The Integrity Council for the Voluntary Carbon Market (ICVCM) has achieved a new milestone, announcing its plan to assess over 100 active carbon credit methodologies for adherence to the high-integrity Core Carbon Principles (CCPs).

The first decisions on these assessments are due by the end of March.

An expert group, including members of the Integrity Council’s Governing Board, its Expert Panel, and external stakeholders, has categorized similar carbon credit methodologies into 36 different groups. The groups will undergo three types of assessments based on their complexity and issues.

It was in August last year when ICVCM released its long-awaited Assessment Framework.

Types of Assessments for Carbon Credit Categories

The Core Carbon Principles (CCPs), comprising 10 fundamental tenets for high-integrity carbon credits, are supported by detailed criteria outlined in the CCP rulebook.

The issuance of high-integrity CCP-labeled credits could facilitate the flow of climate finance to Global South countries. This is essential in helping them achieve their national climate objectives.

These credits will enable buyers to identify and support top-notch projects that effectively reduce and remove emissions. Projects range from initiatives to safeguard and restore forests to the expansion of challenging-to-commercialize innovative clean technologies.

The Categories Working Group (CWG) has sorted carbon credits categories into one of three types of assessment:

-

Internal assessment:

Categories covering 8% of carbon credits in the market will be assessed internally by the Integrity Council secretariat and members of its Expert Panel. This includes methodologies such as:

- capturing methane from mines and landfill sites,

- detecting and repairing leaks in gas systems,

- destroying ozone-depleting chemicals, and

- reducing emissions of sulfur hexafluoride.

-

Multi-stakeholder assessment:

Categories covering 47% of carbon credits in the market will be assessed by Multi-Stakeholder Working Groups. These categories, including renewable energy, efficient cookstoves, improved forest management, and REDD+ (Reducing Emissions from Deforestation and Degradation in Developing Countries), raise complex issues in specific areas.

-

Considered by the CWG to be very unlikely to meet the criteria:

Categories covering 1% of carbon credits in the market, considered unlikely to meet CCP criteria, will be assessed once other evaluations are complete. These include new natural gas power, waste heat recovery, and industrial energy efficiency.

Major Programs Under Assessment

Programs have the discretion to exclude certain carbon credit methodologies from the assessment process.

Verra, for instance, introduced its new REDD+ methodology for evaluation while omitting its prior REDD+ methodologies, constituting 27% of the market credits. The organization has put forth only the latest versions of methodologies for specific project types. They’re developing a pathway to facilitate projects transitioning to these updated versions.

