HSBC has committed $1 billion to finance climate technologies including carbon dioxide removal globally, helping startups grow and scale their clean solutions. This aligns with the global financier’s pledge to bring its financed portfolio to 2050 net zero emissions.

This funding will support startups focusing on various ranges of climate tech solutions, including electric vehicle (EV) charging, battery storage, sustainable food and agriculture, and carbon removal technologies.

Unlocking Critical Finance for Climate Tech

The new investment follows two similar programs of HSBC aimed at advancing the cleantech space: HSBC Innovation Banking and HSBC Asset Management’s Climate Tech Venture Capital. The latter seeks to provide financial support to tech startups that address climate change across sectors like energy, transportation, and agriculture.

The UK-based universal bank and financial services group has also invested $100 million in Bill Gates’ Breakthrough Energy Catalyst Fund last year. This fund supports green projects worldwide.

Remarking on the $1B pledge, HSBC’s global commercial banking CEO Barry O’Byrne said:

“Access to finance is critical for early-stage climate tech companies to create and scale real world solutions… With HSBC’s global reach, in-house climate tech expertise, we can offer these pioneer companies unrivaled support.”

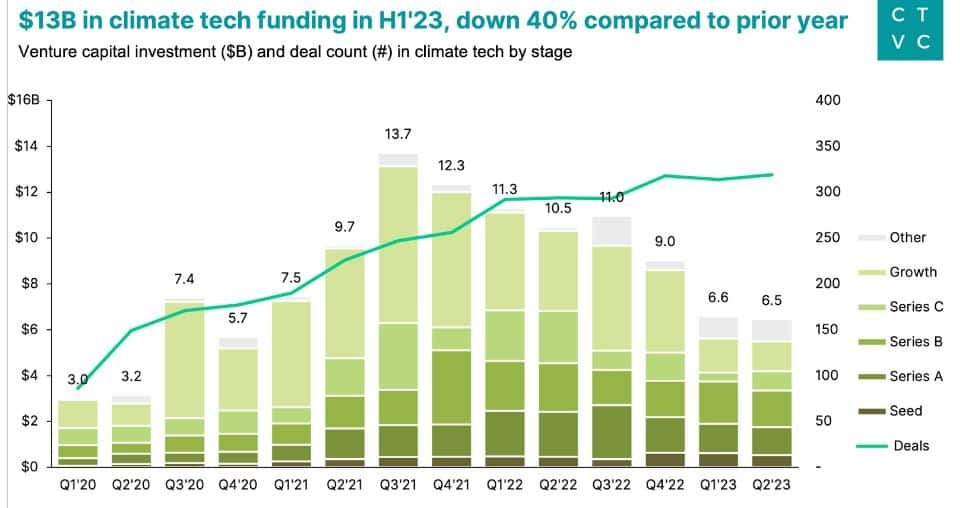

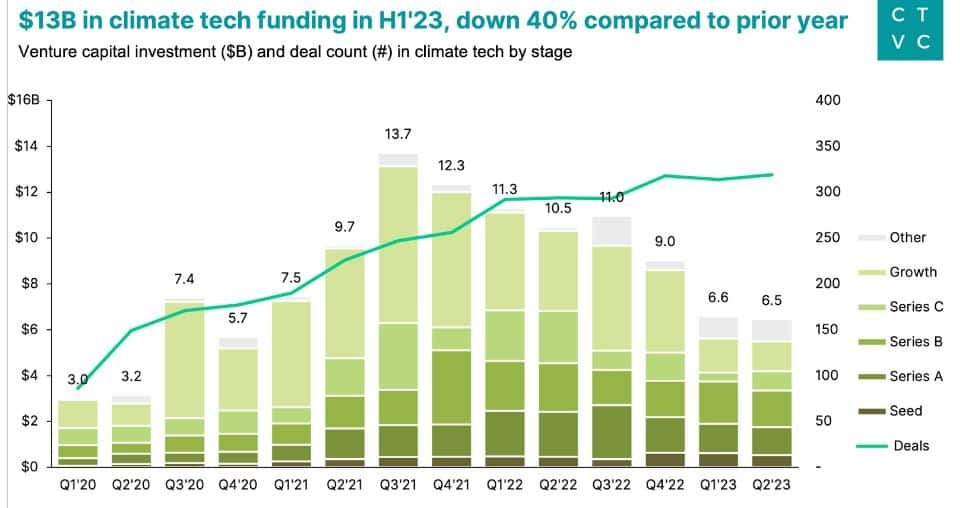

Study shows that venture capital (VC) funding for climate startups declined by 40% in the first half of 2023, HSBC noted.

