News: Microelectronics

11 December 2023

Gallium nitride (GaN) power devices have been successfully adopted in several power applications, starting with lateral GaN devices. After the release of its new GaN electronics IP report, technology intelligence and IP strategy consulting company KnowMade discusses the status of vertical GaN device technology in the power GaN patent landscape. With the potential to overcome breakdown voltage and current capacity limitations of lateral devices, while alleviating some thermal issues, vertical GaN is seen as a promising technology for the next generation of power devices.

China takes over leadership from Japan in vertical GaN inventive activity

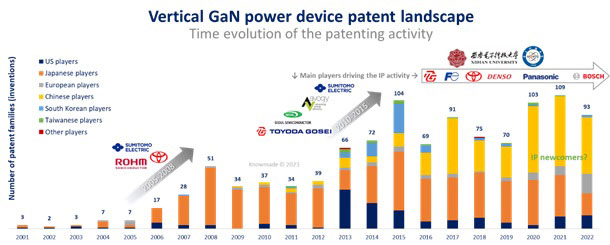

According to patenting activities (Figure 1), the intellectual property (IP) development of vertical GaN power devices took off in the mid-2000s, led by Japanese companies (Sumitomo Electric, ROHM, Toyota Motor). Yet the number of inventions per year remained relatively low until 2012. In 2013, the inventive activity sharply increased, driven by Sumitomo Electric, Toyoda Gosei, Seoul Semiconductor and Avogy (whose power GaN patents were transferred to NexGen Power Systems in 2017). Since 2015, the IP activities for vertical GaN power devices have reached a plateau, with new leading innovators such as Fuji Electric, Denso, Panasonic and Bosch. Notably, Chinese players – led by research organizations Xidian University and UESTC – seem to have taken the lead in inventive activity, outperforming Japanese players year after year since 2020.

Figure 1: Time evolution of patent publications related to vertical GaN power devices since 2001.

Most IP newcomers in vertical GaN come from China

The main IP newcomers that have entered the patent landscape since 2019 are Chinese research organizations, such as Shandong University and Xi’an Jiaotong University, and Chinese companies. One of them is the start-up GLC Semiconductor, founded in 2018, which focuses on the development and production of GaN epiwafers, and provides GaN chip design, production, packaging and testing services. The firm disclosed several inventions in 2020 related to vertical GaN FET structures, with its chairman Yeh Shun-Min as the inventor. Interestingly, unlike most Chinese players seeking protection of their inventions in China only, GLC has successfully filed several patent applications in the US (US11411099, US10854734) and Taiwan, in addition to China.

Outside China, some notable players entered this IP space, such as imec in 2020, following a collaboration with Ghent University, aiming to develop semi-vertical and vertical GaN power devices (US20220406926, EP3627559). Concomitantly, imec has developed an approach to co-integrate vertical GaN power diodes and transistors (US11380789). Interestingly, other major European research organizations have resumed their IP activities in this field since 2019, including CEA. The French research organization has been collaborating with CNRS for the development of new vertical GaN power devices (US20230136949) and published two additional inventions in 2022 describing vertical GaN FETs (US20220310790) and diodes (US20220037538). In the USA, Odyssey Semiconductor, a startup founded in 2019 by Cornell University researchers Rick Brown and James Shealy, entered the vertical power GaN device patent landscape in 2022, with a first patent family (invention) describing a vertical GaN FET (US11652165, US11251295).

Well-established Japanese IP players challenged by NexGen and Bosch

Following Avogy’s bankruptcy in 2017, its CEO Dinesh Ramanathan founded a startup company NexGen Power Systems, which acquired Avogy’s power GaN patents. In 2021, NexGen started its own patenting activity in this field. Since then, it has published more than 10 inventions, including several patent applications related to vertical GaN FinFETs (e.g. US20230260996 and US20230246027). Such vertical devices have also been developed by Bosch since 2012, as indicated by a first patent publication in 2014 (US9525056). Yet Bosch was not active in this field until 2019, and in 2021 the company accelerated its IP strategy for vertical power GaN technology with more than 15 new patent families (inventions) including patent applications US20220310836 and US20220285542.

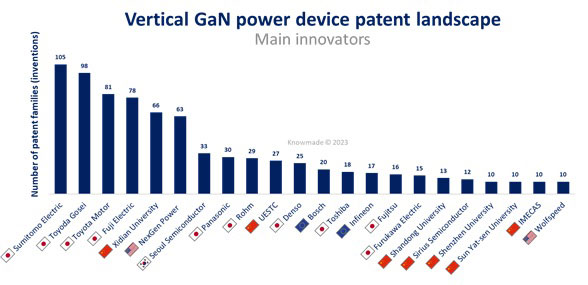

Figure 2: The main players driving the inventive activity related to vertical GaN power devices since 2000.

So far, Japan’s main innovators have not been challenged by Chinese companies but by Chinese research organizations, especially Xidian University and UESTC (Figure 2). These Chinese universities are focusing on China to protect their inventions, and it remains to be seen how they will leverage their patent portfolios to support the development of a domestic vertical GaN technology. By way of example, in the fast-developing power SiC industry, we have seen such organizations driving the emergence of new domestic players through partnerships and patent transfers. For GaN electronics, KnowMade has implemented several monitoring tools to detect the entry of new players in the patent landscape and in the scientific landscape.