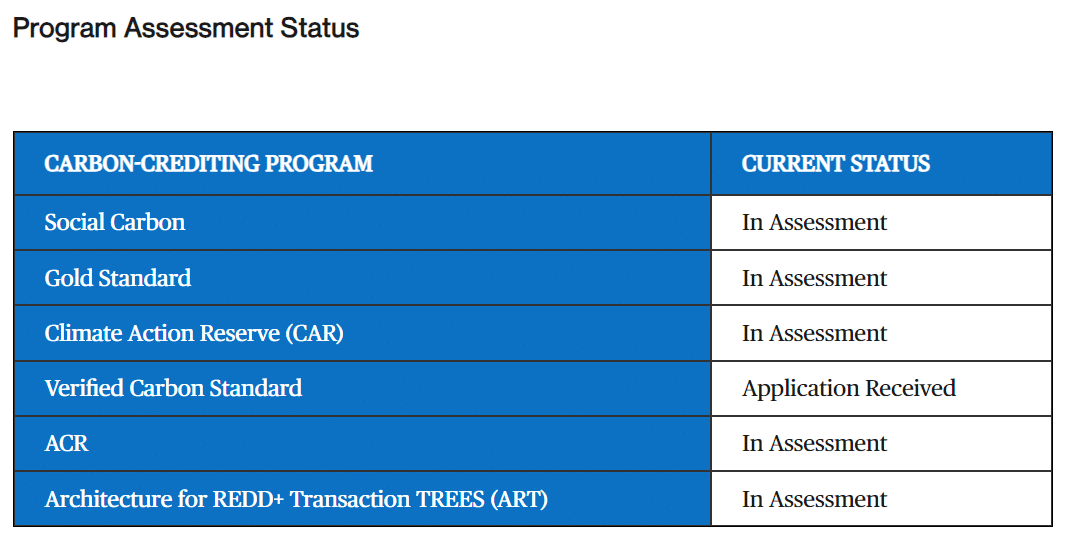

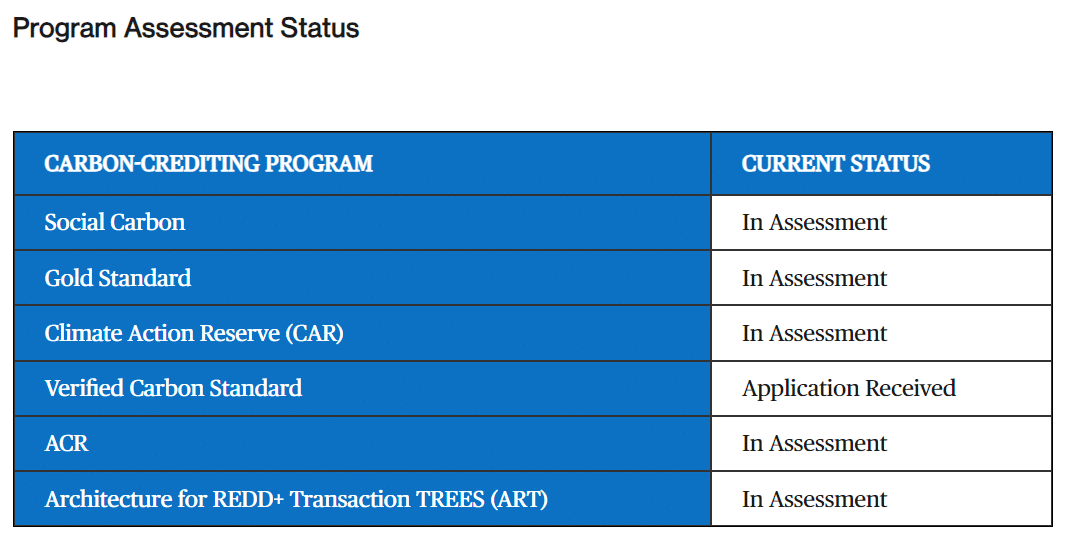

Here’s the status of the major programs under assessment:

An additional 6% of methodologies have either been excluded by other programs or represent older methodologies covering a limited number of credits in the market. Unallocated credits in the market would be due to various reasons. These include data inconsistencies, projects utilizing multiple methodologies, inactivity of some methodologies, and the pending categorization of certain small methodologies.

Carbon-crediting programs commanding a 98% market share have sought approval to use the CCP label. The secretariat is concurrently evaluating these programs alongside the assessment of categories.

Approved programs meeting the criteria will be authorized to display the CCP label on both existing and new credits from approved categories.

Annette Nazareth, Integrity Council Chair, said:

“The Core Carbon Principles establish a global benchmark for high integrity. We know buyers are eagerly awaiting CCP-labelled carbon credits. We are keen to ensure the labels reach the market as soon as possible while ensuring that we properly consider complex issues and make the right decisions.”

Marching Towards Integrity

The Integrity Council anticipates revealing the outcomes of its assessments by March. The organization has dedicated web pages on its site tracking the progress of all categories and programs undergoing assessment.

The Governing Board’s decisions, along with rationale, will be made public, accompanied by transparent explanations for any negative determinations.

-

It’s important to note that not all methodologies within a specific category may receive approval.

In cases where remedial action is necessary before program or category approval, or if approval is unlikely, affected programs will be notified. They will have the right to submit their input and participate in a hearing before any final decisions are made.

