnered with the Lawrence Livermore National Laboratory (LLNL) and published a report highlighting that MIFTI’s Z pinch process. This process could theoretically produce an energy yield of 7.05 MJ (2.5 x 1018 neutrons) with a total energy of 3.25 MJ injected into the system if they were to use an existing 20MA pulsed power driver such as the Z- machine located at Sandia National Laboratories .This was simulated using LLNL’s advanced radiation- hydrodynamics predictive code called HYDRA. This is substantial since it shows that breakeven could potentially be achieved using MIFTI’s technologies and the Department of Energy’s existing facilities.

Zap Energy also announced a new temperature milestone has been achieved. Their system was able to achieve electron temperatures of 3keV (close to 37 million degrees Celsius) on their sheared flow Z pinch device which is much smaller than the larger tokamaks and field reversed configuration reactors that have previously achieved higher temperatures.

Both Z pinch solutions in development by MIFTI and Zap Energy are appealing from a commercialization standpoint given that these technologies do not require superconducting magnets or lasers, making them much cheaper to construct and easier to test.

Figure 3: Venture Deals in Fusion Companies by Dollar Amount

While larger companies like Commonwealth Fusion and Helion, will play an important role in the overall journey towards commercialization. some of these smaller innovators may also play a sizeable role on the path towards connecting fusion energy to the grid worldwide.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cleantech.com/three-fusion-trends-to-watch-in-2024-growth-in-asia-move-towards-stellarators-and-continued-advancement-of-novel-fusion-technologies/