In an update regarding the ongoing legal battle between the SEC and Ripple Labs, court trial dates have been officially confirmed for the case in the Southern District of New York. This trial will primarily address the motions that were previously left undecided during the motions for judgment. To provide a brief recap, the Securities and Exchange Commission (SEC) initiated a lawsuit against Ripple and its executives in December 2020, alleging an unregistered securities offering. However, in a noteworthy ruling by Judge Torres back in July, it was determined that XRP sales on public crypto exchanges could not be classified as securities offerings.

Moving forward, the trial is slated to take place sometime between April 1st and June 30th, 2024. It is worth noting that the SEC intends to appeal the ruling on XRP sales, seeking the review of an appellate court. By doing so, they aim to potentially avoid separate trials and secure a holistic review of the decisions made thus far in the case. The SEC justified this appeal by citing divisions within the Southern District of New York, emphasizing the necessity for a comprehensive and unified resolution. This development marks an important milestone in the legal proceedings surrounding Ripple Labs and the SEC, setting the stage for a crucial chapter in this unfolding saga.

Overview of the SEC’s Case Against Ripple Labs

Introduction

The Securities and Exchange Commission (SEC) has recently filed a lawsuit against Ripple Labs and its executives concerning an alleged unregistered securities offering. This case has attracted significant attention within the financial world, as it has far-reaching implications for the crypto industry. In this article, we will explore the background of the lawsuit, the key rulings made thus far, the scheduled court trial dates, and the SEC’s plan for appeal.

Background information

In December 2020, the SEC made a bold move by filing a lawsuit against Ripple Labs. The crux of the lawsuit revolves around the accusation that Ripple conducted an unregistered securities offering, raising funds through the sale of its digital asset, XRP. This case raises important questions regarding the regulatory status of digital assets and the potential consequences for companies involved in the cryptocurrency space.

SEC’s lawsuit

The SEC’s lawsuit against Ripple Labs centers on the assertion that Ripple conducted an unregistered securities offering, violating securities laws. The SEC claims that XRP, the digital asset offered by Ripple, should be classified as a security, and therefore falls under the jurisdiction of the SEC. This lawsuit presents a significant legal challenge for Ripple, as the outcome could have profound implications for the broader crypto industry.

Key rulings

One of the crucial rulings made in this case was by Judge Torres in July. She determined that XRP sales on public cryptocurrency exchanges should not be considered securities offerings. This decision was seen as a victory for Ripple, as it excluded these sales from the scope of the SEC’s allegations. However, it is important to note that this ruling solely pertained to XRP sales on public exchanges and did not address the broader issue of whether XRP itself is a security.

