In the rapidly evolving financial services landscape, the journey from entrenched legacy systems to cutting-edge digital payment platforms is a technological upgrade and a fundamental transformation.

This transition embodies a shift towards fostering innovation, operational excellence, and superior customer engagement.

It’s a strategic move that redefines the essence of banking in the digital era. It marks a departure from traditional practices towards a future where agility, efficiency, and customer-centricity dictate market leadership.

Understanding the legacy system dilemma

Banks and financial institutions have relied on robust, albeit inflexible, mainframe-based systems for decades. These legacy systems have been the linchpin of financial operations, offering a degree of reliability unmatched by newer technologies.

However, as the digital landscape has transformed, these once-stalwart systems have begun to show their age in terms of technology and their ability to meet the modern consumer’s expectations.

The limitations of these systems are multifaceted, including high maintenance costs, difficulty in integrating new functionalities, and a general lack of agility.

In an era where flexibility and speed are paramount, such constraints can impede an institution’s ability to innovate and adapt. This scenario sets the stage for critically reevaluating legacy infrastructures, prompting a transition towards more agile and scalable solutions.

The architectural backbone of digital transformation

A shift in architectural principles underpins the journey towards digital transformation. Cloud-native technologies, microservices, and APIs represent more than technological choices; they are the pillars of a strategic framework that enables institutions to become more adaptive, innovative, and customer-focused.

This architectural shift facilitates the development of new services and the integration of third-party innovations, allowing banks to offer a more personalised and seamless customer experience.

The focus extends beyond merely adopting new technologies in the quest for modernisation. At its heart, this journey is about redefining the essence of banking and financial services in a digital-first world. Institutions increasingly seek solutions that offer technological advancements, strategic agility, and scalability.

The digital era demands flexibility, rapid innovation, and a seamless customer experience—qualities that traditional systems struggle to provide with their high maintenance costs and integration complexities. The imperative for financial institutions is clear: evolve or risk obsolescence.

The shift towards digital platforms like HPS’s PowerCARD is emblematic of this change, offering a pathway to transform payment processing systems into dynamic, integrated, and customer-centric ecosystems.

PowerCARD is HPS digital payments platform that connects any channel, any kind of payment, for every customer, everywhere.

A close look at PowerCARD’s architectural innovation

Delving deeper into PowerCARD’s architectural innovations, we uncover the pillars of its success: cloud-native technology, microservices architecture, and an API-first approach.

This trifecta enables unparalleled scalability and agility, allowing financial institutions to adapt to market changes and consumer trends rapidly.

The suite of PowerCARD solutions cover the entire payment value chain : Issuing, Acquiring, Switching. It provides a secure and efficient payment ecosystem capable of handling the complexities of the modern financial landscape.

A seamless transition to modernisation

A compelling illustration of HPS’s expertise in system migration and modernisation is the case of a leading bank in Asia Pacific. This bank embarked on a mission to overhaul its payment processing infrastructure, moving away from an outdated legacy system to embrace the advanced capabilities of the PowerCARD platform.

The bank’s objectives were clear: to implement a scalable and responsive platform capable of handling ultra-high transaction volumes (1.5million+ transactions are processed daily), consolidate its payment activities across issuing and acquiring, and switch to a single technology platform.

The bank faced the daunting task of replacing its legacy systems without disrupting ongoing operations—a critical concern for any financial institution where reliability and uptime are paramount. The legacy systems, while robust, were not equipped to meet the evolving demands of the digital payments landscape, particularly regarding scalability and flexibility.

HPS’s PowerCARD platform was the ideal solution to meet the bank’s needs. The migration process was meticulously planned, leveraging HPS’s proven tools and strategies.

This transition will enable the bank to significantly enhance its operational efficiency and scalability and to future-proof its payment infrastructure.

The bank is now well-positioned to introduce innovative payment products and services rapidly, responding effectively to the needs of its customers and maintaining a competitive edge in the market.

Meeting the industry where it matters: Money2020 Asia

For almost 30 years, HPS has been at the forefront of financial technology innovation, consistently allocating 15 percent of its annual revenues to product development.

This steadfast commitment has ensured the PowerCARD suite remains at the vanguard of payment processing solutions, characterised by its cloud-native and micro-services architecture.

Through its Open Innovation program, HPS champions collaborative growth, integrating its solutions with the broader technological ecosystem of its partners. This synergy enhances the value delivered to users, positioning payment solutions as enablers and drivers of industry transformation.

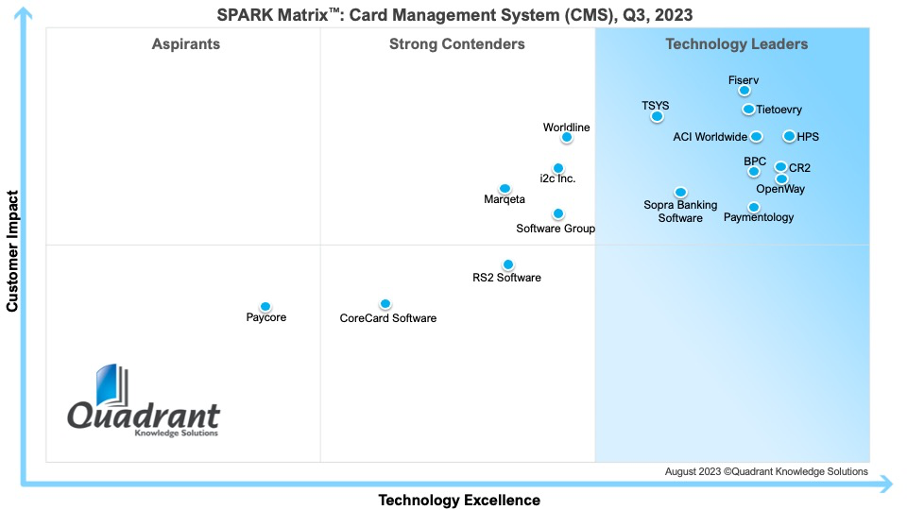

As highlighted in the Spark Matrix Vendor Guide, recognition of HPS’s technological leadership and impact on customer experience attests to the company’s enduring pursuit of excellence.

SPARK Matrix™: Card Management Systems (CMS), Q3, 2023 by Quadrant Knowledge Solutions (Source: HPS)

This commitment extends to HPS’s active participation in Money 20/20 Asia, an event that brings together the brightest minds and the most cutting-edge ideas within the financial services sector.

For those ready to lead in the digital transformation of the financial sector, meet HPS representatives at their booth (Booth #5011) to engage with the future of payments through the PowerCARD digital platform and take the first step towards redefining your institution’s technological landscape. Click here to make an appointment.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93650/money-20-20-asia-2024/how-next-gen-payment-platforms-are-leading-the-shift-from-legacy-systems-hps/