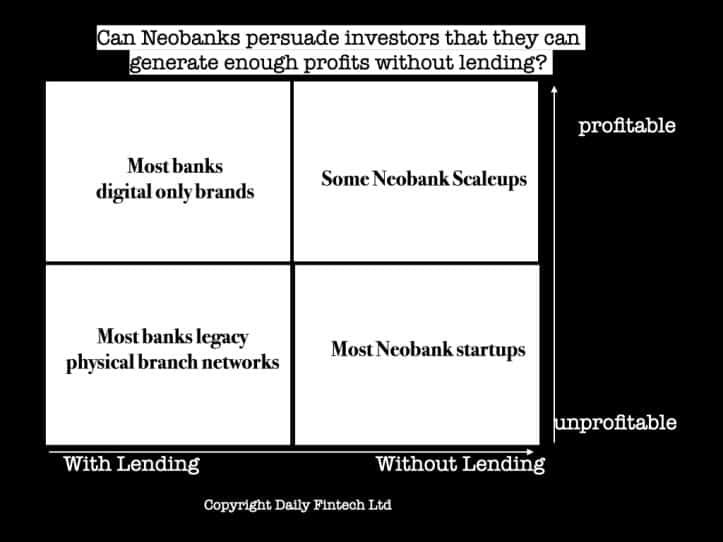

Neobanks (regulated digital only) are hot right now with 5 already in the Fintech 50 Index, many more lining up to IPO and top tier investors (including Warren Buffet in Nubank) going all in on private equities. However with the public equity market demanding profits again and with many Neobanks getting revenue without lending, the question we address today is whether Neobanks can persuade investors that they can generate enough profits without lending.

The companies in this space include Starling Bank, Monzo Bank, N26, WorldRemit, Wise, WeSwap, Nubank, Chime, Revolut, Swissquote, Green Dot ($GDOT), Robinhood ($Hood), Paypal ($PYPL), Visa ($v), MasterCard ($MC), Klarna, Afterpay, Affirm

5 are already in the Fintech 50 Index – Green Dot ($GDOT), Robinhood ($Hood), Paypal ($PYPL), Visa ($v), MasterCard ($MC).

In addition most big banks offer a digital only brand. We looked at Chase’s entry a few weeks ago. Big Tech are also making money from Finance, mostly via non-regulated services.

The non-lending revenue models include payments, brokerage, foreign exchange & fee-based accounts. The freemium model (free accounts monetized via lending) has been the default banking business model for a long time and so this innovation is not obvious. Many Neobanks offer cash accounts without any credit checks and some charge fees and/or monetise via payments, brokerage and foreign exchange.

Legacy banks have been profitable despite the drag from their physical branch networks because their monetisation models include payments, brokerage, foreign exchange AND lending. In this game, size and finances do matter, but so does agility & focus. It is easy for a big bank to launch a digital bank with a separate brand and many have done so, but few have got to scale.

One thing is for sure, the economics of high street branch banking are awful. The winner will be a digital bank; the only question is whether that digital bank will be funded by VC or a bank or a tech firm.

When (not if) interest rates rise, lending will do well again. However we may never return to ye olde 363 bankers rule – borrow at 3%, lend at 6% and tee off (golf) at 3pm – due to competition with prices already falling in payments, brokerage and foreign exchange. Competition in lending has historically been restricted to legacy banks, but the emergence of Buy Now Pay Later (BNPL) ventures such as Klarna, Afterpay & Affirm brings real competition to at least consumer lending.

Some Neobanks go after relatively untapped geographic markets, such as Nubank in Brazil.

Some Neobanks such as Revolut are ambitious globally and compete in many non-lending revenue models such as payments, brokerage, foreign exchange.

The key is an old fashioned idea – great customer service – with a modern twist – 24/7. WordPress manage to do this for a low cost digital service, so it is possible. The first digital bank to do this well may become a big market winner. Disclosure: I use both Revolut and WordPress but am not invested in either.

Daily Fintech’s original insight is made available to you for US$143 a year (which equates to $2.75 per week). $2.75 buys you a coffee (maybe), or the cost of a week’s subscription to the global Fintech blog – caffeine for the mind that could be worth $ millions.

PlatoAi. Web3 Reimagined. Data Intelligence Amplified.

Click here to access.