Consultation | April 10, 2024

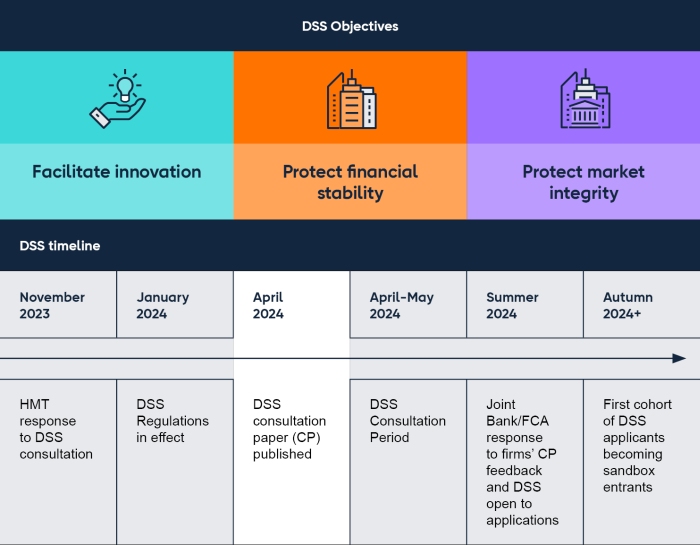

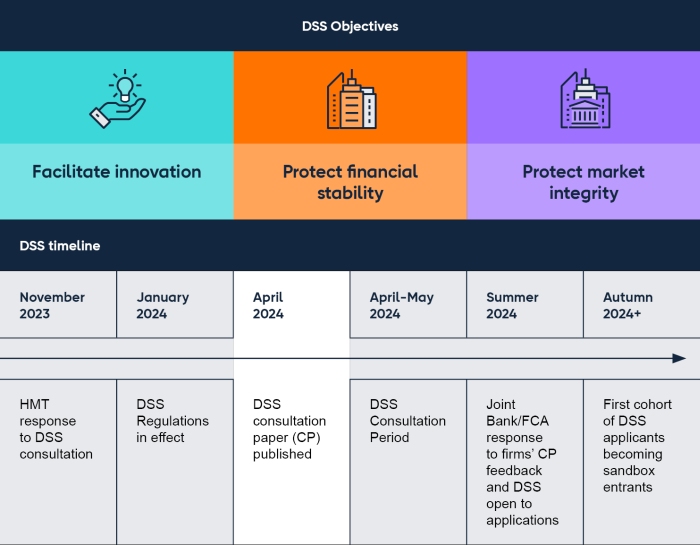

Image: FCA and BOE Digital Securities Sandbox Objectives and Timeline

Image: FCA and BOE Digital Securities Sandbox Objectives and TimelineDigital Securities Sandbox Joint Bank of England and FCA Consultation Paper

The Bank of England, in conjunction with the Financial Conduct Authority (FCA), has released a consultation paper on the implementation and operation of the Digital Securities Sandbox (DSS) and is seeking feedback on a wide array of topics. The DSS aims to explore the potential of developing technology, such as Distributed Ledger Technology (DLT), in the trading and settlement of securities, including shares and bonds. The sandbox is intended to last for five years, serving as a bridge to a more permanent, technology-friendly regime for the securities market.

- The DSS is designed to facilitate the application of new technology to securities trading and settlement, offering a path to a new technology-friendly regulatory regime. The Bank of England and FCA will jointly operate the DSS, aiming to promote a safe, sustainable, and efficient financial system, protect financial stability, and ensure market integrity.

See: UK Launches Pioneering Digital Securities Sandbox

- The sandbox will accommodate equities, corporate and government bonds, money market instruments, fund units, and emissions allowances, excluding derivative contracts and unbacked cryptocurrencies like Bitcoin.

- The paper emphasizes the use of limits to allow for the safe scaling of businesses, mitigating risks to financial stability without hindering innovation.

- The DSS will enable firms to engage in activities traditionally associated with central securities depositories, such as the issuance, maintenance, and settlement of financial securities. It also opens the door for the creation of new business models by combining these activities with those of a trading venue.

Targeted Areas for Specific Feedback

While the document outlines a comprehensive framework for the sandbox, including its objectives, scope, and operational guidelines, there are specific areas where the regulators are particularly seeking feedback. Here are some key questions and areas of focus where inputs are being solicited:

- How should the regulators balance the promotion of innovation with the need to maintain financial stability and protect market integrity? This includes feedback on the proposed regulatory framework that accommodates new technologies such as Distributed Ledger Technology (DLT) while ensuring the financial system’s safety and reliability.

See: UK Digital Securities Sandbox: A Guide and Implications

- What are the views on the scope and eligibility of financial instruments and activities proposed to be included in the DSS? This includes opinions on which securities should be allowed, the appropriateness of including certain types of instruments (e.g., equities, bonds, money market instruments), and the exclusion of derivative contracts and unbacked cryptocurrencies.

- How should the DSS be structured and operated to facilitate its objectives effectively? This involves input on the proposed stages of permitted activity, the process for moving between stages, and the overall design of the sandbox to enable a smooth transition from a sandbox environment to a permanent regime.

- What measures should be implemented to ensure that the sandbox activities do not pose undue risks to financial stability and market integrity? This includes feedback on the use of limits on the value of securities that can be issued within the DSS and the methodology for setting these limits.

- How can the DSS best support the development and testing of innovative business models and technologies in the financial securities market? This encompasses thoughts on the potential benefits and challenges of integrating new technologies like DLT in securities trading and settlement.

- What should the approach to supervision and enforcement within the DSS look like to ensure compliance while encouraging innovation? This includes opinions on the proposed joint supervision by the Bank of England and the FCA, and how regulatory oversight should be tailored to support sandbox participants’ innovative efforts.

See: Former Citi Executives Launch Bitcoin Securities Startup

- What are the views on the proposed fee/costs regime for firms participating in the DSS? This seeks feedback on the fairness and appropriateness of any charges that sandbox participants might incur.

Public Consultation Key Dates

The consultation paper invites feedback on its proposals, including the approach to operating the DSS, the application process, and how to manage financial stability and market integrity risks. The primary audience for the paper includes prospective providers of financial market infrastructure interested in applying to the DSS. The closing date for responses is 29 May 2024, with the DSS expected to open for applications over the summer of 2024.

Conclusion

These questions are aimed at gathering a wide range of perspectives from stakeholders, including financial market infrastructure providers, firms interested in applying to the DSS, and other market participants.

See: FCA’s Finanal Social Media Financial Promotion Guidelines

The feedback will help shape the final guidelines and rules under which the DSS will operate, ensuring that the sandbox effectively supports innovation while safeguarding the interests of participants and the broader financial system.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/fca-boe-digital-securities-sandbox-consult-on-final-rules/