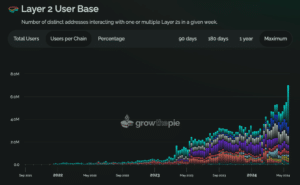

The growth in distinct addresses on Ethereum L2s shows that Ethereum’s scaling strategy is working.

Layer 2 networks, widely known as rollups, aim to improve the scalability capacity of Ethereum.

(Unsplash/JJ Ying)

Posted May 24, 2024 at 2:47 pm EST.

The number of distinct addresses for Ethereum layer 2 blockchain networks has climbed to an all-time high last week, a sign that the rollup-centric roadmap is coming to fruition.

According to L2 analytics platform GrowThePie, the number of distinct addresses interacting with at least one layer 2 blockchain network between May 13 and May 19 stood at over seven million, more than double the amount since the last week of 2023.

The top layer 2 blockchain network by distinct wallets last week was Arbitrum with 3.7 million, making it responsible for 52% of all the addresses that interacted with one or multiple L2s. Base, the L2 that was incubated by dominant U.S.-based exchange Coinbase, took second place with nearly 815,000 addresses.

The base layer of Ethereum, in contrast, had 2.1 million active addresses.

The rollup-centric roadmap entails a shift of activity from Ethereum’s base layer to its layer 2 networks. “Currently, users have accounts on L1, ENS names on L1, applications live entirely on L1, etc. All of this is going to have to change,” wrote Ethereum co-founder Vitalik Buterin in Oct. 2020. “We would need to adapt to a world where users have their primary accounts, balances, assets, etc entirely inside an L2.”

The sustained growth of addresses interacting with layer 2 networks highlight the ongoing improvements in the Ethereum ecosystem’s scalability, or ability to handle more transactions.

Read More: Why ETH Isn’t Moving Higher After SEC Approves Key Filings for Spot ETFs

The number of distinct addresses on Ethereum L2s hit the new record high before the U.S. Securities and Exchange Commission approved the 19b-4s filings of several spot ether exchange-traded funds yesterday. While the move is a step closer to the rollout of ETFs directly investing in ETH, the native gas token for the Ethereum blockchain, trading of spot ETH ETFs still awaits a further SEC approval.

The SEC has to approve S-1 forms, registration documents needed for a firm to offer shares of an ETF to the public.

The price of ETH has rallied about 20% in the past seven days but has decreased 2.5% in the past 24 hours to trade at $3,720 at the time of writing, data from CoinGecko shows.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/ethereum-l2-networks-reach-record-high-of-7-million-distinct-addresses/