- The US issued PPI data that provided additional evidence that inflation had peaked.

- British inflation reached a 41-year high due to rising food and household energy costs.

- Jeremy Hunt unveiled tax increases and spending reductions to try and fix Britain’s finances.

The GBP/USD weekly forecast is bullish as the Bank of England is bound to raise rates to tame skyrocketing inflation.

Ups and downs of GBP/USD

Last week was packed with important US and UK economic releases. The US issued PPI data that provided additional evidence that inflation had peaked and retail sales data that showed increased consumer spending.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The UK released inflation and retail sales data. British inflation reached a 41-year high due to rising food and household energy costs. In the year that ended in October, consumer prices increased by 11.1%, which was a significant increase over September’s 10.1% increase and the highest rate since October 1981.

Better-than-expected retail sales for Britain led to a gain in the pound on Friday. This came a day after finance minister Jeremy Hunt unveiled tax increases and spending reductions to convince the markets that the government was serious about combating inflation.

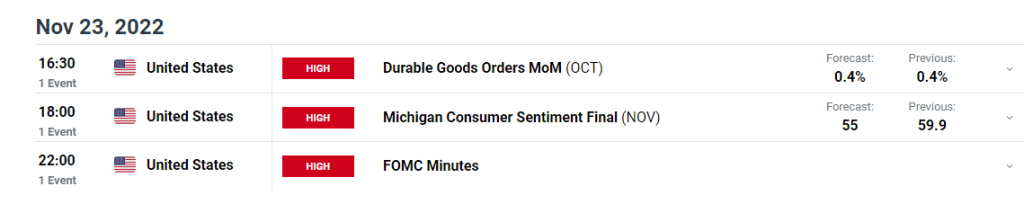

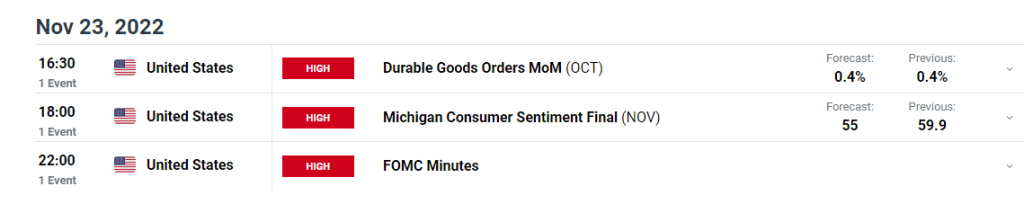

Next week’s key events for GBP/USD

There won’t be many economic reports next week. Therefore, GBP/USD will be rather quiet. The FOMC meeting minutes will attract more investor attention. They will give a detailed description of the two-week-old policy-setting meeting of the committee and offer clear insights into the FOMC’s position on monetary policy. Therefore, investors will closely examine them for cues on the result of subsequent interest rate decisions.

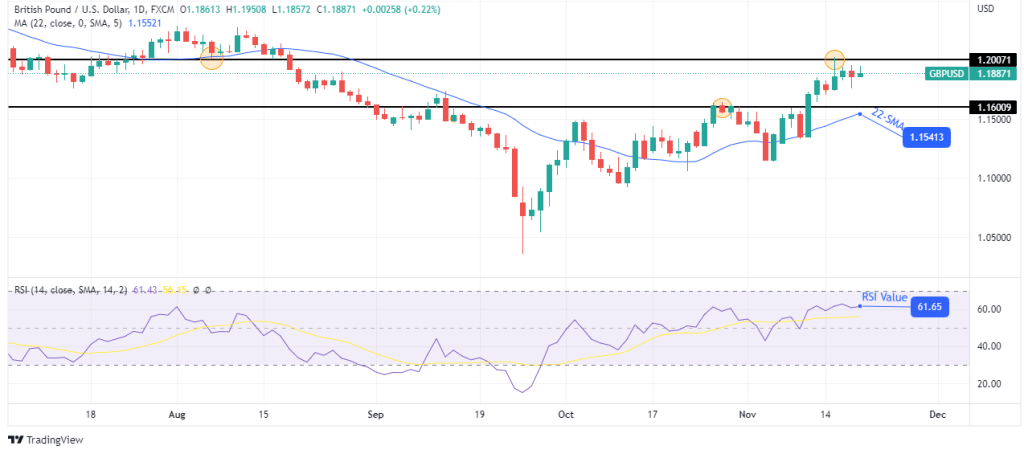

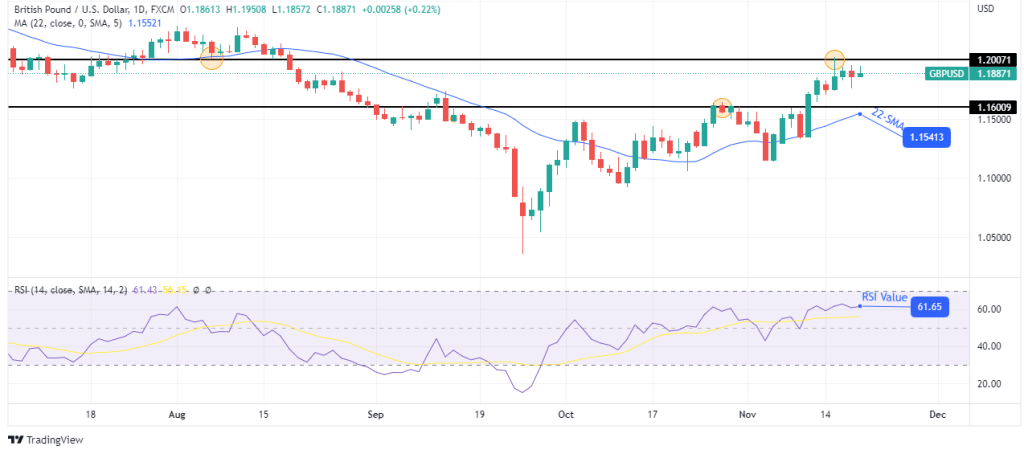

GBP/USD weekly technical forecast: Set for a pullback

Looking at the daily chart, we see the price trading above the 22-SMA and the RSI above 50, all signs that bulls are ahead. The price is in a bullish trend as it is consistently making higher highs and higher lows. The most recent high was made at the 1.2007 key resistance level after bulls broke above the previous high at 1.1600.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The bullish move paused after reaching the 1.2007 resistance level, and the price is trading in a tight consolidation. If bulls are still strong, they might break above the resistance level without a deep pullback. However, if bears come in for a pullback, they might retest the 22-SMA before the price resumes the uptrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.Click Here

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-boe-challenged-by-rising-inflation/