After a significant rally that saw bitcoin briefly jump to $18,400 from $17,000 in just two days, cryptos are a bit more chill today.

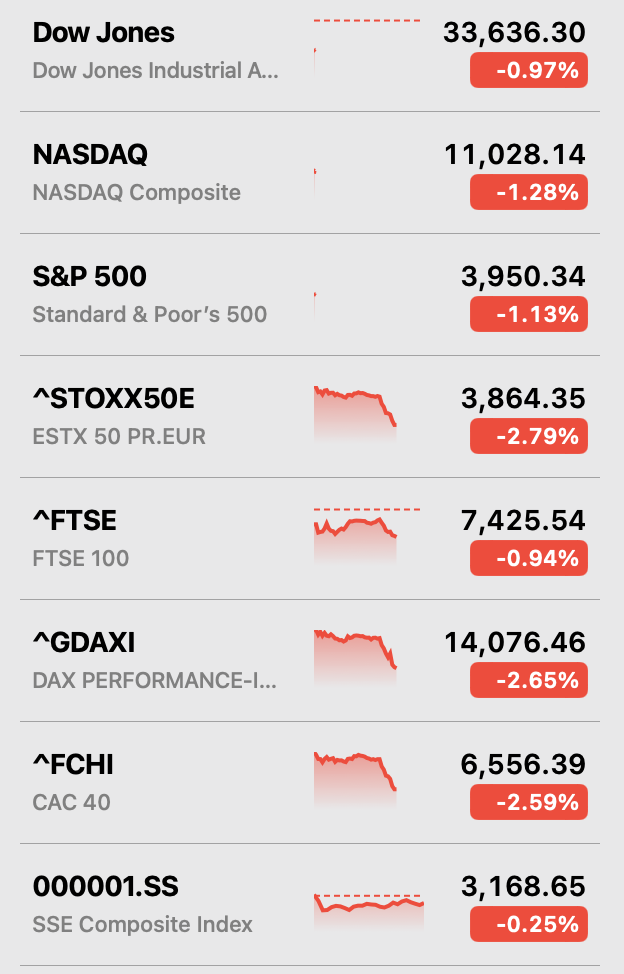

Likewise Nasdaq saw gains of 3% and 4% earlier this week, but for the day has a -1.3% of Christmas red.

Markets got excited following the release of inflation data which indicated a clear downtrend from a peak in June.

Some argue we may in fact be in deflation as the month on month inflation rate is barely increasing and for the past six months amounts to about 2%.

If that keeps on, the year on year inflation rate will become a minus for the first time in decades. Now that would be quite a show.

It can however happen because Fed is basically walking blind with markets taken aback by the continued hawkishness of Jerome Powell, the Fed chair.

Asking how high, he said he expects interest rates to rise to 5.1%.

Considering the current rate is 4.5%, that’s just two more increases of 0.25% to get to 5%.

That’s generally what was expected. A 50 point increase, which happened on Wednesday. Then a 25 points increase next year. Then… we’re too ahead to really know.

The current Christmas red therefore is probably more due to sell the news after the rumor was bought rather than anything Fed said.

However, markets can now look forward to rate cuts in probably about six months when what might be established as that June peak potentially turns attention back to not enough inflation.

Fed has a slower timeline. They think rates will go down to 3% in 2025, but no one can see that far into the future unless they’re following a plan that doesn’t care about the data. Engineering the economy in effect, rather than trying to be a neutral value measurement assessor.

On the economy, Fed had to increase their GDP projection to 0.5% this year from 0.2%. They have been too pessimistic, and continue to be pessimistic, lowering growth projections to 0.5% next year from 1.2%.

They have no clue basically, but the economy has held surprisingly well despite the huge rate hikes that have been seen this year.

The worry was they might crash it. They haven’t, but it is unlikely the current boomers in charge will deliver proper growth, so we might see instead just slow turtles.

Unless of course there has been some structural change in the economy that is outside the hands of these boomers, primarily due to innovation and significant investment in research and development by public and private companies.

The very tight labor market may suggest so. There have been layoffs, but demand for labor still outstrips supply, and though Powell has tried and tried to change that, even at 4.5% it still remains the case that labor is in high demand.

The economy may therefore withstand this, and if it does we may well enter a new era that has some vibes of a tech industrial revolution.

For now, the new era we’re entering temporarily is out with Powell and in with Christmas. Not for the day maybe, but soon enough investors will stop thinking about money as such, and the focus will turn on gifts, on family, and on the new year.

Christmas day itself tends to be an eventful day for bitcoin. Drunk buys and sells volatile to excite, hopefully.

Because a lot is now in the rear mirror, and this is where it set the prices. Looking forward, can it get worse? There’s always the maybe, but the outlook now is probably more getting up from the bottom range, rather than down.

November is out. Christmas is almost here. The bear is over we think, the real bear. Where long term investments are concerned therefore, it is probably time to dive if you can hodl through the fights of bulls and bears, which may get very vicious next year.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2022/12/15/sell-the-news-dips-bitcoin-and-stocks