Though it sounds depressing, zooming out to the bigger picture will put things into perspective. There is a total of $117B of venture funding raised by around 2,500 climate tech companies since 2020. The slower growth rate in quarterly results indicates a relative slowdown in overall industry growth. It does not suggest an all-out retreat.

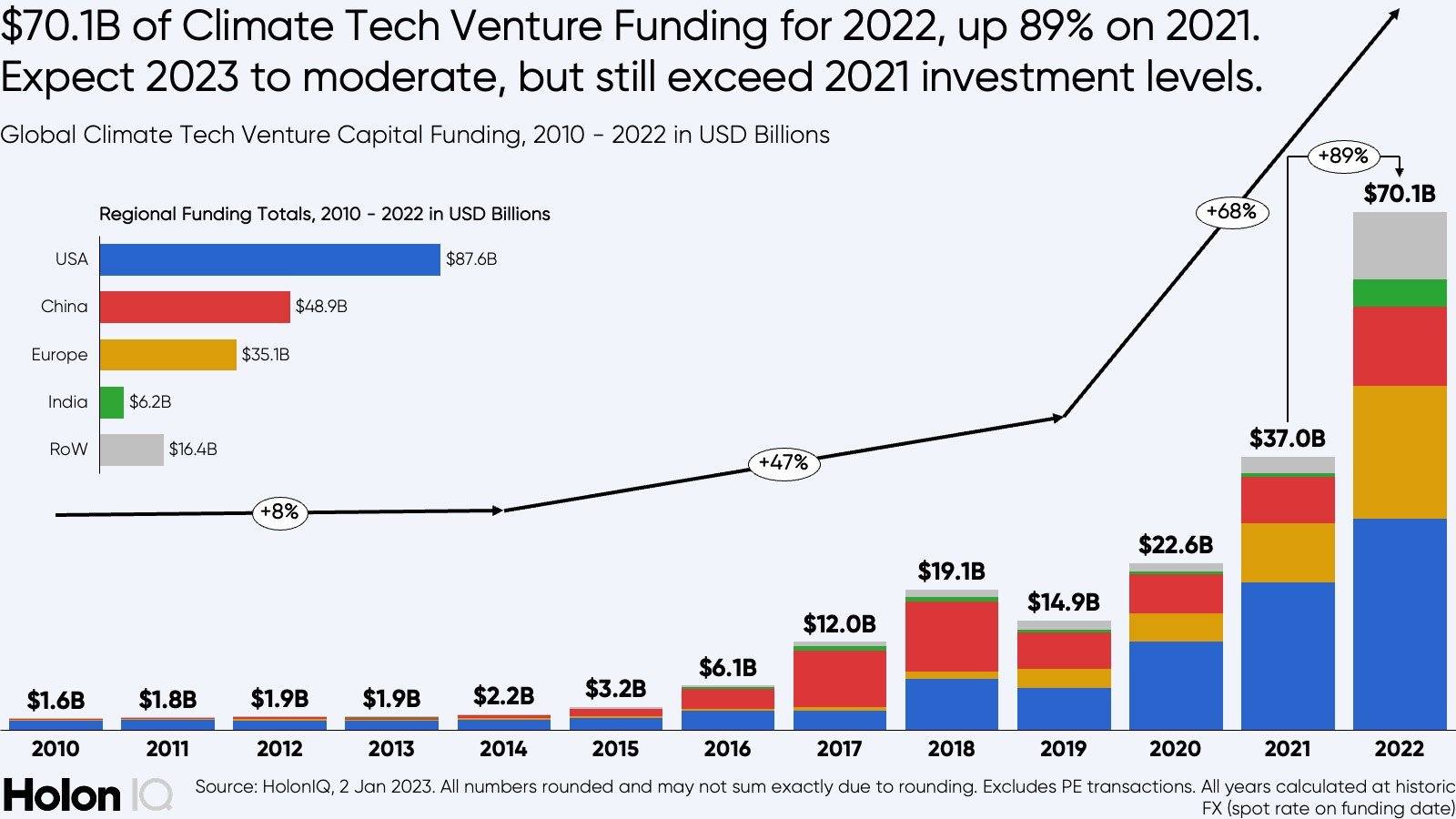

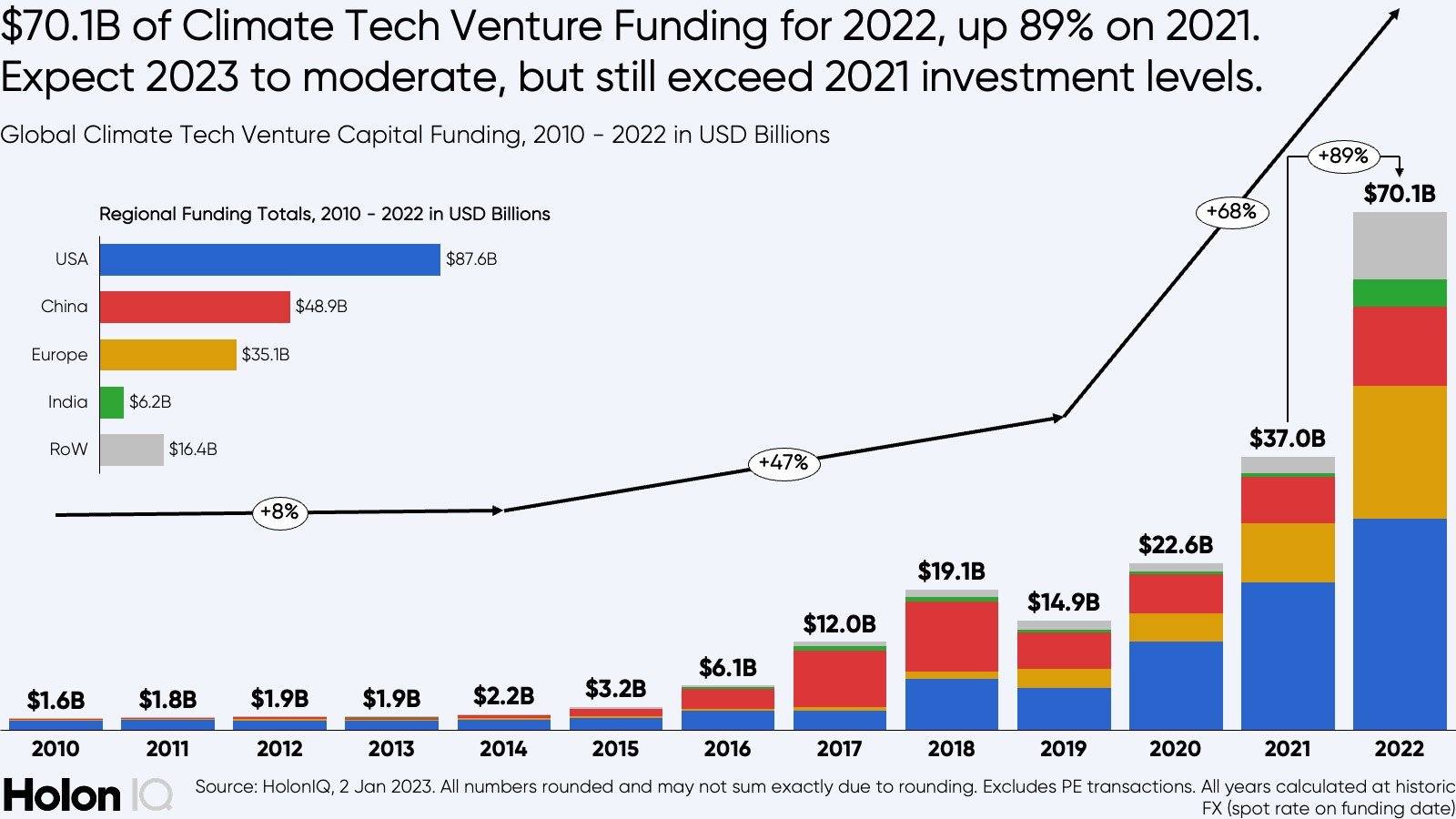

It’s also worth noting that before this year’s dip in climate tech VC funding, it skyrocketed up to last year. According to HolonIQ, climate tech VC funding reached over $70 billion in 2022.

As the bridge to capital markets, VC investors are crucial in helping startups to develop, commercialize, and scale up. While there are various factors at play, supportive policies such as the EU Green Deal Industrial Plan and the U.S. Inflation Reduction Act help ramp up early-stage investments.

