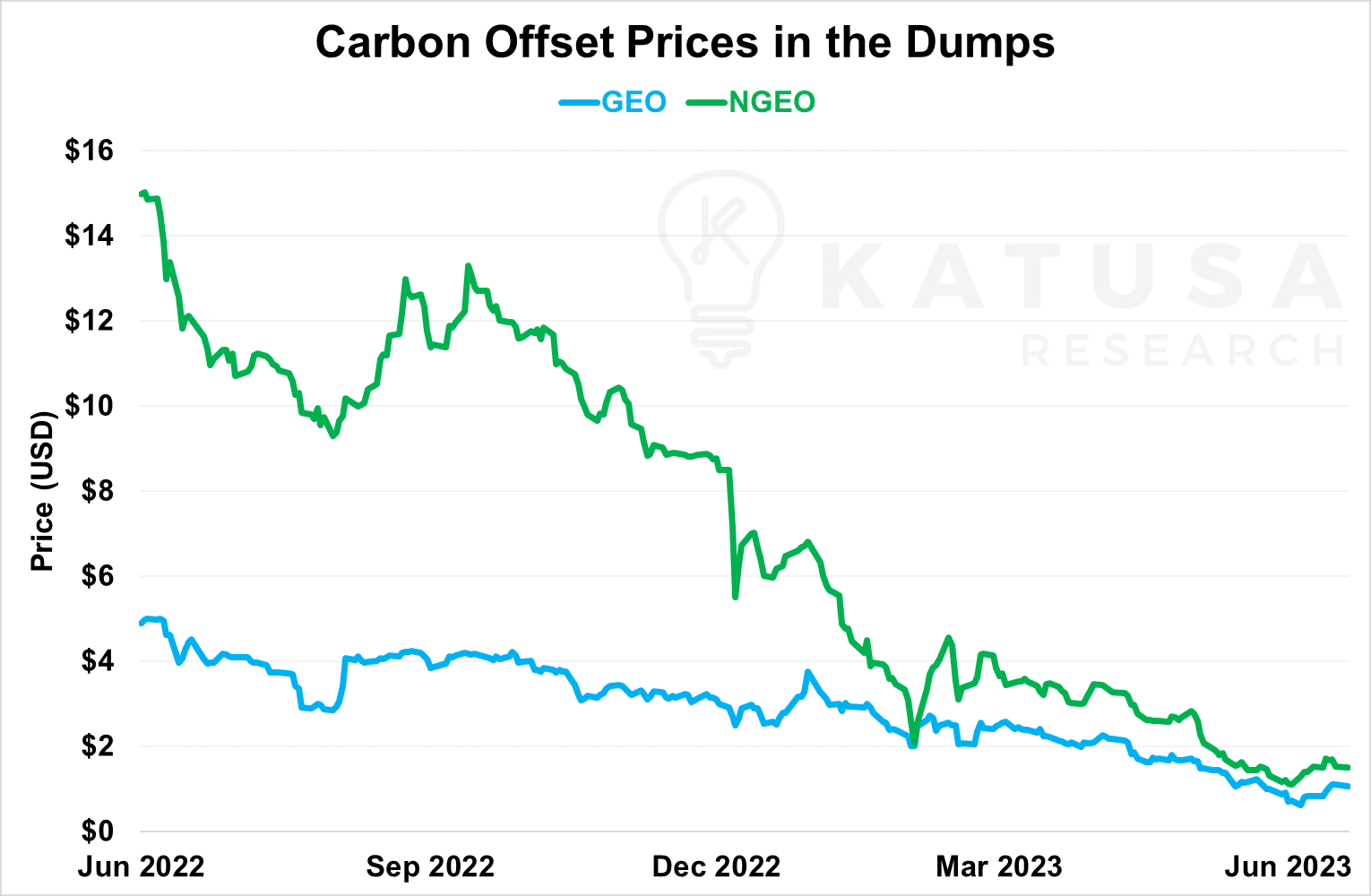

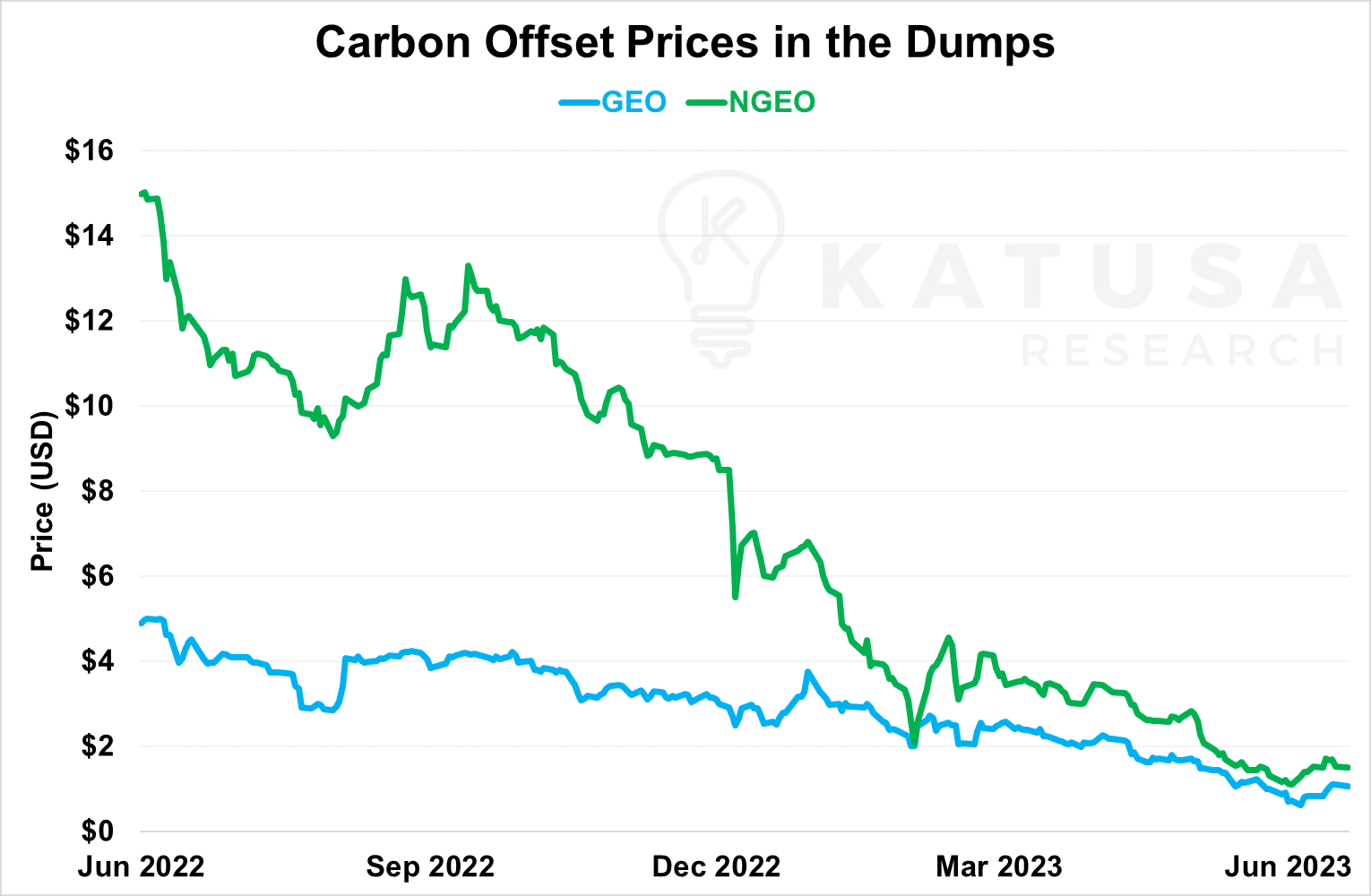

Carbon offset credits trading on the voluntary markets have taken quite a hit in the past year, with their prices falling down.

Prices for the various CBL carbon offset futures contracts, such as GEO (based on the aviation industry’s standards) and NGEO (for nature-based offsets) have seen significant declines in the last twelve months:

There’s a couple of factors at play here, not least of which would be the tough global macroeconomic conditions we’ve had lately.

High rates of inflation not seen in decades, on top of the continued war in Ukraine and lingering pandemic effects all contributed to slower economic growth exiting 2022 and entering 2023.

