Recent data on US credit card holders tells us that they value flexibility and control more than rewards and fee-based offers. In light of rising interest rates and debt, consumers view credit cards as ‘liquidity

management’ tools and expect them to serve various purposes. And with

51% of American credit card holders now revolving their debt, higher flexibility in payment plans is valued more than traditional rewards.

All of this points to a new set of credit card use cases that issuers need to compete on. From on-card BNPL to digital wallets that link seamlessly with debit and credit products, fintechs or big techs with no dependence on legacy systems are already touching

4 out of 10 US customers by offering more flexibility and control.

Issuers cannot deliver these use cases on legacy issuer processor systems in an economically or operationally sustainable way. This is driving urgency around the issues of modernization of issuer processing cores, and what kind of capabilities they should

be building.

In this blog, we help clarify the capabilities that differentiate the next generation of issuer processor technology, and how it can help future-proof an issuer’s business lines.

10 must-have capabilities in a next-gen issuer processing platform

Like any new technology offering, the landscape of modern issuer processing platforms can seem like a forest of buzzwords. Cloud-based, API-first, microservices driven—most modern platform providers use the same descriptors. However, the real test of a next-gen

processing platform should not be its technology enablers but the capabilities it offers issuers.

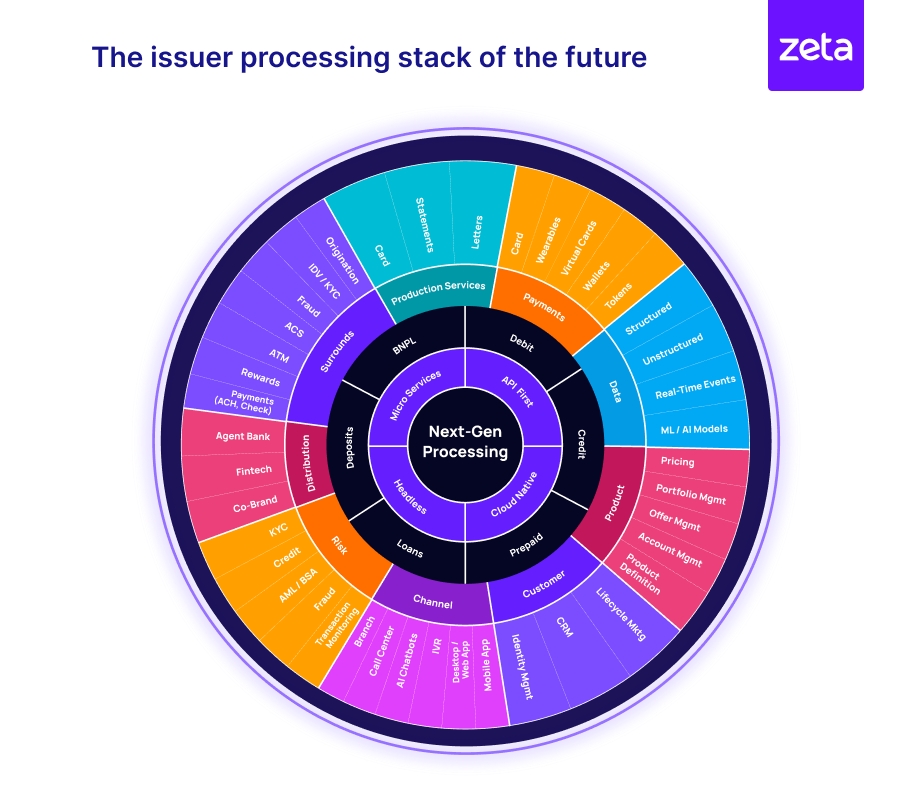

Image 1 illustrates the broad scope of functional elements that need to be incorporated in a next-gen processing platform, with a view to future-proof a bank’s payments platform and resulting business lines.

Image 1: The issuer processing stack of the future

Next-generation technology is inherently connected, scalable, and composable, which allows issuers to orchestrate a unified customer experience across product types (debit, credit, prepaid or BNPL) and customer touch points (transactions, services, distribution,

etc.) Let’s look at the 10 key capabilities that differentiate next-gen processing and help issuers overcome shortcomings of legacy systems to achieve this vision of next-gen processing.