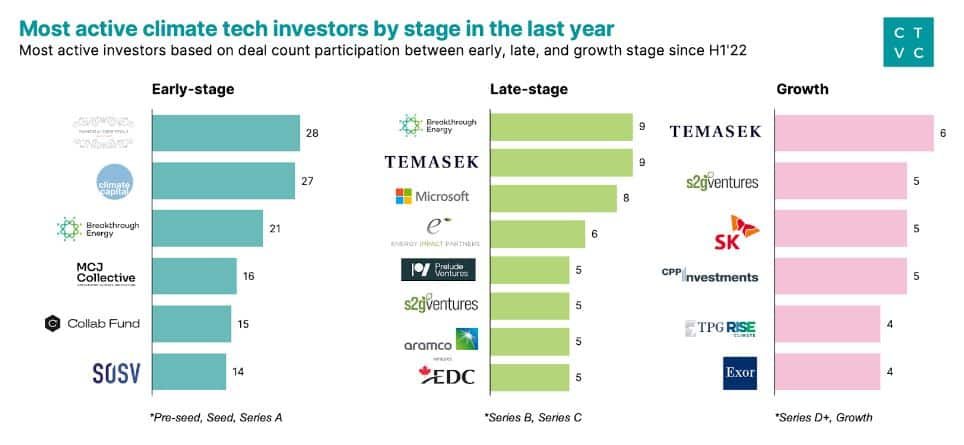

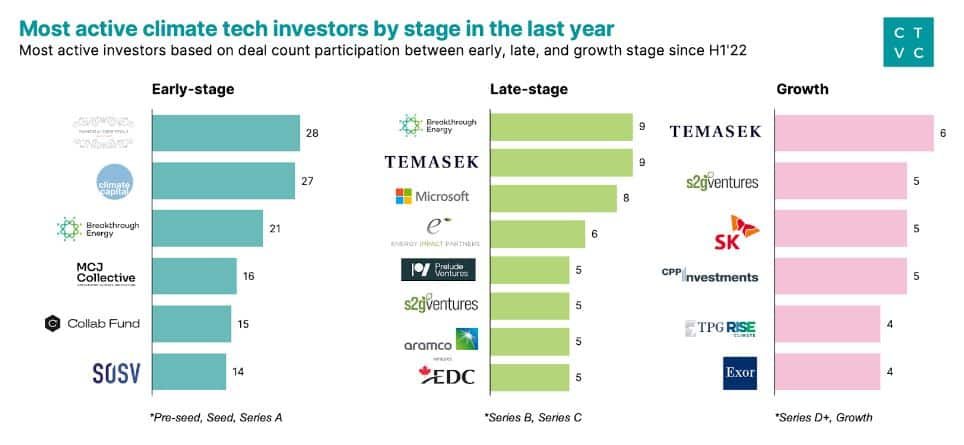

According to CTVC analysis, the most active climate tech investors by stage in 2022 are the following:

Key strategic investors, such as Microsoft, Aramco Ventures, and SK are frequently participating in Late-stage and Growth funding rounds.

Climate tech startups are in dire need of these investors, especially since the IEA estimated that about 50% of carbon reductions needed to reach 2050 net zero emissions depends on how fast their technologies develop at scale. HSBC’s climate tech VC initiative aims to fast-track the adoption of these crucial technologies.

HSBC’s Climate Action Efforts

The $100M that HSBC allocated will particularly support four major technologies – Direct Air Capture (DAC), clean hydrogen, long-term energy storage, and sustainable aviation fuel.

Earlier this year, the universal bank also joined the World Bank’s Private Sector Investment Lab. It focuses on amplifying financing for renewable energy and infrastructure projects.

Last year, it also supported Hong Kong’s Exchanges and Clearing Ltd (HKEX) in developing a global carbon market. In the same year, the banking giant also declared that it would not support projects involving the development of new oil and gas fields.

All these efforts are geared towards HSBC’s commitment to the net zero transition. The bank aims to achieve net zero in operations and supply chain by 2030 and in the financing portfolio by 2050.

To meet these climate targets, HSBC aligns its financed emissions – emissions generated by customers and funded projects – to net zero. And the $1 billion pledge in climate tech startup funding will help make that happen.

HSBC’s financial support for climate tech startups reflects its commitment to tackling climate change. By supporting early-stage businesses and project financing, the bank contributes to developing innovative and clean tech solutions such as carbon removal.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/hsbc-commits-1b-to-climate-tech-startups-going-to-net-zero/