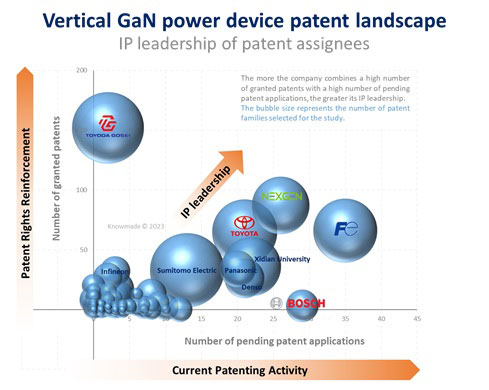

Although Japanese players own the largest patent portfolios for vertical GaN power devices in terms of inventions (Figure 2), their impact on the IP competition is very contrasted (Figure 3). For instance, Sumitomo Electric, which has been the main innovator in this space, seems to be no longer competing for vertical GaN power devices: the company abandoned 70% of its patents protecting its vertical GaN inventions. Within Toyota Group, several companies such as Toyoda Gosei, Toyota Motor and Denso have been actively filing vertical GaN patents. As a result, Toyota group stands out as an undisputed IP leader in this space. However, these companies have followed quite different trajectories in the vertical GaN power device IP landscape over the years (Figure 3).

Figure 3: The global IP competition for vertical GaN power devices.

Starting filing patents in the 2000s, Toyota Motor is one of the main historical players in this landscape, together with Sumitomo Electric and Fuji Electric. Yet its IP leadership remained limited until Toyota initiated a partnership in 2018 with Denso, a new player in this space, to accelerate the development of power GaN technology, leading to more than 20 patent co-filings. Since then, the ownership of several vertical GaN patent co-filings has been transferred to Denso, confirming that Denso took the leadership in this collaboration. In contrast, Toyoda Gosei started actively publishing vertical GaN patent applications much later than Toyota Motor, in 2014, describing the development of vertical GaN MISFET. Toyoda Gosei stopped its IP activities in 2021, after positioning itself as the best-established IP player in this space, owning the highest number of granted patents for vertical GaN power devices. Lately, Toyoda Gosei announced a successful collaboration with Osaka University to develop 6-inch diameter GaN substrates targeting power devices.

Following Toyota Group’s lead, Fuji Electric and NexGen emerged as the main IP leaders for vertical GaN power devices, with Bosch as the main IP challenger. As shown in Figure 3, Xidian University is closing the gap with other leading IP players, although its IP activity has been limited to China so far.

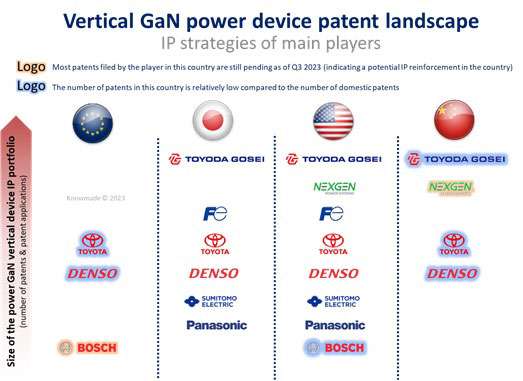

Main IP battlefield for vertical GaN technology lies in the USA

The USA accounts for the largest number of granted patents for vertical GaN power devices, ahead of Japan. Indeed, most of the well-established IP players in this space are Japanese players that have focused their IP strategy on US territory, in addition to their headquarters country (Figure 4). Yet, according to the current IP trend, China may soon become the most crowded space in terms of vertical GaN patents.

Figure 4: IP strategies of the main players competing worldwide.

As of 2023, Japanese players are not aiming to extend their IP leadership to other countries (China, South Korea, Taiwan, Germany). Apart from Japanese players, the main IP players are not interested in protecting their inventions in Japan. Instead, NexGen is aiming to strengthen its IP position in China. Unsurprisingly, most Chinese players focus their IP activities on their national territory and have shown no significant IP activities in the other countries. Likewise, Bosch has almost limited its IP activities to Europe so far, filing only three US patents and two Chinese patents. Still, several PCT (Patent Cooperation Treaty) applications have been filed lately by Bosch, which may result in more patent applications in these countries. As vertical GaN technology increases in maturity and finds new applications, we expect IP players with a view to enter the power GaN market with vertical devices to extend the geographic coverage of their patenting activities, i.e. to protect their key inventions in the main power electronics markets.

After 20 years of innovation, the IP competition for vertical GaN technology has just started

Although more than 1000 patent families (inventions) have been filed to cover the development of vertical GaN technology since the 2000s, the IP competition has been remarkably moderate so far. This situation reflects a relatively limited investment in vertical GaN device technology. For comparison, more than 6000 inventions have been disclosed for power SiC devices so far, a technology that would be in direct competition with vertical GaN in power applications. Yet both technologies have shared similar technical issues in terms of material and device processing, which have made it particularly challenging for them to reach the maturity required in high-power and high-temperature applications.

However, several players, including incumbent automotive companies, are still investing in vertical GaN technology. Indeed, several established IP players (Fuji Electric, NexGen, Toyota Motor) and relatively new IP players (Denso, Bosch) are accelerating their patent filings. Accordingly, the vertical GaN patent landscape is expected to become increasingly competitive in the next decade. Importantly, as this technology proves itself, several well-established IP players in the field might resume their IP activities to prepare for industrialization and commercialization of the vertical GaN power devices (ROHM, Seoul Semiconductor, Sumitomo Electric).

Turning point in RF GaN patenting over last 2 years

Power GaN device IP dynamics heralds future ramp-up of market

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.semiconductor-today.com/news_items/2023/dec/knowmade-111223.shtml