Barring a last-minute turnaround, Tesla seems destined to end 2022 with its sharpest stock decline in at least four years. And with sales sliding and production being cut, only a few bulls appear ready to back the suddenly-ailing automaker.

Tesla stock stumbled for eight days straight ahead of the Christmas break. The downturn only seems to be accelerating as the New Year approaches. As of mid-morning Tuesday, shares trading on the Nasdaq as TSLA were hovering around $112 a share, hitting a new 52-week low as shares were off more than 8% in one day. (Note: we will be updating the share price thoughout the day.)

Fueling a sell-off

Tesla has lost more than $800 billion in market capitalization – more than two-thirds of its value – since April, when CEO Elon Musk launched his controversial bid to acquire Twitter. And the downturn only accelerated after the deal was completed on October 28. But while Musk’s handling of the social media service since then clearly triggered investors’ concerns, a variety of other factors now are feeding fuel to the sell-off.

During a conference call with analysts to discuss third-quarter earnings, Musk was nothing but upbeat, promising an “epic” final quarter and boasting of “excellent demand” to keep its four Gigafactories “running at full speed.”

But things aren’t turning out that way.

In the U.S., Tesla appeared to confirm declining demand for the brand’s battery-electric vehicles when it first launched $3,750 in incentives on the Models 3 and Y, then doubled the givebacks to $7,500.

China sales slump

There are other reasons why investors seem worried as China is looking like the bigger problem. It’s the world’s biggest market for BEVs, and Tesla has been one of the dominant players since opening up a Gigafactory outside Shanghai in late 2021. The Texas-based automaker generated $5.1 billion in revenue in China during the third quarter, nearly a quarter of its global total.

But the Chinese market, as a whole, is slowing as the latest round of COVID hammers the entire economy.

Early this month, Tesla signaled it would take the unprecedented step of closing Gigafactory Shanghai for a week to balance production and demand. But it unexpectedly told workers to go home a day earlier than planned. The Chinese factory is expected to reopen on January 2, but there have been rumors and speculation that the shutdown might extend further into the month.

With no formal public relations department, Tesla has failed to respond to a request for comments.

Sliding residuals

All manner of problems appear to be popping up. A new report by Edmunds indicates that prices for a used Tesla have fallen sharply – from a July high of $67,297 to just $55,754 in November. The price for previously owned vehicles, in general, slipped during that period, but by a much more modest 4%. And used Teslas remained in dealer inventory 50 days, on average, according to Edmunds, compared with 38 days for the average used vehicle.

Musk himself has acknowledged that there are “macroeconomic” issues pressuring the automaker, rising interest rates among the most troubling. That’s one reason why forecasts for the U.S. new vehicle market are neutral, at best, with a number of analysts downright bearish.

Investors have long focused on the bright side with Tesla and, indeed, it continues to command stock multiples far beyond those of “heritage” brands, such as General Motors, Volkswagen and even Toyota. But the gap is narrowing rapidly.

Twitter troubles

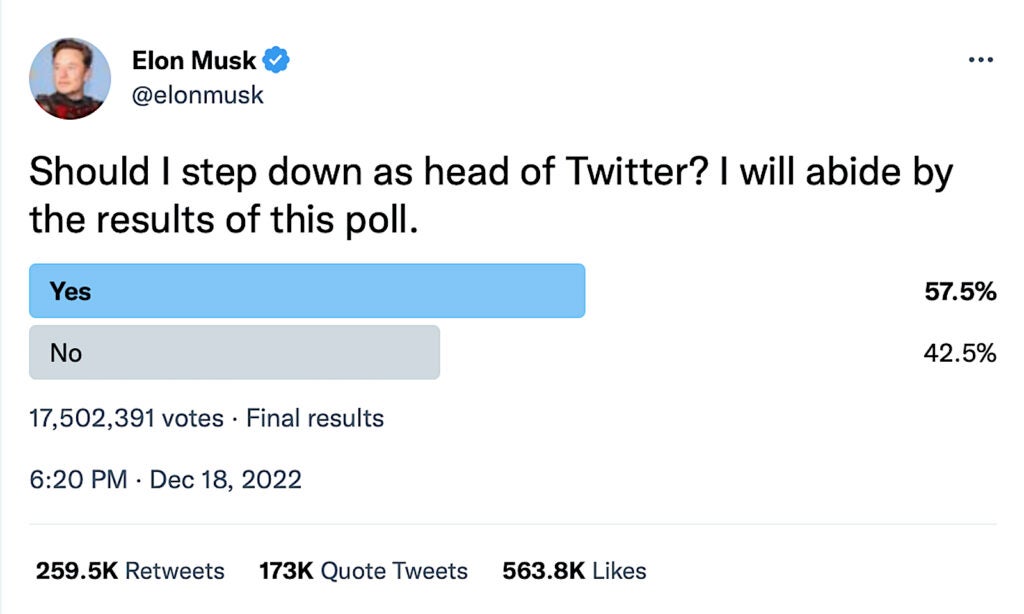

One of the concerns has been Musk’s apparent focus on Twitter which has itself gone through a meltdown since he acquired it two months ago. The serial entrepreneur has now promised to abide by a poll on the service which found 57.5% of Twitter users saying he should resign as CEO. He hasn’t said when that will happen, however, and Musk tweeted that finding a replacement could be difficult because a successor would need to be “foolish” enough to take the job.

In the meantime, he is now facing calls to step down as Tesla CEO, as well, though the automaker’s hand-picked board has so far shown no signs of concern.

But things could yet get worse. Tesla is facing a series of lawsuits and regulatory actions, including a possible criminal case under review at the U.S. Department of Justice.

They cover a broad range of topics, including problems with Tesla’s semi-autonomous Autopilot and Full Self-Driving technologies, racial discrimination and sexual harassment, and even the lavish pay package the Tesla board approved for Musk, at one point making him the world’s richest man – until the Tesla stock meltdown.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2022/12/tesla-heads-for-biggest-downturn-in-4-years/