The Red Sea, a vital trade route connecting Asia, Africa, and Europe, has faced security concerns since the first attack on a commercial ship last year. This has sparked worries in the transportation, logistics, and supply chain sectors about disruptions, higher freight costs, longer shipping times, and the resurgence of the bullwhip effect. Consequently, some cross-border e-commerce merchants and brands have already begun increasing orders to mitigate potential supply chain challenges.

CIRRO conducted a quantitative analysis of a specific case to assess the impact of the Red Sea Crisis on inventory management for global e-commerce enterprises reliant on international supply chains and logistics. From this, we will dive into the insights about organizing the stock smartly and handling any issues that come our way, offering some essential advice for cross-border merchants who want to fine-tune their inventory game.

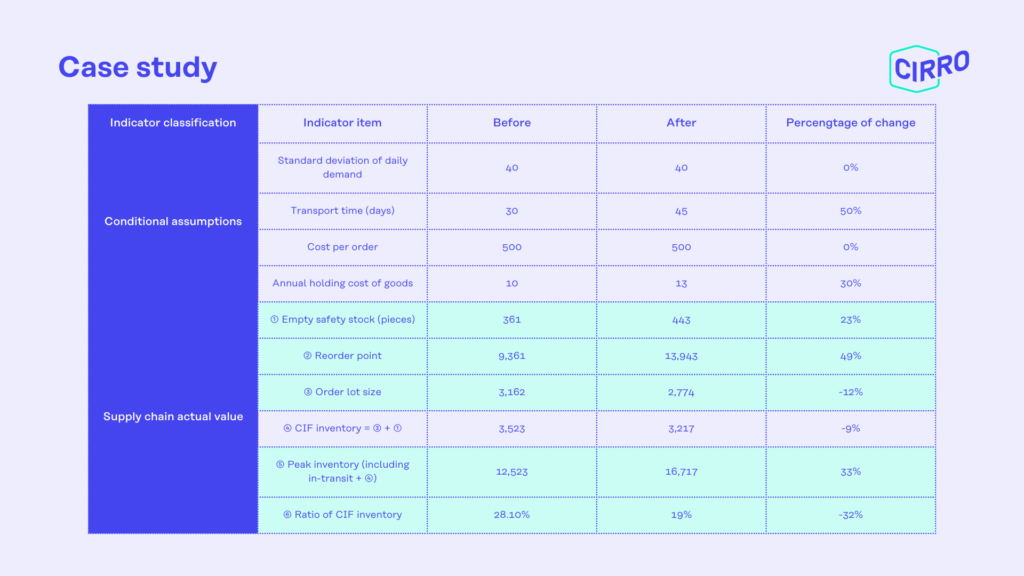

Case study

The graph depicted below illustrates a fundamental principle of inventory management. To maintain inventory levels above the safety stock threshold, cross-border e-commerce enterprises must initiate reorders prior to reaching the safety stock level, considering the lead time of production.

Assume that there is a cross-border e-commerce company. The average daily market demand (d) is 300 pieces. Based on historical data, the standard deviation of daily demand (σd) is 40 pieces. Lead time (LT) is 30 days. Its annual demand (D) is 100,000 pieces (assuming 333 working days per year), the fixed cost (S) of each order is $500, and the annual holding cost (H) of each commodity is $10/piece. The company has set a service level of 95%, with a corresponding Z value of 1.65 (hoping to meet 95% of order requirements).

Under the Red Sea Crisis, assume that the lead time (LT) is increased to 45 days, the annual holding cost (H) of each commodity is increased to $13, and all other parameters remain unchanged.

Key observations from the recalculated values include:

1. Increased safety stock point

Due to heightened uncertainty, the safety stock point rises by 23%.

2. Earlier replenishment initiation

The reorder point shifts, prompting earlier replenishment orders, leading to increased orders by European retailers in December-January.

3. Decrease in single order quantity

Replenishment from high inventory levels decreases single order quantity, potentially necessitating exceptional measures to meet demand.

4. Rise in overall inventory

Lengthened cycles result in a 33% increase in overall inventory peak.

5. Change in inventory distribution

Share of stocks in transit increases, while share of stocks on arrival decreases, impacting local fulfillment capacity.

The adjustments made by enterprises reflect the ‘accelerator effect’, where businesses proactively adapt to external changes, expanding or reducing inventory levels. While the accelerator effect aids in maintaining operational continuity during crises, it leads to higher inventory costs and capital pressure, necessitating a delicate balance between supply chain stability and cost management.

Key learnings

To address potential supply chain disruptions, cross-border e-commerce firms must proactively devise strategies in the long run. They can undertake supply chain modeling under various scenarios and develop adjustment plans accordingly. Here are some actions suggested to take:

Internally, cross-border e-commerce firms can work on the following five aspects:

1. Inventory optimization

Prioritize high-turnover, high-margin products to ensure inventory safety and maximize capital efficiency. Allocate limited funds away from slow-moving and low-profit items.

2. Service level adjustments

Tailor out-of-stock rate thresholds for different product categories. Consider raising thresholds for non-core products or adjusting prices to moderate sales velocity during pressure.

3. Flexible pricing strategy

Implement dynamic pricing to reflect supply costs and inventory changes, thus alleviating inventory pressure and enhancing operational stability.

4. Financing for resilience

Explore financing options to bolster inventory levels if necessary, ensuring preparedness and enhancing financial resilience against rising inventory costs.

5. Reduction in expenditure

Evaluate opportunities for efficiency improvements or cost reductions to offset increased inventory expenses.

Externally, cross-border e-commerce companies can focus on the following two strategies:

1. Seek reliable logistics partners

Prioritize stability and timeliness in logistics services and partner with reputable logistics providers or fulfillment companies, like CIRRO, to secure efficient transport routes and sufficient storage capacity.

2. Collaborate with industry partners and suppliers

Explore inventory-sharing arrangements or partnerships with related industries or suppliers to mitigate inventory-holding costs. Leverage OEM opportunities provided by factories, achieving flexible supply chain solutions and competitive advantages in lead time reduction.

The impact of the Red Sea Crisis on the supply chain depends significantly on how severe it becomes over time. In a prolonged crisis, having a clear, responsive plan becomes essential. Given the ongoing and evolving nature of the Red Sea Crisis, cross-border e-commerce merchants and brands must closely monitor its developments.

Read More…

Cross-border data competency “can ease supply chain pressures”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.logisticsbusiness.com/packaging-ecommerce/efulfilment/crisis-impact-on-e-commerce-inventory-management/