As corporations worldwide intensify their efforts to combat climate change, commitments to carbon offsetting have become increasingly prominent. In this update, we delve into Rio Tinto’s ambitious pledge to retire 3.5 million carbon credits annually by 2030 and Eni’s remarkable achievement of already reaching this milestone.

These recent developments in the voluntary carbon market (VCM) have bolstered longer-term confidence in the market’s pivotal role in corporate net zero programs.

Rio Tinto’s Ambitious Carbon Credit Goal

Rio Tinto, the world’s second-largest miner, aims to boost its retirement of carbon credits to 3.5 million annually by 2030. This accounts for roughly 10% of its baseline emissions, according to its recent climate report.

The company plans to intensify its involvement in the VCM to meet its 2030 climate goal. This comes into light after acknowledging the necessity of offsets after likely missing interim 2025 decarbonization targets.

To achieve this, Rio Tinto will conduct feasibility studies in Guinea and South Africa while scaling up activities in priority regions. This effort will particularly focus on nature-based solutions (NBS) pilots and studies. The company pledges to disclose commercial partnerships in the VCM, along with details of its carbon credit sourcing strategy.

With annual scope 3 emissions of 578 million tonnes of carbon dioxide equivalent (tCO2e), Rio Tinto’s emissions in scopes 1 and 2 remained relatively stable at 32.6 million tCO2e in 2023.

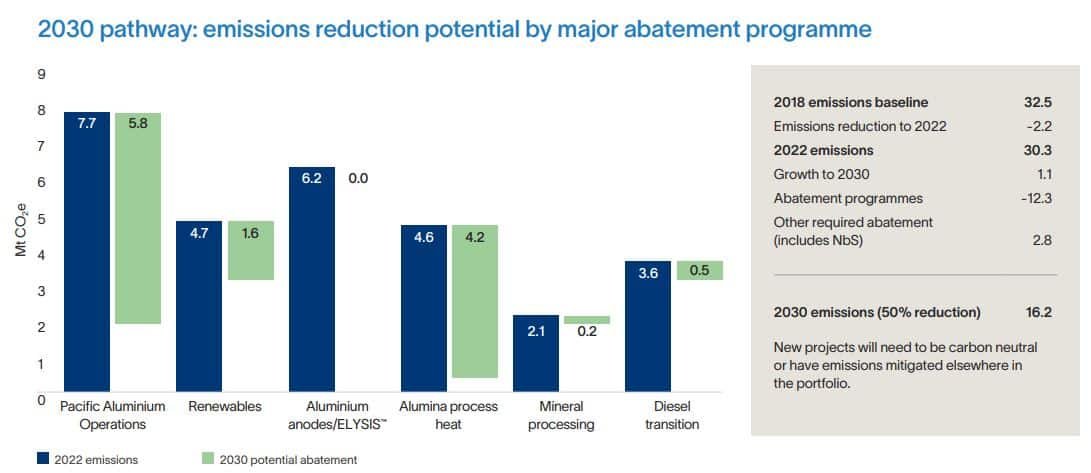

The company has set targets of 15% reduction by 2025 and 50% by 2030 for these emissions.

From an initial aim of generating 1.7 million tonnes yearly by 2030, the miner plans to retire about 3.5 million carbon credits annually over the next decade.

Carbon credit procurement, mainly through Australian Carbon Credit Units (ACCUs), is expected to rise to around 1.7 million tCO2e by the end of the year.

The company aims to commit at least 500,000 hectares of land to high-integrity NBS programs globally by 2025.

Total decarbonization spending for 2024 is estimated at $750 million, including capital and operational expenditures, offsets, and Renewable Energy Credits (RECs). However, Rio Tinto revised its expected expenditure for meeting 2030 climate targets downward to $5-6 billion from $7.5 billion.

To lower emissions, Rio Tinto plans to increase biofuel use, procure renewable energy, enhance smelter efficiency, and introduce more LNG vessels. The mining giant will also focus its carbon credit investments in regions with substantial emissions, such as Australia and North America. Their strategy entails transitioning upstream to co-developing or co-financing carbon offset projects, ensuring long-term access to high-quality credits.

Eni’s Remarkable Feat: 3.5M Retired Credits

While the Australian miner targets to retire 3.5 million carbon credits, the Italian oil and gas producer, Eni SpA has already achieved it. Eni retired a total of about 3.5 million carbon credits from various REDD+ projects. These include the following:

- Mai Ndombe REDD+ project (VCS934): 1,058,000 v2020, 600,000 v2019, 600,000 v2018, and 269,000 v2017 credits.