Court Trial Dates and Motions

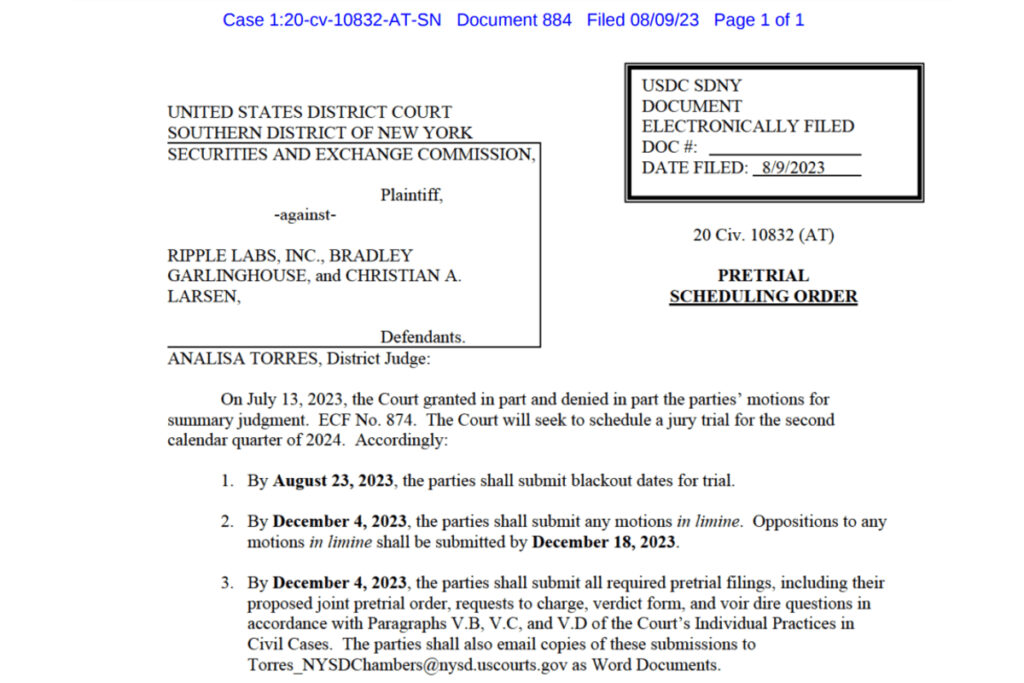

Setting of court trial dates

The court trial dates for the SEC’s case against Ripple Labs have been established in the Southern District of New York. The trial will serve as an opportunity to address motions that were not ruled on during the motions for judgment phase. This trial, eagerly anticipated by industry participants, will clarify several key aspects of the legal dispute between the SEC and Ripple.

Purpose of the trial

The trial aims to provide a forum for both sides to present their arguments and evidence pertaining to the unresolved motions. This will allow the court to make informed judgments on these outstanding matters. The trial is expected to be a crucial milestone in determining the outcome of the SEC’s case against Ripple Labs.

Motions for judgment

During the pretrial phase, both the SEC and Ripple Labs filed motions for judgment on various issues. These motions sought to resolve specific legal questions without proceeding to a trial. However, several motions were not ruled on, prompting the need for a trial to address these outstanding matters.

Motions not ruled on

The motions that were not ruled on during the motions for judgment phase are of significant importance in the SEC’s case against Ripple Labs. These unresolved motions encompass crucial legal arguments put forth by the parties involved, and their determination will have a substantial impact on the ultimate outcome of the case.

Details of the SEC’s Lawsuit

Unregistered securities offering

At the core of the SEC’s lawsuit against Ripple Labs is the allegation that the company conducted an unregistered securities offering. The SEC argues that XRP, the digital asset offered by Ripple, should be classified as a security and subject to the regulatory framework governing securities offerings. This claim underscores the SEC’s commitment to safeguarding investors’ interests within the rapidly evolving crypto space.

Parties involved

The lawsuit involves two primary parties: the SEC and Ripple Labs. The SEC brings its case against Ripple Labs, accusing the company and its executives of conducting an unregistered securities offering in violation of the law. Ripple Labs, on the other hand, defends its actions, refuting the SEC’s allegations and asserting that XRP should not be considered a security.

Timeline of events

The events leading up to the SEC’s lawsuit against Ripple Labs are a critical component of this legal dispute. The precise timeline of activities, including the initial sale of XRP, subsequent regulatory actions, and the SEC’s decision to file suit, will be meticulously examined during the trial to ascertain the legality of Ripple’s actions.

Allegations against Ripple and its executives

The SEC’s lawsuit outlines specific allegations against Ripple Labs and its executives. These allegations focus on the company’s purported failure to register XRP as a security, thereby violating federal securities laws. The SEC argues that Ripple Labs knowingly engaged in an unregistered securities offering, inflicting potential harm on investors.

Judge Torres Ruling on XRP Sales

Background of the ruling

Judge Torres’ ruling in July regarding XRP sales on public crypto exchanges was a significant development in the SEC’s case against Ripple Labs. This ruling addressed the question of whether those specific sales should be considered securities offerings. Judge Torres determined that they should not, thereby excluding them from the scope of the SEC’s allegations.

Impact on the case

Judge Torres’ ruling had a notable impact on the SEC’s case against Ripple Labs. By excluding XRP sales on public crypto exchanges from the classification of securities offerings, the ruling narrowed the focus of the lawsuit. However, it is essential to emphasize that this ruling did not definitively address the broader issue of whether XRP itself should be deemed a security.

Exclusion of XRP sales as securities offerings

Judge Torres’ ruling specifically excluded XRP sales on public cryptocurrency exchanges from the classification of securities offerings. This exclusion was a significant victory for Ripple Labs, as it limited the scope of the SEC’s case against them. However, it is crucial to recognize that the question of whether XRP itself is a security remains open and is expected to be a central issue during the trial.

Expected Trial Period

Timeframe for the trial

The trial for the SEC’s case against Ripple Labs is expected to take place between April 1st and June 30th, 2024. This anticipated timeframe indicates the significance and complexity of the case, with both parties given ample time to present their respective arguments and evidence.

Trial commencement date

The trial is scheduled to begin on April 1st, 2024, marking the formal initiation of proceedings to address the unresolved motions in the SEC’s case against Ripple Labs. This date will be a critical milestone in the legal battle, as it signifies the start of a comprehensive examination of the outstanding issues.

