US consumers may not be crossing the chasm to EV ownership just

yet, according to new analysis from S&P Global Mobility.

According to return-to-market vehicle registration data, households

with gasoline internal-combustion engine vehicles are more likely

to migrate to hybrid cars (including both HEVs and PHEVs) than to

full battery electric vehicles (BEV). And if Tesla is removed from

the equation, other brands’ EVs are barely represented in the

migration-from-ICE list.

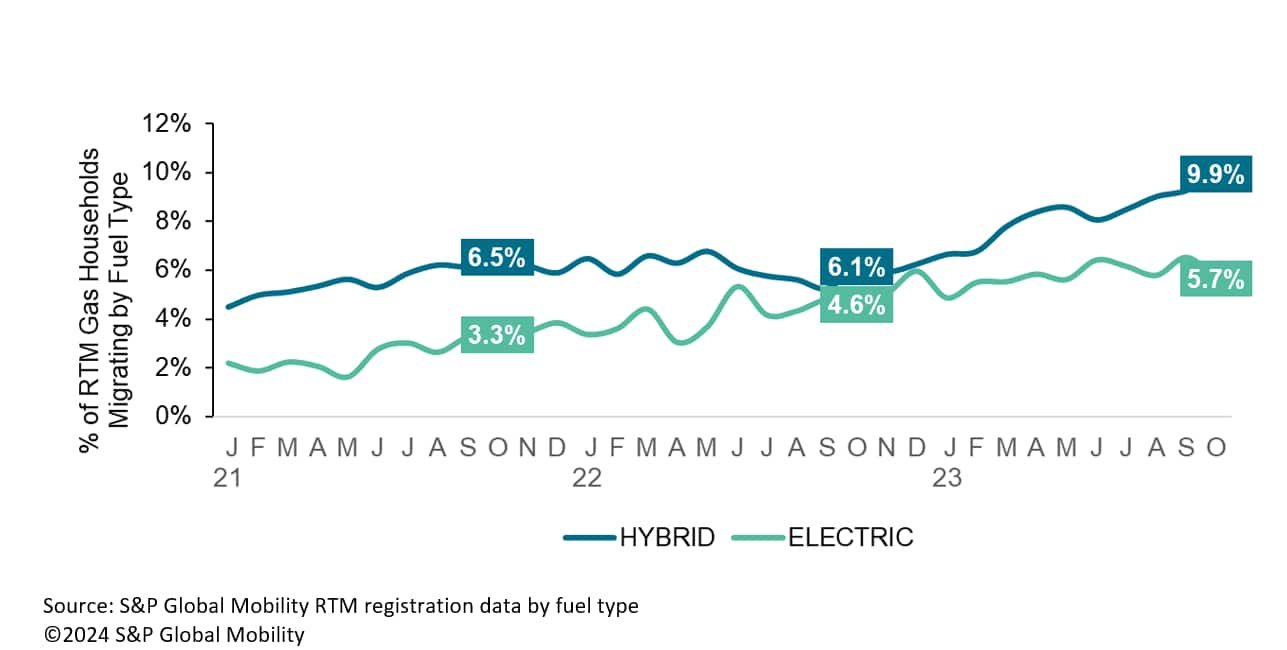

For the period from January through October 2023, 8.3% of gasoline

households who returned to the market for a new vehicle acquired a

hybrid model. Perhaps more significant, this is a rising trend,

reaching 9.9% in October – marking the highest rate of the year and

a 3.8 percentage point increase compared to October 2022. By

comparison, 5.7% of ICE households acquired a battery electric

vehicle in October 2023 – albeit also on a rising trend line.

“The automotive industry’s transformation to fully electric may not

be as rapid as EV advocates are hoping, as US consumers

increasingly opt for more sustainable and energy-efficient

vehicles,” said Tom Libby, associate director for loyalty solutions

and industry analysis for S&P Global Mobility. “This consumer

trend of taking a half-step by choosing a hybrid instead of moving

directly to an EV may be a sign of tentativeness to fully embrace

electricity as the means of propulsion.”

% of Gas RTMs Migrating to Hybrid (HEV/PHEV) & Electric

Fuel Types

This could be due to several factors. Hybrids offer a compromise

between the familiarity of gasoline-powered cars and the

environmental benefits of EVs. They also eliminate the range

anxiety and charging concerns associated with EVs, as they can

switch to gasoline power when the battery runs low.

Even more so, pricing parity between gasoline and hybrid models

plays a significant role in this trend. Year to date, gasoline

households who acquired another gas model have an average monthly

payment of $675 on their new vehicle, according to

AutoCreditInsight by S&P Global Mobility and Transunion. Those

who bought a full hybrid pay $670, slightly less than their

gasoline counterparts. However, households who opted for PHEVs have

a higher average monthly payment of $798, and those who chose an EV

pay the highest at $828. The data suggest that cost considerations

could be a significant factor driving the preference for hybrids

over other EVs.

Average Acquired Monthly Payment by Fuel Type – Gas RTMs

When it comes to specific hybrid models, the Honda CR-V Hybrid is

most popular among prior gasoline households year-to-date. The next

most popular models are the Toyota RAV4 Hybrid and Honda Accord

Hybrid. The Jeep Wrangler stands out as the most popular <span/>PHEV model.

However, when looking at household migration to EVs from

gasoline, if the Tesla Model Y and Model 3 are removed from the

data set, hardly any other brand’s EV makes significant inroads

among those migrating from ICE to a greener solution.

Top Acquired Electrified Models among ICE household

RTMs

This trend toward hybrids is likely to have significant

implications for automakers –

especially as more<span/>BEVs arrive on showroom floors. It

suggests that there may be a substantial market for vehicles that

offer a balance between traditional gasoline power and the benefits

of electrification. <span/>OEMs like Toyota and Honda, who have

refrained from fully committing to EVs while still delivering

efficient, reliable hybrid vehicles, are likely to see increased

demand. Toyota recently launched a redesigned Prius in hybrid and

plug-in options and announced that the next-generation Camry will

only be offered as a hybrid.

While the shift toward EVs seems inevitable, the path to full

electrification may not be straightforward. The rising trend of gas

households migrating to hybrid models suggests that the automotive

industry needs to cater to a range of consumer preferences and

concerns.

FOR MORE ELECTRIC VEHICLE TRENDS

DEMO

OUR VEHICLE TECHNICAL INTELLIGENCE PLATFORM

AUTOMOTIVE PLANNING AND FORECASTING

LIGHT VEHICLE POWERTRAIN FORECASTS

DOWNLOAD OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/gasoline-consumers-migrating-to-hybrid-cars-not-evs.html