PayPal has launched its own stablecoin, called PYUSD. Should you invest?

The short answer is you can’t “invest” in any stablecoin, because they’re designed to hold their value against the U.S. dollar. (You may as well just hold dollars.)

Also, PayPal doesn’t pay interest. So, avoid keeping any significant amount of money on their platform long-term –- whether in dollars or stablecoins. You’re better off in a high-interest savings account, or earning stablecoin yield (see our best interest rates here).

However, investing in $PYPL – PayPal stock – may be a very good idea. Here’s why.

The Shape of Things to Come

PayPal’s stablecoin is the shape of things to come.

First, it shows that major financial companies cannot afford to sit out the crypto revolution much longer. By launching its own stablecoin, PayPal now has its own on- and off-ramps to crypto, allowing its 400+ million users to easily invest in digital assets.

It’s not just investing: PayPal users will also be able to pay for things with PYUSD, and even send and receive PYUSD to other PayPal users, without fees. (PYUSD is built on top of Ethereum, which is notorious for fees, so this is a big deal.)

Second, it’s a PayPal-branded stablecoin. The company didn’t go with an established product like Tether or USDC, but launched its own.

Why? Because PayPal earns interest on your deposits.

Backing up its stablecoins are short-term U.S. Treasuries, which are currently paying 5% yield. That money flows directly back to PayPal.

PayPal is positioning itself to become the default gateway to crypto for millions of users. The company already has terrific consumer products, with easy-to-use apps and simple connections to traditional financial rails like banks and credit cards.

This means more consumers may end up using PayPal as their preferred crypto on-ramp, holding more of their wealth in PYUSD — instead of, say, holding USDT in a clunky Web3 wallet — and PayPal gets to pocket all the interest.

This points to a future where more financial institutions (and countries!) launch their own branded stablecoins, much like I predicted back in February 2020. That prediction is starting to come true. The “stablecoin wars” are just beginning.

Finally, PYUSD is built on Ethereum. As huge believers in Ethereum, PYUSD could become a significant driver of growth for the Ethereum network. It strengthens our conviction on investing in ETH long-term — it’s becoming the “operating system” for crypto, and now PayPal is building on top of it.

Great Risk vs. Great Reward

All this sounds like gravy for PayPal investors – and indeed, $PYPL stock jumped on the news.

From an investor standpoint, PayPal is building next-generation blockchain tech well before its rivals. It stands to reap the rewards (i.e., interest) of its users holding their dollars in PYUSD. And it could control a significant market share of dollars flowing into and out of crypto.

But with these potential rewards come risk. The biggest risk, of course, is the U.S. government, which has yet to define a clear framework for how stablecoins will be regulated.

For the crypto industry, the PayPal stablecoin is welcome news, as it will encourage lawmakers to hurry up and get new regulations passed, which will allow the industry to breathe a little easier.

However, it’s not a done deal. Congresswoman Maxine Waters (D-CA) said she was “deeply concerned” about the PayPal stablecoin, while Patrick McHenry (R-NC) had the opposite reaction, proclaiming it “holds promise as a pillar of the 21st century financial system.”

Considering they’re both on the House Financial Services Committee working on new stablecoin legislation, you can see we’re still working out some differences of opinion.

Then there’s the fact that PayPal’s stablecoin is being managed by Paxos, which was recently sued by the SEC for offering a Binance-branded stablecoin.

So the risks of PayPal running into trouble with the SEC, or the U.S. government, are high. But so is the risk of sitting on the sidelines and doing nothing—especially as more of their consumers turn to crypto.

If PayPal pulls it off, and manages to avoid a legal tussle, stablecoins could become a mighty moat.

Should You Invest in $PYPL?

Again, smart investors should not hold any significant cash in PayPal’s stablecoin (or in any stablecoin, unless you’re earning yield).

However, this is an exciting opportunity to invest in a financial services company that’s making a bold move into crypto – by simply buying and holding $PYPL stock.

Do you already use the company’s products? If so, you have a powerful investing insight. In my family, we’ve been using PayPal for a couple of decades, and Venmo for a couple of years. I think both are terrific products, and far more user-friendly than any bank or crypto app we’ve tried.