Trial conclusion date

The trial is set to conclude on June 30th, 2024, marking the end of the proceedings and providing an opportunity for both parties to present their final arguments. This final stage of the trial will be followed by the judge’s rulings and eventual resolution of the unresolved motions in the case.

SEC’s Plan for Appeal

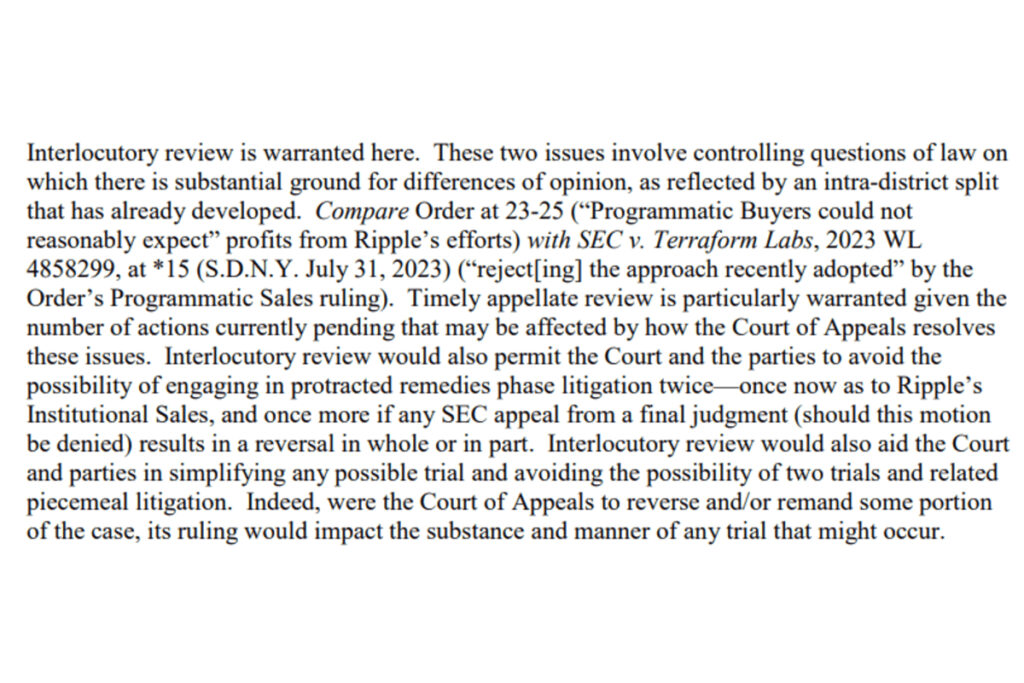

Justification for the appeal

Following Judge Torres’ ruling on XRP sales, the SEC has planned to appeal certain aspects of the case against Ripple Labs. The SEC intends to seek an appellate court’s review of specific decisions made thus far, aiming to ensure a comprehensive examination of the legal issues involved. This appeal reflects the SEC’s commitment to pursuing its regulatory objectives vigorously.

Review of decisions

The SEC’s appeal seeks a rigorous review of the decisions made in the case against Ripple Labs. By appealing, the SEC aims to garner a more comprehensive understanding of the legal arguments and potential ramifications. This will enable the appellate court to provide additional clarity on the unresolved matters and their implications for the broader regulatory landscape.

Prevention of separate trials

The SEC’s plan for appeal is also motivated by the intent to prevent separate trials within the Southern District of New York. By seeking the appellate court’s intervention, the SEC aims to maintain consistency and avoid potential conflicting judgments within the district. This approach reflects the SEC’s commitment to ensuring uniform application of securities laws.

Citing divisions within the Southern District of New York

The SEC has cited divisions within the Southern District of New York as another reason for seeking an appeal. Given the complexity and significance of the case, the SEC argues that resolving the legal issues at hand requires thorough consideration by an appellate court. This citation underscores the SEC’s desire for clarity and consistency in legal interpretations within the district.

In conclusion, the SEC’s case against Ripple Labs has generated substantial attention within the crypto industry and the broader financial landscape. As the legal battle unfolds, it is essential to closely monitor the trial dates, explore the details of the SEC’s lawsuit, consider the impact of Judge Torres’ ruling, and anticipate the SEC’s plan for appeal. The outcome of this case will undoubtedly shape the regulatory future of digital assets and have far-reaching consequences for industry participants.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://cryptocoin.news/legal/sec-vs-ripple-labs-trial-dates-scheduled-in-southern-district-of-new-york-91694/?utm_source=rss&utm_medium=rss&utm_campaign=sec-vs-ripple-labs-trial-dates-scheduled-in-southern-district-of-new-york