In addition, progress on a unifying standard for the carbon credit markets on a global scale remained stagnant at COP27. This further hampers development of the voluntary markets.

However, there’s one more issue causing downward pressure on carbon offset credit prices that I want to focus on today. But unlike the other causes mentioned previously, this issue originates from entirely within the voluntary carbon markets.

When One Man’s Trash is Another Man’s Trash

Last month, the CEO of the world’s largest carbon credit certification company, Verra, stepped down.

Now it’s not always bad news when a company’s top dog steps down. Sometimes they leave to pursue new opportunities, or to retire… but unfortunately, this wasn’t the case with Verra.

Verra’s CEO David Antonioli decided to walk away from his job following a string of bad press covering Verra’s poor environmental standards:

Over the past several months, the integrity of Verra’s carbon credit verification standards came under fire. That’s courtesy of independent investigations by news agencies, corporate watchdogs and other third-party organizations.

The accusations were severe, with many accusing Verra of certifying “junk” carbon offsets.

What makes a carbon offset credit junk? Well, there’s a couple different possibilities.

One major reason carbon offsets would be worthless is if they don’t achieve the environmental benefits they claim to have. A carbon project might be over-exaggerating its greenhouse gas reductions or underreporting its risks. Some carbon offsets are also based on emerging technologies that may not be fully proven yet.

Additionality is also a term often used here that you may have heard of before. In essence, additionality refers to whether a carbon project would have happened anyway even without taking carbon credits into account.

You’ll see this term come up often on renewable energy offset projects as certain types of renewable energy projects are already profitable and thus, have been undertaken regardless of the impact of carbon credits.

Finally, in the worst-case scenario, a carbon offset project might even actively cause harm to the area it’s based in as well as the communities there. This is more likely to happen when the project is based in a developing country. Standards are often more difficult to enforce in these areas.

As a result of these claims, purchasers of Verra credits came under fire by association as well. Companies like Chevron, Disney, Credit Suisse and Gucci were accused of relying on low-quality carbon offsets to achieve their net zero goals.

A Matter of Quality Over Quantity

Now if the voluntary carbon markets were robust and Verra was just another company, this wouldn’t be a big deal.

The problem, however, is that Verra isn’t just another carbon credit company. It’s the carbon credit company.

- Right now, Verra certifies 75% of all carbon offset credits in the market. They issued their billionth credit just last year.

Verra scrambles to win back trust and is revising and updating its carbon credit methodologies, particularly for its rainforest program. But the damage has already been done.

Companies are now instead choosing to look elsewhere for higher-quality carbon credits, even if they might be more expensive:

- Last month, JP Morgan announced that it would be committing more than $200 million towards a number of carbon removal technologies totaling 800,000 tonnes of carbon to be removed from the atmosphere and sequestered – a cost of $250/tonne.

- Tech giant Microsoft also announced in May that they would be purchasing 2.76 million credits over 11 years from Danish energy company Ørsted for capturing and storing carbon emissions from their biomass power plant – a BECCS-type carbon project.

- In April, Apple launched a major expansion of their Restore Fund, adding another $200 million to their portfolio of high-quality nature-based carbon offset projects.

With this kind of money being thrown around, it’s clear that even if Verra’s credits are off the table, carbon offsets as a whole certainly aren’t. The major players are merely finding alternative sources for their needs.

Green-Lighting the Path Forward for Carbon

The market for carbon offsets doesn’t look great right now with their prices plummeting down. Yet, their usefulness as a tool in combating climate change and role they play in carbon neutrality planning is undeniable.

Despite the negative press surrounding the carbon offset industry in recent months, the companies with real, actionable net zero plans haven’t shied away. Rather, they’ve doubled down on their investments with sizeable commitments towards proven, high-quality carbon projects, as shown above.

Simply put, the voluntary markets continue to shake off the after-effects of the bad press from Verra and the tough economic conditions. Both companies and individual investors need to be more selective with the carbon projects they want to get involved in.

There’s a veritable forest of carbon projects and carbon companies out there – and only the best will emerge unscathed from this market downturn.

The big oil companies know carbon offsets are part of the solution. But this sector will continue to evolve.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://carboncredits.com/the-flight-to-quality-in-the-carbon-offset-credit-markets-with-their-prices/