-

Microservices-driven headless architecture with API-first, extensible object models

-

Cloud-native infrastructure with near-infinite scalability

-

Omnistack for asset and liability products enabling the construction of both asset and liability products on the same platform

-

Config-as-code through web-based interfaces and modern intuitive UX for real-time changes via configuration and not code, unleashing significant speed in product creation

-

Extreme integrability using APIs, events, webhooks, interceptors

-

Real-time transaction processing and settlement with almost no downtime

-

Flexible data models supporting supporting one-to-many, many-to-many, and many-to-one relationships between entities

-

Rich and multi-modal data access to enable real-time analytics that improve decision making, embed contextual nudges in customer journeys, and build segmented offerings

-

True ‘segment-of-one’ product construction using hyper-personalized pricing (fee and interest) at program, customer, account or transaction level

-

Native embeddable banking support to allow building distribution ecosystems via agent banks, fintechs, and co-brands

With these foundations, a truly next-gen issuer processing stack extends a bank’s ability to build a vibrant ecosystem to deliver seamless, omnichannel digital experiences for customers and internal applications for the bank, leveraging a network of services

and partners.

Building competitive card portfolios with next-gen capabilities

As American cardholders demand greater control and flexibility in their credit cards, digital-first disruptors and early adopter banks are changing the competitive landscape by delivering newer experiences. A next-gen processing platform can help issuers

accelerate their transformation journey and rapidly introduce new features in response to market needs or regulatory changes.

Let’s look at some of the innovative use cases in the cards market today, which can be enabled by next-gen processing:

-

On-card BNPL like Citi Flex Pay, Chase My Plan, and American Express Plan It that helps customers control their payment schedule

-

Seamless provisioning of digital cards into digital wallets for easy online and offline transactions

-

Enriched transaction statements with real merchant names, additional merchant details, and the ability to add personal notes for more meaningful spend insights

-

Digital cards with enhanced controls to allow cardholders to set location controls, spend limits, and even merchant-level controls

-

Aggregated visibility and control across related accounts and products level (for example, a family hub that allows primary card holders to control features & access for dependent card holders)

-

One-time or limited validity virtual cards for enhanced security for online transactions, one-time payments, or to avoid accidental recurring charges on subscriptions.

-

Enhanced card security features, such as support for multiple methods of authentication, including PINs, OTPs, device tokens, etc., in response to Strong Customer Authentication (SCA) requirements

In the near term, we also see a significant case for AI-driven use cases, whether for alternative credit risk assessment or as tools/virtual coaches for consumers who want to build up their credit scores. Next-gen processing systems deliver the fundamental

building blocks that enable AI-driven banking experiences.

A call for bold, not incremental, transformation

Accenture’s modeling of global profitability data shows that incremental improvements in digital operational maturity can lead to a 17% improvement in in EBITDA profits, while leapfrogging stages to become future-ready can enhance profits

by 48%. As banks undertake the expense and risk of modernizing their issuer processor cores, they need to ensure that the strategy goes deeper than lift-and-shift to the cloud or adopting digital solutions in individual functions.

Fundamentally, the adoption of a next-gen issuer processing platform is about changing the way a bank runs its cards business, reimagines business models, and launches products for the future. This is not possible with approaches like hollowing out legacy

cores or layering on top of legacy technology.

McKinsey identifies the future opportunities for banks in their 2023 Global Payments Report as follows: “In the Decoupled Era (of payments), banks will no longer be able to rely solely on the account ownership paradigm. They will need to build new businesses

to keep clients within their service ecosystem. The transformation will require technology changes in the form of core modernization and the application of generative AI. Furthermore, because the independent actors in decentralized systems pull toward their

advantage, banks and nonbanks will experience a heightened need for security as avenues for fraud and financial crimes increase.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25987/building-the-cards-of-tomorrow-10-must-have-capabilities?utm_medium=rssfinextra&utm_source=finextrablogs