- Ntakata Mountain REDD project (VCS1897): 650,000 credits

- Kulera Landscape REDD+ project (VCS1168): 269,000 credits

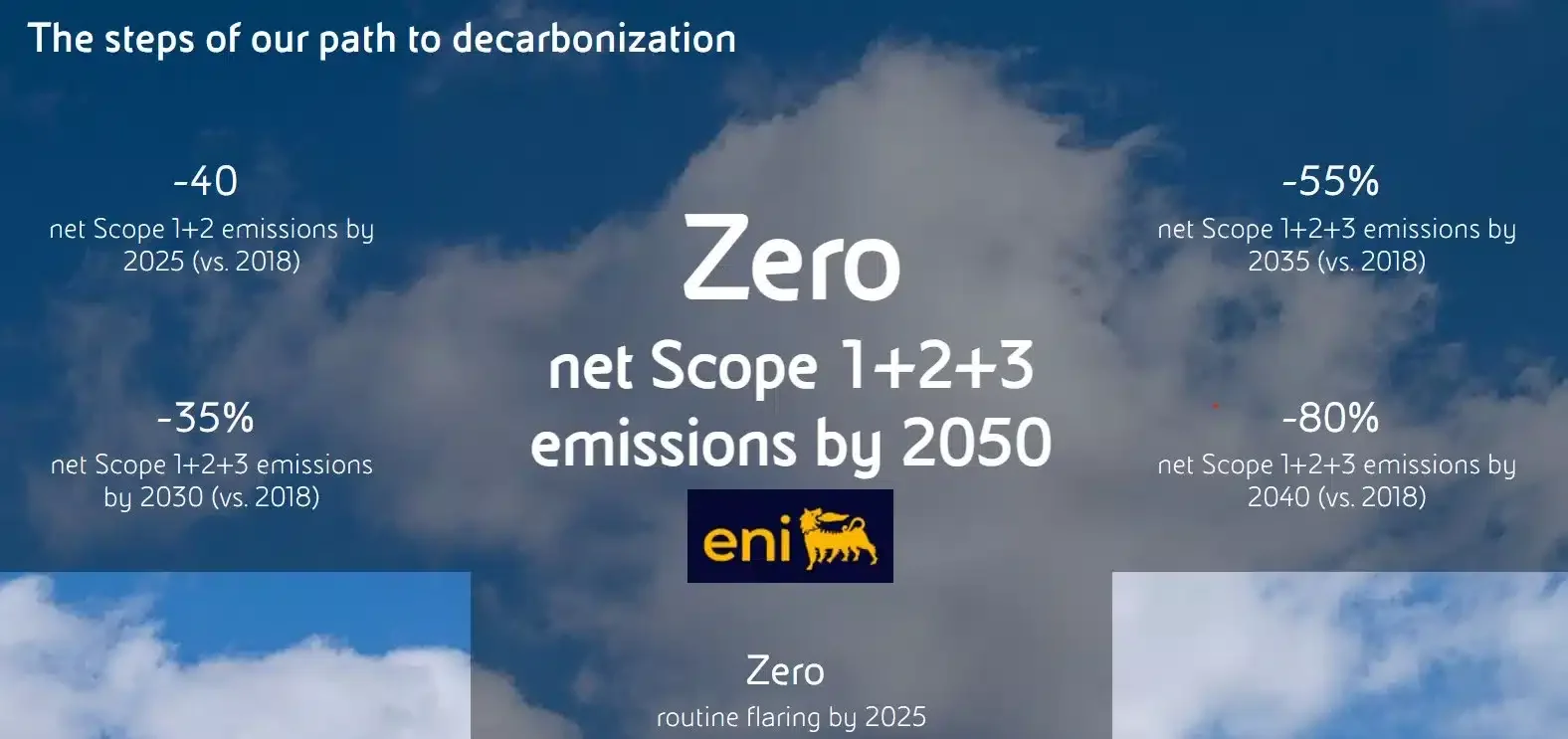

The energy company aims to reach net zero emissions by 2050. For Eni, net zero means “achieving carbon neutrality of processes and products”.

The company’s interim targets include achieving net zero from exploration activities by 2030 and from operations by 2035 (Scope 1+2). Ultimately, they aim to reach Net Zero for all greenhouse gas emissions, including Scopes 1, 2, and 3 by 2050, as shown below.

To hit those goals, Eni employs various decarbonization measures in a comprehensive industrial transformation plan involving the entire company. Key components include decarbonizing the upstream portfolio, expanding into biofuels, renewables, and circular economy sectors, and providing new energy solutions.

To hit those goals, Eni employs various decarbonization measures in a comprehensive industrial transformation plan involving the entire company. Key components include decarbonizing the upstream portfolio, expanding into biofuels, renewables, and circular economy sectors, and providing new energy solutions.

In addition to Eni’s emissions reduction plan, they have initiated Carbon Offset Solutions projects. They aim to safeguard biodiversity, sustainably manage land through ecosystem restoration, and compensate for residual emissions that cannot be mitigated.

Signs of Market Resilience? New Credits Listed on CBL

These announcements occurred during a week marked by active corporate interest and discussions but relatively light carbon credit trading volumes. The total volume on the CBL platform was 123,721 tons, with nature-based carbon credits comprising the majority.

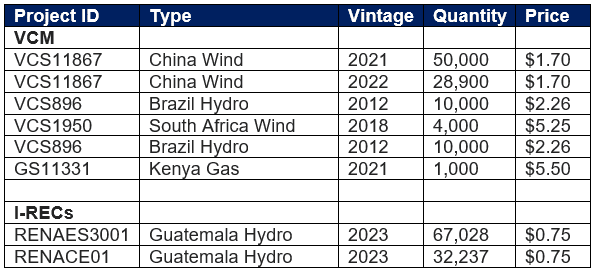

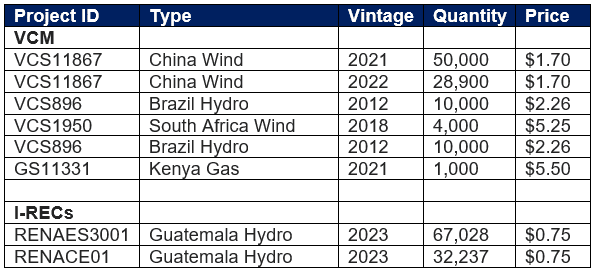

Notably, though, Xpansiv’s weekly environmental markets report revealed a significant number of new voluntary credits posted to the CBL central limit order book. That includes almost 100,000 I-RECs alongside various nature and technology carbon credits.

The offers listed below are firm, yet subject to execution, modification, or cancellation.

Nevertheless, that bunch of new voluntary credits listed and increased retirement plans indicate continued interest and participation in the market. More interestingly, does that mean carbon prices could rebound after plummeting in the last two years? This is something to keep a close eye on.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/rio-tinto-aims-3-5m-carbon-credit-pledge-eni-leads-with-retired-credits/