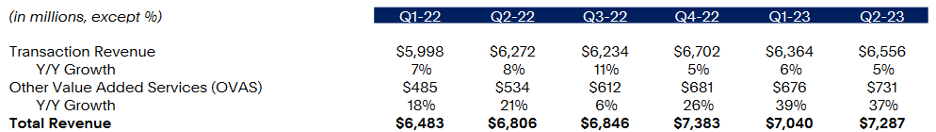

PayPal’s financials look good, with quarterly revenue growing from $6.8 billion to $7.3 billion year over year:

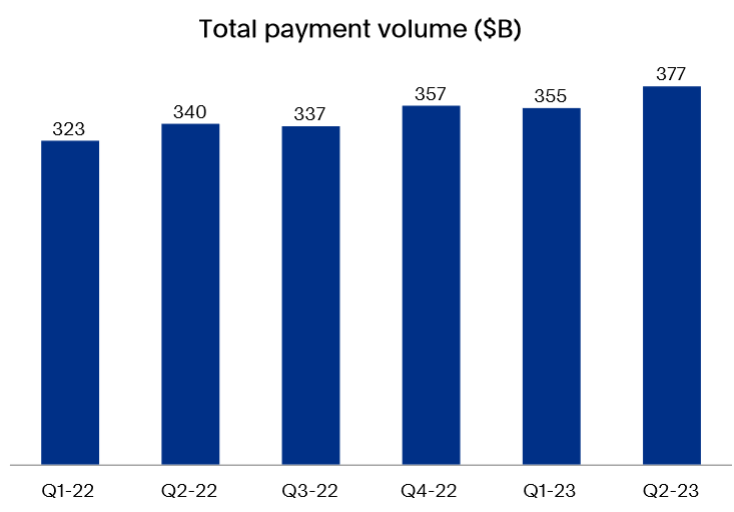

Payment volume is up:

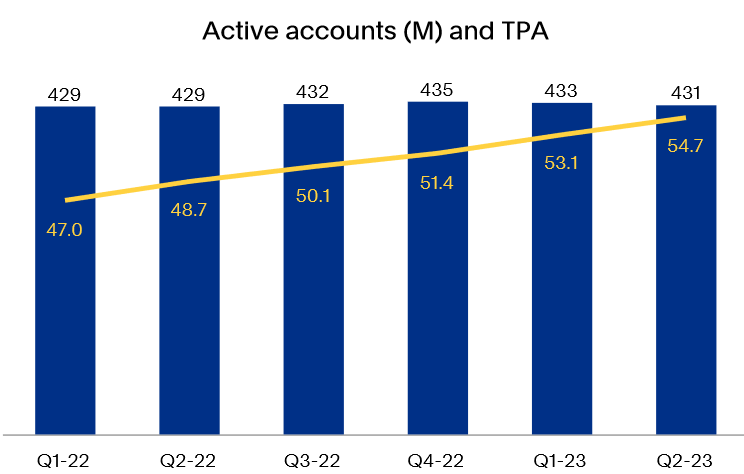

Transactions per account are up, too (yellow line):

However, PayPal’s active accounts (blue bars, above) are worryingly flat, since we place such a premium on user growth here at Bitcoin Market Journal. Perhaps the stablecoin launch may help user growth, attracting a new generation of DeFi users to transact using PayPal.

Cross-border trade has also remained relatively flat. Again, PYUSD could potentially help kickstart international payments, especially between PayPal users (remember: zero fees).

On the leadership front, PayPal is run by Dan Schulman, who had huge wins at AT&T, American Express, and Virgin Mobile before taking the CEO position at PayPal. He’s held that position since 2014, taking the company from $8 billion to $28 billion in revenue. However, he’s announced that he’ll be stepping down as CEO at the end of 2023, which is a risk factor.

In summary: a very good company, but not without risk.

Investor Takeaway

PayPal’s launch of its own stablecoin feels like one of those transformative moments when crypto goes from being an interesting sideshow to becoming a pillar of the modern financial system.

If you think crypto is the future of finance, then PayPal is positioning itself for that future. Importantly, $PYPL is not a crypto token: it’s a fully-regulated, publicly-traded stock. You can buy it on E*Trade, Fidelity, or anywhere stocks are sold.

As a blockchain believer, I believe that PYUSD now makes $PYPL an even better buy.

Over 50,000 investors get this column every Friday. Click to subscribe and join the tribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.bitcoinmarketjournal.com/paypal-stablecoin/