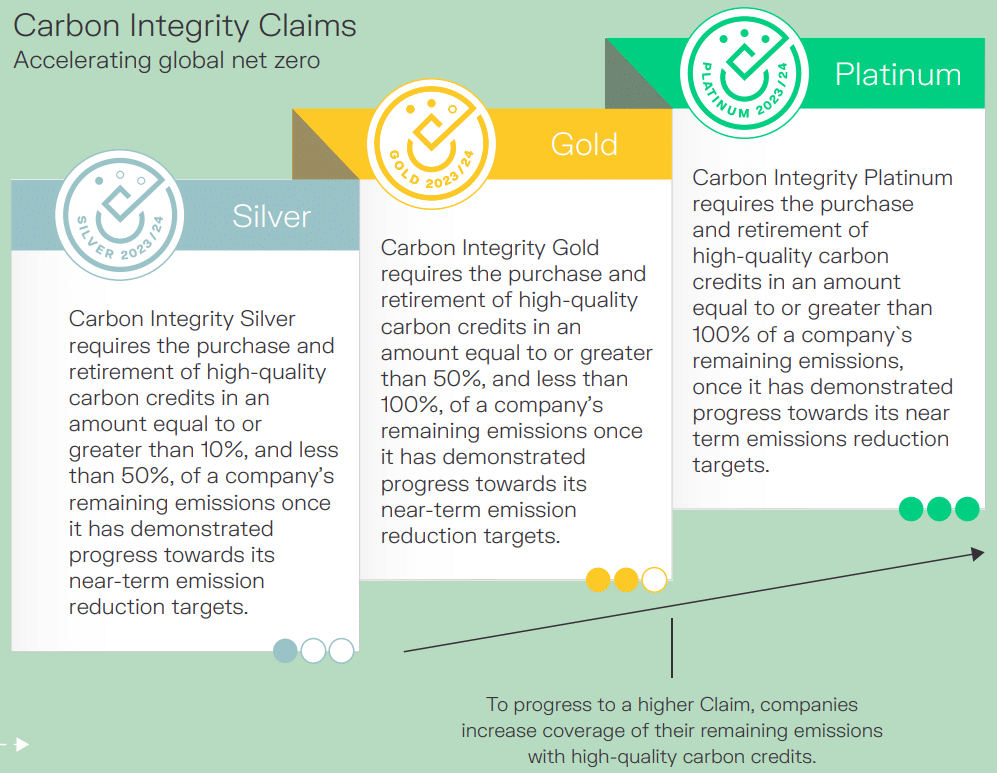

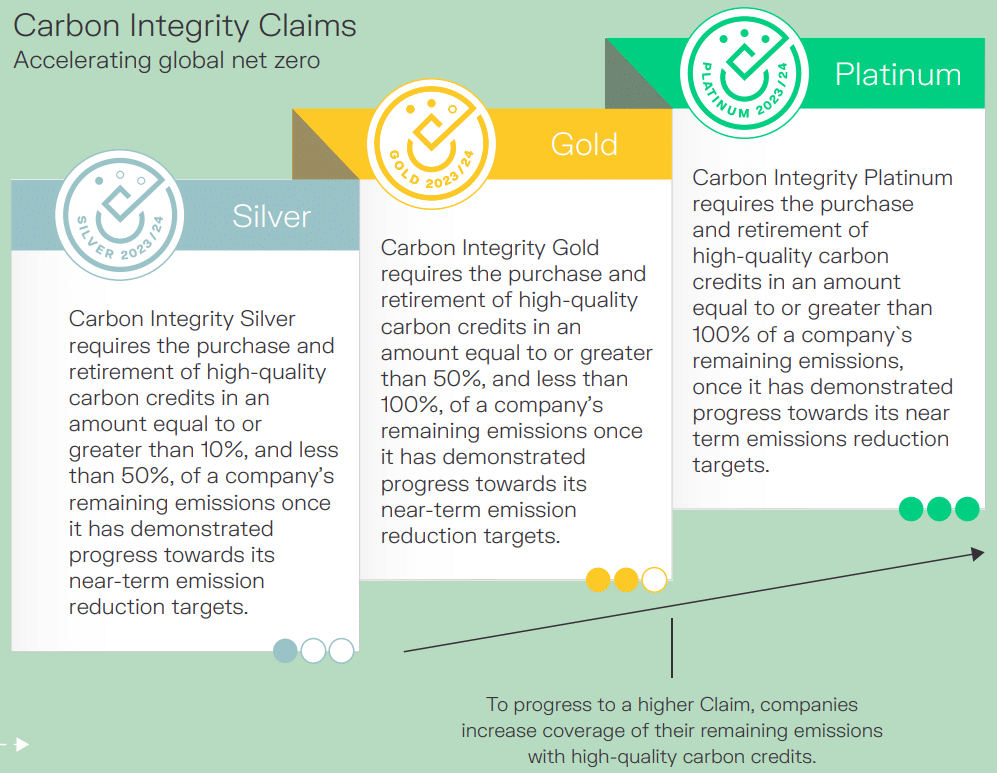

The Integrity Council’s efforts to instill integrity in carbon credits align with the Voluntary Carbon Markets Integrity Initiative (VCMI). VCMI focuses on ensuring integrity in credit use with the following claims type.

The VCMI’s Claims Code of Practice provides guidance to companies on using credits to make credible claims regarding their progress towards net zero commitments, emphasizing the need to purchase credits meeting the CCP quality threshold.

More notably, governments and regulators are increasingly considering the ICVCM’s CCPs as an international standard for incorporation into their frameworks. In particular, the UK has expressed intent to endorse the CCPs and explore their integration into policies, regulations, and guidance.

The Monetary Authority of Singapore is also actively exploring how to align its transition credits with the CCPs. In the US, the Commodity Futures Trading Commission has published draft guidance aligning carbon credit derivatives listings with the CCPs.

ICVCM reached a significant milestone geared to enhance the credibility of carbon credits, supporting climate finance in Global South countries and aiding buyers in identifying top-notch projects. The process involves internal and multi-stakeholder assessments, with approved programs displaying the coveted CCP label on their credits.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/icvcm-sets-the-bar-high-with-100-carbon-credit-methodologies-under-assessment/